Bull markets die on euphoria.

If you’ve been on this planet for more than a couple of decades, you’ve seen it happen firsthand. Investors get a little too confident. Then they get complacent.

That’s when the trouble begins.

The broad market continues to push to new highs as we sprint toward the end of the year. Surely this means that the pros are going all-in when it comes to their managed portfolios.

Or not…

“The level of cash in actively managed stock portfolios has crept up to 3.5 percent of assets,” Reuters reports. “While low on an absolute level, that figure is the highest percentage of cash held by fund managers since the financial crisis in 2008.”

As it turns out, many of these portfolio managers are worried about stocks taking a dive early next year. Despite what you may have read, there’s still a healthy amount of fear in this market.

“If you are wondering where potential buying pressure will come from, it could be right here,” notes Schaeffer’s own Ryan Detrick. “Also, seeing the lowest number of bulls in the AAII poll since late August and you have another sign of some worry.”

So where is this euphoria everyone is talking about? Where are the out-of-control, overbullish investors?

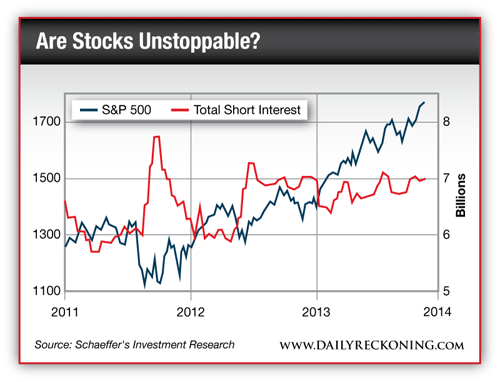

Meanwhile, catalysts that could continue to push this market even higher are popping up everywhere. Detrick notes that total short interest on S&P components is creeping toward its highest levels of the year. That’s added buying pressure if these shorts have to cover…

“All in all, I feel there is more than enough left in the tank to keep this rally going till at least early 2014,” Detrick says.

Stay long and strong heading into the holidays as stocks continue to climb the wall of worry…

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply