If Warren Buffett announced he was about to jump off a cliff, countless investors would gleefully race him to the edge and fling themselves into the abyss.

The Cult of Buffett has amassed an unprecedented following over the years. His Midwestern charm and track record of shrewd investments have elevated Buffett to cult status. It’s safe to say he’s the most imitated investor on the planet…

So it’s no surprise that a stray comment made by Uncle Warren this week is spreading through the financial news like wildfire.

Speaking at Forbes magazine 100th anniversary event in New York Tuesday night, Buffett stuck to his usual script.

“Being short America has been a loser’s game. I predict to you it will continue to be a loser’s game,” he said.

Then he casually mentioned that he believes the Dow Jones Industrial Average will be “over 1 million” in 100 years, CNN Money reports.

Dow 1,000,000.

That’s a big number. Too big, according to the reactions of some market watchers. The financial press is all over the forecast, twisting its hive mind in a knot to comprehend a seven-figure Dow.

But is a Dow 1 million call irresponsibly, outrageously bullish?

Of course not.

For starters, Buffett won’t live to see whether his prediction will come true. No one reading this note today will be around, either.

I can’t fathom what the world will be like in 20 years – much less 100 years from today. The year 2117 isn’t a part of my investment plan. They say you’re supposed to only invest in stocks that you want to hold forever. That’s never sat right with me. In forever, I’ll be dead.

But we don’t have to own a time machine to understand that Dow 1 million is actually a conservative forecast.

For starters, the Dow isn’t a single company that must navigate 100 years of technological development and geopolitical strife. It’s is an actively managed group of the biggest and best companies in the world. When a serial underperformer emerges, it’s booted for a new company that better represents the current economy. In short, it’s designed to go higher over time. No matter what.

Not much is certain in this world. But this is: the Dow will look completely different 100 years from now.

Now let’s break down Buffett’s big number.

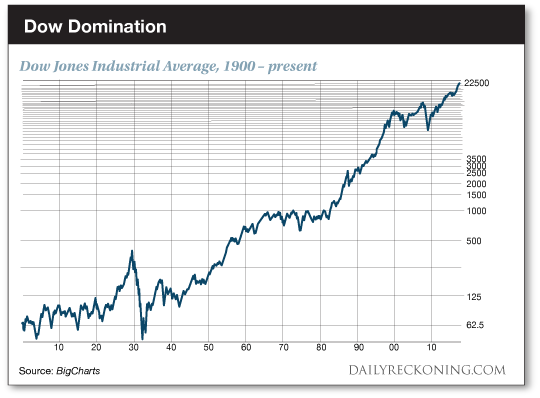

Right now, the Dow Jones Industrial average is sitting near 22,400. If the Dow perfectly follow’s the Oracle of Omaha’s call and hits 1 million exactly 100 years from today, we’re looking at a total return of 4,370%.

That’s feels like a big number at first glance. But spread these gains out over a century and you’re not exactly setting the world on fire. Dig down a little further and you’ll find that Dow 1 million by 2117 would net an annualized return of just 3.8%.

To put that number into context, the Dow was sitting near 80 in 1917. Since then, it’s produced a return of 27,500% return. That’s a little less than 5.8% annualized.

The Dow’s performance over the past hundred years proves that Buffett’s call isn’t so crazy. In fact, it’s downright conservative.

Don’t let the big number fool you. Your great-grandkids won’t think anything of it…

inflation makes counting harder but buying an item stays about the same. wouldn’t a constant dollar value make for an easier life. who needs to pay $1,000 for a pound of sugar?