The grisly Syrian civil war is dominating headlines across the globe today.

Stateside, stocks slipped after Secretary of State John Kerry effectively toughened the administration’s stance on the conflict. Warships are on the move. The market will certainly open much lower this morning as traders go on the defensive…

But there’s more at stake here than U.S. stocks having an off day. The situation in Syria is rippling across global markets. With this in mind, I’m going to detail three main side effects of the developing Syria crisis to give you the chance to strategically position your portfolio.

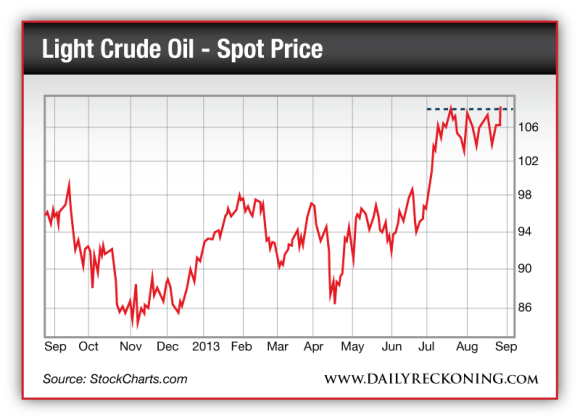

1. Oil Challenges Summer Highs

Crude is spiking more than 2% this morning. Just before 5 a.m., light crude futures stood at $106. By a little after 8 a.m., oil was hitting new 2013 highs above $108. Post-financial crisis highs for crude sit just below $114. We’re not that far off…

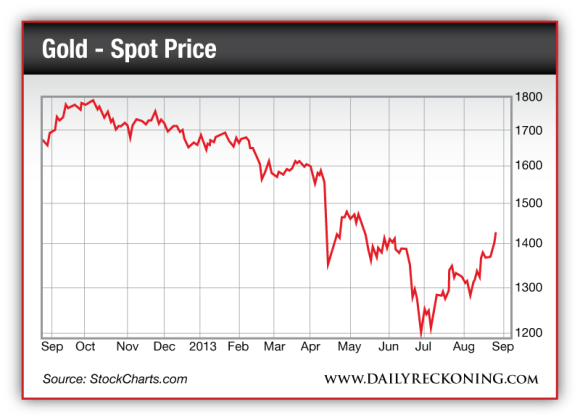

2. Gold is Ripping Higher

Gold loves fear. The yellow metal is on fire this morning after toying with the $1,400 level during much of yesterday’s trading. Now, gold futures have blasted through $1,420—adding a quick $26 (2%) to yesterday’s close.

If $1,420 holds, the next major resistance for gold is in the $1,450 range. It has momentum at its back right now. Metals and miners are continuing to outperform the broad market this month.

3. Emerging Market Outflows Intensify

Yes, U.S. stocks are getting hit today. But emerging markets could absorb the brunt of the selling as this crisis continues to unfold. Year-to-date outflows from emerging market funds ballooned to $5.9 billion, according to the Wall Street Journal. That’s absolutely brutal.

I wouldn’t be surprised to see the basket of emerging markets measured by the iShares Emerging Markets ETF push toward their June lows.

The carnage might tempt you to try to buy the blood in the streets. Don’t make this move just yet. Wait for signs of a bottom before making a contrarian bet…

Leave a Reply