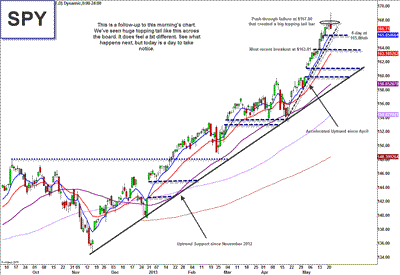

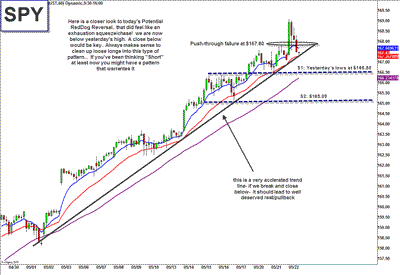

I’ve attached two charts: the daily chart and the 60-minute chart, and both have potential massive topping tails. We see the same topping tails across many sectors right now. Bernanke triggered an early push higher in the market with his usual dovish comments, but it seems after he said the words “on the other hand” the market starting pulling in. The rest of the FOMC is more hawkish than the Fed Chairman, so it is no surprise that the minutes released at 2 PM ET were less market-friendly and caused the sell-off to intensify.

Combine those two Fed related events with the fact that we are in a very extended markets, and it makes for some potential volatility. If nothing else, this is now a spot to clean up some loose longs, in my opinion. If you have been looking for short entry signals, I think this is the strongest one we’ve had in a while, but we’ll see what it leads to. I wouldn’t put anything past this 2013 market, so you should tread softly in whatever you do here, in my opinion.

The 8-day moving average stands at $165.76 and the 21-day MA stands at $166.33 — those are the next levels to watch.

Daily – (NYSEARCA:SPY)

(click to enlarge)

60-minute

(click to enlarge)

Disclosure Scott Redler is long BAC, short SPY. Traded but flat AAPL, MCP, JAZZ, INTC, ZNGA.

Leave a Reply