“NQ is a massive fraud,” the report begins. “We believe it is a ‘Zero’.”

Ouch.

Carson Block and Muddy Waters Research pulled no punches in the firm’s scathing report on Chinese ADR NQ Mobile Inc. (NYSE:NQ). The report alleges fraud from almost every angle. Muddy Waters claims NQ has lied about its user base, its Chinese security revenue and cash balances.

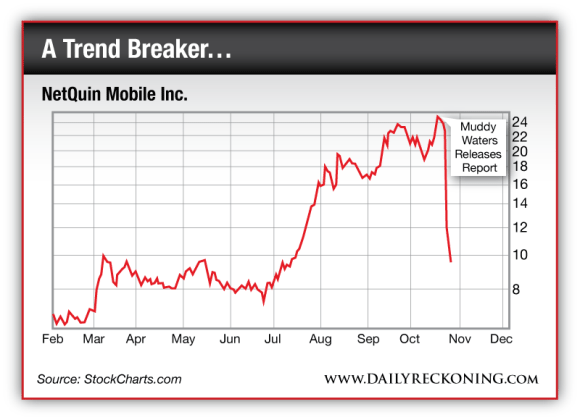

NQ had been a particularly popular trading stock since the summer. Shares sprinted from $8 to a high of almost $26 from June until the Muddy Waters report went out late last week. Since the allegations against the company surfaced, the stock has dropped more than 60%…

Short sellers going after Chinese companies isn’t a new game. But the Muddy Waters report has managed to rekindle investor fears over Chinese stocks right as many of them were beginning to look like great trades. The timing of the report has caused the NQ fallout to spread like a virus throughout other popular ADR momentum names.

As sellers ripped apart NQ shares, shareholders slammed other Chinese stocks that had enjoyed huge gains over the past couple of months. Investors have spared only a select few Chinese stocks listed on American exchanges. It’s not looking good out there…

Here’s the deal:

I don’t care if the Muddy Waters report is 100% accurate. That doesn’t matter. What we’re seeing among the Chinese ADRs is an abrupt (and painful) sentiment shift. That’s not something that a conference call or press release can fix overnight.

It’s not safe to trade these Chinese stocks right now. And by no means should you consider trying to hang on to Chinese ADRs for the long haul. Playing buy and hold with Chinese ADRs is like asking for a margarita at an Irish Pub. Your order probably won’t meet your expectations…

Leave a Reply