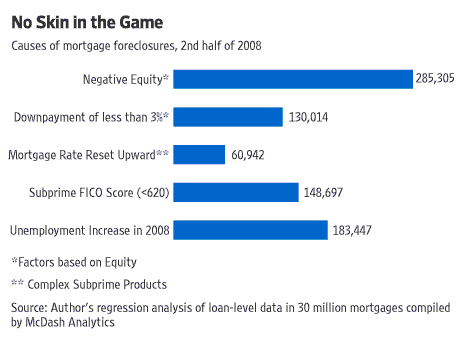

In an op-ed in Friday’s WSJ, professor Stan Liebowitz, suggests zero money down, not subprime loans, led to the mortgage meltdown. The professor also emphasizes in his piece how important a low LTV ratio (the % of a property’s value that is mortgaged) is in explaining the slide in great numbers into foreclosures. Here are a few excerpts:

What is really behind the mushrooming rate of mortgage foreclosures since 2007? The evidence from a huge national database containing millions of individual loans strongly suggests that the single most important factor is whether the homeowner has negative equity in a house….This means that most government policies being discussed to remedy woes in the housing market are misdirected.

Many policy makers and ordinary people blame the rise of foreclosures squarely on subprime mortgage lenders…

But the focus on subprimes ignores the widely available industry facts (reported by the Mortgage Bankers Association) that 51% of all foreclosed homes had prime loans, not subprime, and that the foreclosure rate for prime loans grew by 488% compared to a growth rate of 200% for subprime foreclosures. (These percentages are based on the period since the steep ascent in foreclosures began — the third quarter of 2006 — during which more than 4.3 million homes went into foreclosure.)

Understanding the causes of the foreclosure explosion is required if we wish to avoid a replay of recent painful events. The suggestions being put forward by the administration and most media outlets — more stringent regulation of subprime lenders — would not have prevented the mortgage meltdown regardless of their merit otherwise.

Rather, stronger underwriting standards are needed — especially a requirement for relatively high down payments. If substantial down payments had been required, the housing price bubble would certainly have been smaller, if it occurred at all, and the incidence of negative equity would have been much smaller even as home prices fell.

Graph: WSJ

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply