Oil has three cracking points: when it gets refined, when it stops rising, and when it breaks the economy. Econbrowser analyzed oil prices and the economy and concludes:

Every recession (with one exception) was preceded by an increase in oil prices, and every oil market disruption (with one exception) was followed by an economic recession.

Merrill Lynch’s Sabine Schels, a commodity analyst, calculates that $120/bbl will break this recoveryless recovery. This price makes the energy sector 9% of the economy, and she says we saw that in the 1980s and in 2008. Since oil tends to rise into the summer, this puts the cracking point out in Q2.

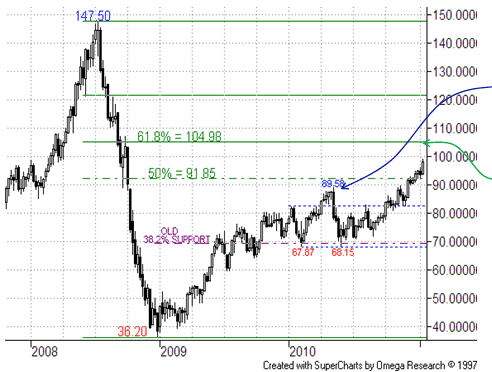

Might oil peak before $120? Oil’s price is approaching a key level at $105/bbl (see chart, courtesy Market Oracle), the 61.8% retracement (this is the Brent Crude level; in the US WTI, oil fell a bit more on a cash basis, to $32, so the US level is just above $101/bbl.) You can see how it oscillated around the 38% level for a while before testing the 50% level at $90/bbl and falling back. It has now crushed through $90 and fallen off a bit, but stayed above $90. Watch to see if it falls back below in short order, indicating a false break. Otherwise we seem headed above $100 in short order.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply