Bloomberg is carrying an interview with San Francisco President John Williams. Williams reiterates the possibility that future policy moves may be up or down:

“Even if we do adjust downward our purchases, it doesn’t mean we’re now in some autopilot of moving in the same direction,” Williams, 50, said in an interview yesterday in San Francisco. “You could even imagine a scenario where we adjust it downward based on good data and then adjust it back” if the economy weakened.

Yes, the Fed can change policy in any direction. But I reiterate what I said earlier: I simply do not believe that they believe that such changes will be likely. First, I don’t think they will want to reduce the pace of purchases until they are sure they do not need to reverse course in the next meeting. Second, I think they will want to end asset purchases well ahead of hitting the 6.5% unemployment threshold. And I don’t think they can do that if they are fooling around with the pace of purchases over the next year.

That said, we will hear many officials repeat this same line. Why? Williams has the answer:

“Because we have this freedom to adjust, how will people interpret it?” he said. “This is uncharted territory.”

Once the Fed does decide to calibrate its bond-buying, its challenge will be to communicate that “these are just adjustments and not strong signals about things going forward,” he added.

The Fed is trying very hard to ensure that market participants do not overreact to any one policy shift, with the most likely overreaction being to tank Treasury prices and spike yields. The Fed believes that the way to prevent this is to continuously remind everyone that any subsequent moves might be up or down, so don’t assume a downward move in the pace of purchases implies anything about the next meeting.

But keep in mind that the Fed does not have a forecast that suggests policy will shift up and down randomly. They have a forecast that the first cut to the pace of purchases will be the beginning of the end for quantitative easing and, in all reality, will start the clock on the first rate hike. In other words, they can talk about moving policy up-and-down, but I can’t imagine that they really expect such ups-and-downs to be the path of policy going forward.

In other news, New York Federal Reserve President William Dudley reiterates Federal Reserve Chairman Ben Bernanke’s position:

“I don’t really understand very well how the tug-of-war between the fiscal drag and the improving economy are going to sort of work their way out,” Dudley said in an interview with Michael McKee airing today on Bloomberg Television. “Three or four months from now I think you’re going to have a much better sense of, is the economy healthy enough to overcome the fiscal drag or not.”

Dudley adds something that I think is important:

“The important thing to recognize about the U.S. economy is that things are actually improving underneath the surface,” Dudley said in the interview. “We don’t really see that so much in the activity data yet because of the large amount of fiscal drag.”

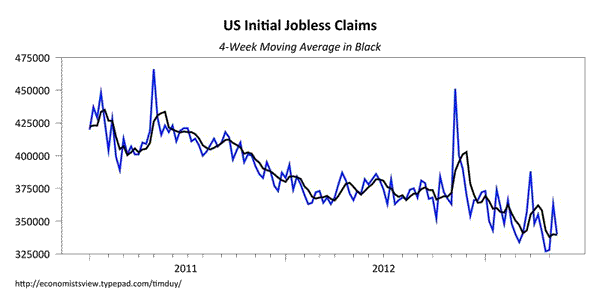

Translation: Fiscal drag will weigh down the GDP numbers. Look underneath those numbers to building momentum in the economy. I think this means there will be extra weight on the jobs data rather than the GDP data as an indicator of the impact of fiscal policy. With that in mind, note that jobless claims reversed last week’s spike:

I would say the downward path of claims remains intact despite the fiscal drag. That is what will be meaningful for assessing “strong and sustainable.”

Bottom Line: Assuming current data holds, the beginning of the end of QE is coming. But not immediately. Maybe three meetings out in September assuming that the impact of fiscal drag remains largely contained to the GDP data. The Fed does not want us to jump to conclusions about future policy moves based on that initial shift. But I am hard-pressed to see a forecast that would allow for up-and-down moves once the Fed pulls the trigger. Up-and-down moves cannot be their expected policy path.

Leave a Reply