Move over O.J. Simpson. It looks like the Big Wall Street Banks just got away with something close to murder.

After causing $2.7 trillion in investor losses during the financial crisis, it looks like the Too Big To Fail gang will pay a paltry $100 billion collectively to resolve all of their toxic mortgage issues.

That’s equal to a thief stealing $100 but only turning over less than four bucks to cops when he’s caught, with the rest of the money staying in his pocket.

Who would argue that such a bounty wouldn’t tempt a thief to steal again?

But throw that same thief in jail, and you deter him from committing a similar crime.

One of the worst offenders of packaging toxic mortgages, Citigroup (C), last week agreed to settle with the U.S. Justice Department for a total of $7 billion. While that amount may look large on the surface, Citigroup’s stock rose 3% on the announcement, showing that the market viewed the settlement as a positive.

Citigroup has plenty of company regarding such settlements. On top of already paying more than $50 billion in settlement fees, Bank of America may pay another $12 billion to resolve its mortgage issues with the Government, a sum similar to what JP Morgan Chase previously paid. In all, the legal tab for the Wall Street banks collectively will be about $100 billion, a sum which pales in comparison to the multi-trillion dollar damage that these greedy banks wrought.

The Justice Department uncovered 45 mortgage-security deals in 2006 and 2007 in which Citigroup made misrepresentations about the quality of the underlying loans, according to Andrew Grossman and Christina Rexrode of the Wall Street Journal.

Citigroup did not duck its responsibilities here; the settlement was based on statements of fact that Citigroup and the Justice Department agreed on.

Indeed, Citigroup played tricks with clients and acted more like a card shark than a sound financial institution in grading the high risk mortgages, according to the Justice Department.

If a due diligence team turned up lousy mortgages that were low-grade, Citigroup simply lied. For example, if a mortgage was missing key documents or was a loan made to a borrower with poor credit, Citigroup “often chose not to reject the loans,” according to the Journal. “Instead, Citigroup engaged in a sleight of hand, in which it reclassified the loans as better performing, the Justice Department said, and then misrepresented their quality to investors.”

Presto change-o, instant investment grade securities!

Remember, hundreds of thousands of these individual mortgages were bundled together by Citigroup and other banks to create mortgage backed securities. The banks then sold those bonds to institutions who believed they were getting an investment grade product. And then those same securities went poof, and the global economy crashed.

In addition to the $100 billion sum, banks have paid several billion dollars in settling lawsuits brought by investment fraud lawyers on behalf of defrauded investors.

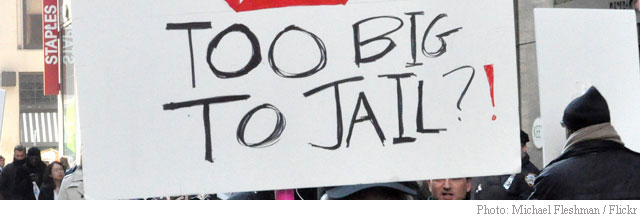

So why no jail sentences for the bank executives involved in serious criminal and fraudulent conduct?

Attorney General Eric Holder once said that prosecution of a big bank may be “difficult” given the complexity of their trades. He later recanted that statement, but it was certainly very telling.

In short, prosecuting a “Too Big To Fail” Wall Street institution for defrauding investors is tough work. But a decade ago, a government task force successfully jailed Jeff Skilling and convicted Ken Lay for the Enron fraud which was extremely complex and difficult. The Feds also put Bernie Ebbers of WorldCom, Adelphia executives, Tyco big shots and other similar fraudsters away for long jail sentences.

But that was ten-years ago. Somehow, there doesn’t seem to be a will to do anything this time around.

Perhaps bank executives are just “too big to jail.” But the American public deserves to see the spectacle of a trial to understand the callous nature of the Too Big To Fail banks crimes.

O.J. Simpson got away with a crime, too. But he stood trial. The public witnessed the sad but riveting Ford Bronco chase, followed by the criminal and civil trials, all revealing Simpson’s twisted state of mind and guilt a decade ago. From such a spectacle, the American public began to understand the pervasive nature of domestic violence and spousal abuse. Trials can educate and inform, not just deter.

For Citigroup, a $7 billon penalty for knowingly peddling toxic mortgages is a drop in the bucket. It’s the cost of doing business. And the message from Attorney General Holder is clear. If they want to lie to customers, Wall Street banks have plenty to gain and almost nothing to lose.

Zamansky LLC are securities and investment fraud attorneys representing investors in federal and state litigation against financial institutions.

Leave a Reply