With the flip of a switch, stocks stampeded to new highs.

The market finally took a break yesterday. Stocks closed in the red. Barely. The S&P gave back just three points the day after the no-taper parade, marking just the second day this month the broad market posted a red day.

But get this—investors actually started pushing and shoving their way back into stocks before the big Fed announcement:

“Global equity funds attracted the largest inflows since at least 2005 in the week ended Sept. 18 as investors piled into stocks before the Federal Reserve’s decision to maintain monetary stimulus,” Bloomberg reports early this morning. Funds locked down $25.9 billion during this period.

That makes the next few weeks the ideal time for a post-Fed hangover to take hold. Especially since August’s entire decline was devoured with a swift barrage of buying that has left the broad market overbought at these levels…

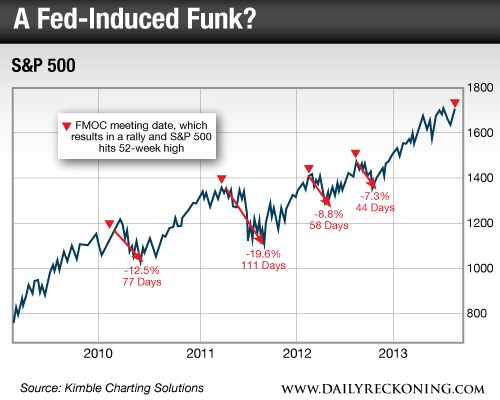

A short-term decline from here wouldn’t be unprecedented. Not by a long shot. If recent history is correct, stocks tend to trip up when new highs and FOMC meetings go hand in hand.

Take a look at this excellent bit of analysis from Kimble Charting Solutions:

Going back as far as 2010, post-FOMC rallies that result in new highs is a recipe for a broad market hangover. They’ve become less intense recently. But the 7% to 8% hangovers we last saw in 2012 remain noticeable after-effects of the post-Fed new highs phenomenon.

Yesterday, I told you that the fourth quarter could end up being a big one for the stock market. To be clear, I still think this market will shoot to even higher highs before all is said and done. But we’re ripe for a pullback right now. It wouldn’t surprise me at all if the market headed lower to shake out some of the dumb money before its 2013 finale.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply