Trading ‘high beta’ stocks that have a lot of momentum requires a quick mind as well as quick fingers (depending on the time-frame). Trading momentum stocks can be extremely rewarding if a trader is able to time them well, but it can also be extremely risky if you do not know how to obey levels.

When trading momentum stocks, the worst thing you can be is stubborn or inflexible. When a momentum stock (such as Tesla) flashes a caution/sell signal or a buy signal, the trader needs to be on their toes to react quickly. A trader can be in a lot of pain very quickly if they don’t make adjustments and ask questions later. The recent action in Tesla is a good recent example recently of why you need to be on your toes with momentum stocks. Tesla has provided multiple entry signals on its way up, but that doesn’t mean it will never go down. Over the last few days Tesla (TSLA) flashed us signals that at the very least momentum may be exhausted and that a trader should take caution.

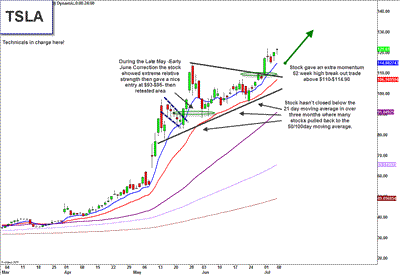

The first chart (shown below) is from a couple weeks ago. The chart explains a few of the buyable patterns that all (momentum) stocks show. At the time when this chart was created Tesla was showing strong momentum to the upside. Most of the time a good way to determine if a stock is going to have momentum is if it’s ‘riding’ the 8- and 21-day EMAs and near highs showing relative strength, exactly what we saw in Tesla. One of the cleanest buyable patterns at the time was when Tesla was bull-flagging before 5/23. A bull flag in a momentum stock is usually a good pattern to enter on as flag patterns signal potential continuation. A couple weeks later the next buyable pattern appeared on 6/26 and 6/28 (both entries), as Tesla had consolidated in a wedge pattern and was testing the upper range of it, poised for a breakout.

(click to enlarge)

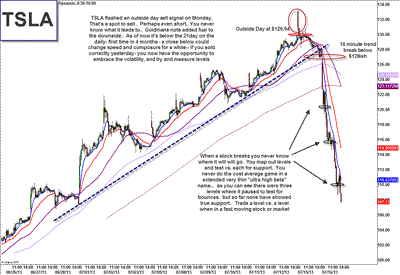

The next chart was created on 7/16, a few weeks after the chart we just viewed. At this point TSLA had just extended higher after breaking out of its last buy point we just talked about near $110 on 6/28 or $106 on 6/26. Tesla made a new high of 133.26 before traders got a wake up call from the price action that warned them of a potential composure change in this momentum name. This wake up call came on 7/15 as Tesla formed an exhaustion gap after an upgrade and the announcement that it would be added to the NASDAQ 100. An exhaustion gap alone is not a death knell for a stock, in fact sometimes it simply leads to a rest or pause(Ex. 5/7). However, at the very least it is a warning sign that traders should watch the stock more closely. The action on 7/15 was a warning to traders and 7/16 was confirmation of a momentum shift. The following chart is a 15 minute chart from 7/16 that goes over some intraday pivots that traders were looking at for potential actionable areas that day. The chart also clearly shows the confirmation move from the warning sign we received on 7/15.

(click to enlarge)

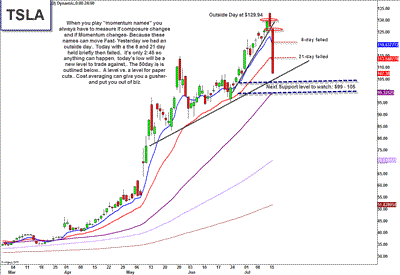

The final chart we are going to examine is that of Tesla on the daily timeframe from 7/16. Usually momentum stocks ‘riding’ the 8- and 21-day EMAs are likely going to continue in that direction and can provide great opportunities if you are able to spot the appropriate patterns. However, with momentum names the down moves are just as fast if not faster than the up moves. When price action flashes a warning sign like we just talked about it is essential for a trader to respect that and adjust appropriately. Momentum can cut both ways and just like it is wise to be long when it is ‘riding’ the 8 and 21 EMAs, when a momentum stock breaks below these key MAs the character of the stock immediately changes and therefore so must the trader. As of 7/16 Tesla is ‘broken’ and will need time to rebuild and gain upside momentum again. With the help of some simple patterns we can be prepared to react accordingly to when a momentum stock flashes signals that need to be watched for potential changes in pace or character.

(click to enlarge)

Leave a Reply