There’s nothing like a little mean reversion to start your day…

The Japanese Nikkei fell flat on its face overnight. Investors looking for an excuse to take profits received just that in the form of soft Chinese manufacturing numbers. That’s all it took for traders to mash the “sell” button…

After shooting as high as 15,492, an afternoon selloff snowballed into major losses. By the end of the session, the index had fallen more than 7%, its biggest drop since the 2011 tsunami. According to Bloomberg, every single company in the Nikkei 225 retreated for the first time in 8 years.

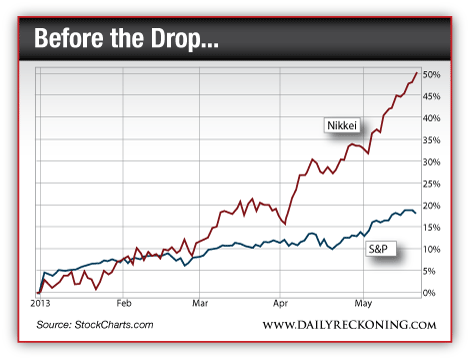

Even before its big drop last night, the Nikkei had become quite the sideshow. It set a blistering pace—rising more than 50% so far this year. Since the rally began in mid-November, the Nikkei had returned 80% before today’s correction.

So to put in all in perspective, last night’s drop takes Japanese stocks back to where they were… on May 9th.

Does this mean US markets won’t feel the effects of the Japanese correction? Absolutely not. Seven percent is a big number any way you slice it. It’s going to create some short-term fear.

The Hang Seng dropped more than 2.5%. Most European markets are down more than 2%. Stateside, S&P futures are off about 1%. If you’re one of those investors who has waited and waited for a pullback, this action—coupled with yesterday’s drop—certainly looks like the beginnings of a cooling period the market desperately needed.

When you compare the S&P gains with the Nikkei, it doesn’t look that impressive. But that doesn’t mean US stocks didn’t need this time to consolidate…

Don’t get spooked by today’s action. Too many investors are easily “brainwashed” when markets move in one direction for too long. Anyone who thought stocks would never have an off day is waking up on the wrong side of the bed today…

But if you’ve paid attention, you know that it’s time to watch and prepare. The trend is up. A pullback is brewing. Embrace it and look carefully for your next buying opportunity.

Leave a Reply