Of the three pillars of the nascent European banking union, establishing a unified bank-resolution mechanism is the most pressing issue. This column suggests some changes to the existing Single Resolution Mechanism proposals. The decision to initiate resolution should be left to the ECB and national resolution authorities. Debt automatically convertible into equity when capital thresholds are violated could partially replace liabilities subject to bail-in. The Single Bank Resolution Fund must be supranational to ensure the credibility of the mechanism.

A banking union in Europe is essential to the long-run stability of the Eurozone (Draghi 2013 ). It will be built on three pillars:

- A single supervisory mechanism.

The necessary regulation for this is already in force.

- A single resolution mechanism.

This is now under negotiation before the European Parliament and the Council, with a political compromise likely to be reached at the forthcoming European Council meeting in December.

- Deposit insurance.

For the time being, European leaders have decided to proceed by stronger harmonisation of national legislation, rather than establishing a centralised European system.

New research

The unified resolution mechanism is the burning issue. Resolution is an administrative procedure to manage banking crises out of court, so as to protect financial stability, vital systemic functions, and depositors, while minimising any adverse impact on taxpayers. It normally entails the resolution authority taking full control of the failing bank’s assets, liabilities, and operations, with all the means and tools to reorganise it or wind it down. A recent CEPS Policy Brief provides a timely discussion of the proposals under negotiation and the open questions that must be settled before reaching a compromise (Micossi et al. 2013).

Three phases of bank-crisis management

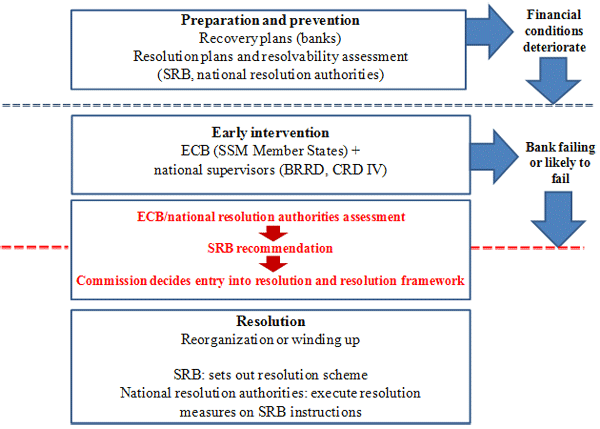

In the legislation under negotiation there are three phases of bank-crisis management (see Figure 1):

- Preparation and prevention;

- Early intervention; and

- Resolution.1

Under preparation and prevention, the resolution authorities (at the EU and national levels) will have to prepare resolution plans, explaining how a bank will be resolved while protecting systemic functions and financial stability, and minimising the potential burden for taxpayers. Resolution authorities are also required to identify impediments to resolvability and adopt measures to facilitate it, including: changes in banks’ structure to reduce complexity; limits to exposures; limitations on or prohibition of activities, products, and business lines; and requirements to issue additional convertible capital instruments.

The single supervisory mechanism regulation attributes strong early intervention powers to the ECB (Article 16) including, among others: the request to hold own funds in excess of minimum capital requirements; to apply a specific provisioning policy; to limit activities and operations; to restrict or prohibit dividend distributions; and to remove management.

Resolution begins when a bank is failing or likely to fail, without any possibility of restoring its viability with a private-sector or supervisory action, and when a resolution action is necessary to preserve financial stability and vital systemic functions.

Resolution procedures and tools

Given the specific nature of the banking business and the risk of contagion spreading to other banks, the procedure for resolving banks must be swift to protect systemic functions and reassure depositors. Ordinary insolvency proceedings normally cannot guarantee this result, which is why most countries already have special administrative (out of court) procedures to handle bank resolution (Financial Stability Board 2013).

Under the proposed legislation, resolution at the EU level will be entrusted to the Single Resolution Board, a new EU agency. Specific principles and tools to guide these procedures were developed by the Basel Cross-border Bank Resolution Group (Basel Committee on Banking Supervision 2010) and the Financial Stability Board (2011). Accordingly, the Single Resolution Board will be able to use administrative resolution tools including: the sale of business, enabling authorities to sell an institution or part thereof without shareholders’ approval; the setting up of a bridge institution, with a view to selling it to the private sector when market conditions are appropriate; asset separation, entailing the transfer of impaired assets to an asset management vehicle, which will then sell them to the market; and bail-in, giving resolution authorities the power to convert into equity or to write down claims of unsecured creditors.

Figure 1. The three phases of bank-crisis management

A Single Bank Resolution Fund will be set up under the control of the Single Resolution Board, to ensure the availability of medium-term funding support while the bank is restructured. It will be funded ex ante through risk-based contributions by the banks included in the Single Supervisory Mechanism, in line with the rules set by the Bank Recovery and Resolution Directive for national resolution funds. The Fund will be allowed to intervene only after shareholders and creditors have contributed to loss absorption and recapitalisation for an amount of at least 8% of total liabilities; the maximum amount it can make available to an individual bank is capped at 5% of total liabilities.

As proposed by the Commission, the Single Resolution Mechanism should apply to all banks falling under the Single Supervisory Mechanism, under the principle that all banks should be treated equally. The request by some member states to exempt some banks – thus reopening a discussion that was satisfactorily settled with the Single Supervisory Mechanism Regulation – would create a second tier of banks exposed to supervisory forbearance and, in general, to broader discretion in the application of common rules, and preserve current distortions in the internal market.

Some changes in the proposals seem necessary

The proposed system appears to be generally well-designed, and respectful of the institutional balance of powers dictated by the Treaty. However, some specific aspects may be improved with a view to increasing the effectiveness and legal strength of the Single Resolution Mechanism. In particular, as argued by Micossi et al. (2013), the following changes appear desirable.

In order to streamline and speed up the initiation of resolution, the assessment that a bank is failing or likely to fail, and that no private or supervisory alternative is available, should be left to the ECB (in its supervisory role) and national resolution authorities, as the last act of early intervention. Accordingly, the Commission should in practice focus its intervention on verifying the existence of the public interest conditions that are required to open resolution. The decision to start resolution should normally be initiated after the close of business on Friday afternoon, and be completed before markets reopen.

On bail-in, we have proposed that the requirement for banks to have sufficient liabilities subject to bail-in could in part be translated into an obligation to issue debentures automatically convertible into equity when capital (evaluated at market prices) falls below certain thresholds. This would greatly strengthen market discipline on shareholders and management. We have also underscored the need for flexibility in the application of bail-in where there is an injection of public funds into a solvent financial institution – be that by national authorities or the European Stability Mechanism – so as to avoid unwanted destabilising effects when a capital shortfall becomes known to the public. This will be especially important in view of the comprehensive and ambitious asset quality review that the ECB and European Banking Authority will launch in the coming months – possibly leading to the conclusion that a major ‘precautionary’ injection of funds is needed in parts of the EU banking system.

On the Resolution Fund, our main proposition is that it must be supranational, since a collection of national funds would not eliminate national forbearance, and without a fiscal backup the entire scheme would lack credibility (on this, see also Gros 2013). The Fund would be paid for by financial institutions participating in the Single Resolution Mechanism, and would not require any support from national budgetary resources. However, this does not eliminate – for the sake of the very credibility of the Single Resolution Mechanism – the need to establish a last-resort fiscal backup for the Fund, to be activated in exceptional circumstances such as a systemic shock affecting large parts of the EU banking system. In this regard, the first line of defence can be provided by the European Stability Mechanism – with appropriate changes in its membership – and subsequently, in extreme cases of systemic banking crisis, by national budgets. The rules for tapping these backstops and the contribution keys by the member states should be agreed in advance, lest they become the subject of frantic and divisive negotiations should a major financial shock materialise. These funds should be repaid by financial institutions as soon as the crisis subsides. The credibility of the Single Resolution Mechanism requires that the system be completed by a fiscal backstop, which may be guaranteed in the first place by the European Stability Mechanism and as a last resort by national budgets.

Finally, we have discussed two legal aspects of the Single Resolution Mechanism’s design – its legal basis and the balance of powers between the different bodies involved in the resolution procedures. On the first aspect, were Article 114 to prove an inadequate legal basis for the exercise of centralised resolution powers deeply impinging on individual property rights, it might be necessary to consider, only in this respect, the joint resort also to Article 352. On the second aspect, we have stressed the critical role of the Commission, which must take the key decisions affecting property rights in the procedure, thus better underpinning their legality and political accountability under the Treaty.

References

•Basel Committee on Banking Supervision (2010), Report and Recommendations of the Cross-border Bank Resolution Group, Bank for International Settlements, Basel, March.

•Draghi, Mario (2013), Opening speech at the European Banking Congress “The future of Europe”, Frankfurt, 22 November.

•Financial Stability Board (2011), Key Attributes of Effective Resolution Regimes for Financial Institutions, Basel, October.

•Financial Stability Board (2013), Thematic Review on Resolution Regimes, April 11.

•Gros, D (2013), “The European Banking Disunion”, CEPS Commentary, Brussels, 14 November.

•Micossi S, G Bruzzone and J Carmassi (2013), The New European Framework for Managing Bank Crises, CEPS Policy Brief 304, Brussels, 21 November.

______

1 The proposals under discussion comprise a Regulation of the European Parliament and of the Council establishing a centralised mechanism for bank resolution, a Single Resolution Board to manage resolution, and a Single Resolution Fund (COM/2013/0520, Brussels, 10 July 2013). Moreover, the main principles and tools applicable for resolving a failing bank are contained in the June 2012 Commission proposal for a Directive on bank recovery and resolution, aimed at harmonising crisis management and resolution tools in EU member states (COM/2012/0280, Brussels, 6 June 2012). Any discussion of the new system must therefore refer to both proposals.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply