The United States and the Eurozone are both currency unions. Member states within each union are prohibited from issuing the common currency. Money creation is delegated to a central authority (the Federal Reserve in the U.S. and the ECB in the Eurozone). The US dollar and the Euro are both major world currencies.

The United States and the Eurozone are both currency unions. Member states within each union are prohibited from issuing the common currency. Money creation is delegated to a central authority (the Federal Reserve in the U.S. and the ECB in the Eurozone). The US dollar and the Euro are both major world currencies.

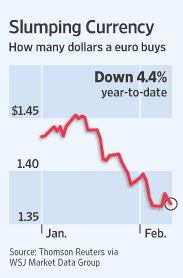

Given these similarities, my question is this: Why is the recent Euro depreciation being explained by the fiscal problems experienced by a subset of Eurozone members?

Actually, let me put the question another way. Why are state-level fiscal problems in the American Union not associated with sharp depreciations in the USD? (California, by the way, is an economy larger than Greece, Portugal, and Spain combined).

One difference between the U.S. and the Eurozone is that the latter has no central tax authority to accommodate wealth transfers (bailouts). In fact, Article 103 of the Euro Treaty explicitly states that the EU shall not be liable for or assume the commitments of central governments.

Another difference between these two unions is that there is no counterpart to U.S. treasury debt in the Eurozone. Hence, while the Fed “monetizes” federal-level debt; the ECB “monetizes” state-level debt (in this case, sovereign debt).

So, perhaps the answer to my question is as follows. When California experiences a fiscal crisis, markets expect it to be bailed out by federal transfers; the market does not expect the Fed to monetize California state debt. This does not pose a direct inflationary concern, and hence is ignored in the FX market. The opposite holds true for the Eurozone; hence, the direct impact on the exchange rate.

There are several reasons why I am not satisfied with this answer. One has to do with my preferred theory of the exchange rate, but I’ll leave this aside for now. The other has to do with the perceived credibility of the ECB. I doubt very much that the ECB will monetize Greek debt (and if it does, it will discount it heavily) and I don’t think the market believes this either. The market likely believes that a bailout is coming (you don’t actually believe that Article 103 is credible, do you?).

The bailout will be sold as “saving Greece;” but in fact, the bailout will in effect save the Germans and other Europeans holding Greek bonds. In short, a typical wealth transfer. Disgusting, perhaps…but inflationary, no.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply