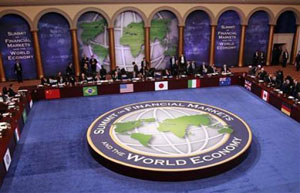

The statement from the G20 Finance Ministers meeting in London would appear to constitute a win for Tim Geithner and Alistair Darling. I use the word appears because it is always wise not to take these sorts of pronouncements at anything more than face value.

The statement from the G20 Finance Ministers meeting in London would appear to constitute a win for Tim Geithner and Alistair Darling. I use the word appears because it is always wise not to take these sorts of pronouncements at anything more than face value.

At any rate, the statement seems to indicate that the consensus was significant tightening of bank capital standards would be the thrust of future efforts. Treasury Secretary Geithner had pushed for this approach several days ago when he issued his guidelines for reform (link here) and he appears to have carried the day.

The French and Germans had come to the meeting with curbing bank pay and bonuses as uppermost in their minds. Recall that the French had already come down hard on their own banks and the Germans seemed inclined to follow their lead. The British were loath to jump on that bandwagon as they are desperate to save as much of the City’s financial industry as possible and viewed onerous compensation regulations as probably the last nail in the coffin.

Bonuses didn’t cause this crisis, they just made it seem all the more unseemly. By attacking overly lax capital standards, the finance ministers are on the right track. The key question is can they carry through and truly impose meaningful standards that can’t be gamed or will they cave to the power and pressure of the finance industry. It’s not an easy task.

more: here

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply