An interesting new research paper by Princeton Professors Alan Blinder and Mark Watson examines differences in performance of the economy under Democratic versus Republican presidents. The paper begins:

The superiority of economic performance under Democrats rather than Republicans is nearly ubiquitous; it holds almost regardless of how you define success. By many measures, the performance gap is startlingly large–so large, in fact, that it strains credulity, given how little influence over the economy most economists (or the Constitution, for that matter) assign to the President of the United States.

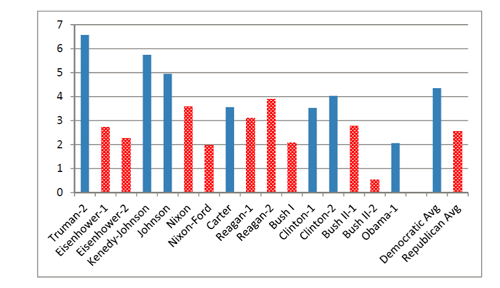

U.S. average annualized GDP growth rates, by term. Source: Blinder and Watson (2013).

After documenting that the difference in economic performance between Republican and Democratic administrations is statistically significant and highly robust, Blinder and Watson go on to investigate what accounts for the difference. They find little statistical explanatory power in any differences in monetary or fiscal policy under Democrats compared with Republicans. Instead, one of the variables that they find did seem to play a role is oil price shocks. The Suez Crisis of 1956-57, OPEC oil embargo of 1973-74, Iran-Iraq War beginning in November 1980, and Iraq’s invasion of Kuwait in 1990 all occurred during Republican terms, and all seemed to contribute to weak performance of the U.S. economy. Jimmy Carter was the one Democratic president unfortunate enough to be in office during a similar episode (the Iranian revolution in 1978-79), and ended up with one of the weakest economic records of the Democratic presidents. Although the public may end up blaming the American president for events like these, a reasonable person could well regard geopolitical conflict in the Middle East as largely beyond the power of the U.S. president to contain or control.

Another factor that the authors find quite important is variation in total factor productivity. For example, the productivity gains associated with the move to big box retailers in the 1990s appear to be a key factor in the strong economic performance during the Clinton administration. Although economists do not have a good understanding of the ultimate drivers of productivity, it again seems hard to make the case that the U.S. president is responsible for an important part of the variation.

A third factor that the researchers identify as potentially important is consumer confidence. For whatever reason, consumers on average have had a brighter outlook on the economy when a Democrat was in the White House. In Blinder and Watson’s statistical analysis, this seems to account for about a quarter of the D-R performance difference.

The authors conclude:

Democrats would no doubt like to attribute the large D-R growth gap to better macroeconomic policies, but the data do not support such a claim…. It seems we must look instead to several variables that are mostly “good luck.” Specifically, Democratic presidents have experienced, on average, better oil shocks than Republicans, a better legacy of (utilization-adjusted) productivity shocks, and more optimistic consumer expectations (as measured by the Michigan ICE).

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply