Very eventful morning in the market. The whirlwind started last night with Steve Jobs’ resignation and continued this morning with Warren Buffet’s $5 billion investment into Bank of America Corp. (BAC). We all know that excitement is to be sold, and fear is usually bought, and those ideas worked to a T with those stocks following their big announcements.

Strength in the banks the last few days makes you suspicious that someone must have known about the Buffet deal. I did not know, but the relative strength had me long Morgan Stanely (MS) and Bank of America (BAC) going into today. I did sell some into the strength pre-market.

Apple Inc. (AAPL) is taking the news in stride and only off 1.7%. This gave those long overnight a way to trade out of it alive, or even add based on a long-term view. Everyone knew this was a possibility given Jobs’ ill-health, so removing the cloud of uncertainty could be a net positive for the stock.

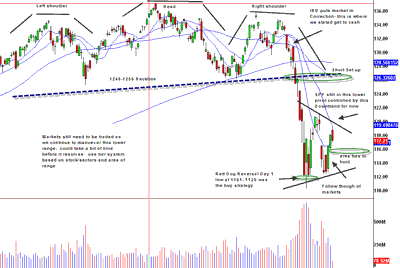

The upper end of this lower pivot contained the rally as the 20 day moving average around 1192 contained the move in the SPX. The QQQ filled it’s gap up to 53 or so.

You still need to actively manage your share size based on stock and the market’s range. Considering it was our 4th up day, taking some profits to be safe this morning made sense. Now we need to hold higher, I would think 1140-1145 should continue to hold. If the 1150 area holds, even better.

This morning I discussed covering the GLD as this was the third down day. The move was quick and harsh. I covered and nibbled long vs. the low of 165.88 for a trade. I also mentioned to cover any SLV shorts you might have had into the down open, but I did not buy this laggard.

Some are hesitant in front of Bernanke tomorrow, and rightfully so! The DAX falling apart is also a bit worrisome, as some are anticipating a downgrade. The Europe situation is far from over.

Disclosure: Scott Redler is long AAPL, MS, BAC, MGM, GLD

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply