I am of two minds when it comes to commercial real estate, so I’m going to write this a little differently than the other SMACKDOWN pieces. I’m going to go over some commonly held (if not majority) views on CRE and then talk about where I come out.

1. Commercial real estate is only beginning to become a problem.

Agree. While I’ve argued the worst for residential real estate is behind us, and while I also think the economy is at least bottoming, the worst for commercial real estate is yet to come. I look at it this way. Imagine a retail development. Doesn’t matter if its a mall or an outdoor space. Assume that the space has many lessees, some larger chains, some local retailers, a restaurant or two, etc.

Consider the progression of this recession. Retail sales didn’t start falling in earnest until August 2008. Ex-autos, the retail sales figure peaked at $310 billion in July, fell to $280 billion by December (9.7% decline). It now stands at $284 billion, a 1.3% increase. So net-net we’re down about 8.4%.

An 8% decline in sales may or may not sink a given retailer, and it certainly wouldn’t cause someone to close up shop right away. Say you leased space to operate a Cantina. You see your sales decline over a 6-month period by 8%. This Cantina is your blood sweat and tears. You aren’t just going to close up shop at the first sign of red ink. It would take a little time for you to conclude you aren’t making adequate profits.

Same goes for bigger retailers. Say there is a Gap within this retail development. Gap isn’t going out of business, but maybe this is one of their underperforming locations. Again, they aren’t going to close it after one underperforming month. But maybe once they get through Christmas, they take a look at their best and worst locations, this one gets cut.

Office buildings aren’t that different. Firms make layoffs but that might not immediately mean they take less office space. Especially a medium-sized business. Say you employed 150 people in some professional services business. Say its an advertising agency. Revenue starts dropping off last summer, but you probably don’t get around to laying anyone off until October or maybe even later. And the first dozen or so layoffs would just create more space for those that are left. Only after large scale layoffs (or closing the business entirely) would you need less office space.

So its obvious that problems in commercial real estate are likely ahead of us, not behind us, even if the economy has already bottomed.

2. Commercial real estate prices are going to drop more than residential prices have.

Agree with this too. Its hard to get real good data on how far commercial real estate prices have fallen. Of course, commercial real estate is a more diverse set of assets than residential. A hotel is very different from an industrial park. Plus assets don’t trade as often. But we can get some idea by looking at REITs. Right now the Wilshire REIT index is down 57% from its peak, and at one point was down as much as 78%. Residential obvious never got this bad, especially not nationwide.

3. Losses on commercial real estate lending will be worse than residential.

Don’t agree entirely. The lending standards were never similar. Here I have two bond deals. One was a large CMBS deal from late 2006, one was a B/C residential deal. Two things to notice.

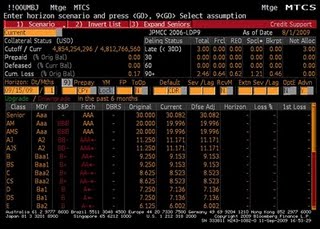

First, the CMBS.

The total delinquencies in the CMBS deal are tiny, only 3%. Next see that the subordination to the senior most part of the deal was originally 30%. That means that losses have to top 30% before the senior bonds start taking losses.

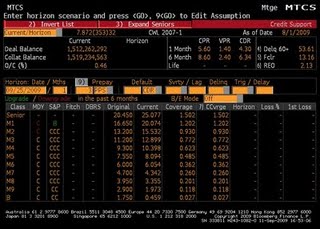

Now look at the B/C residential.

This deal is getting worse all the time!

Delinquencies at 54%, while the originally subordination was only 20%. So the deal was originally set up to take 10% less losses than the CMBS deal.

This gets to an important point. Everyone knew commercial real estate property values could decline when the loans were underwritten. Loans were underwritten accordingly. Residential was underwritten as though home price declines wasn’t possible. That’s why a residential deal full of sub-prime borrowers could actually have less subordination than a commercial deal.

You also have to consider the lack of innovation in commercial real estate. There wasn’t the equivalent of a NINJA loan or Option ARM loan in CRE. On top of all this, residential loans were very commonly repackaged into ABS CDOs. While there were some CRE CDOs, it was a tiny fraction of the total structure squared market. Most of the more infamous RMBS securities, the ones that are sinking Ambac (NYSE:ABK) and sunk Merrill Lynch were these repackaged RMBS. Not the more pass-through like CMBS.

4. Commercial real estate will be worse than residential.

So this last point becomes difficult to say, because it depends on your point of view.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply