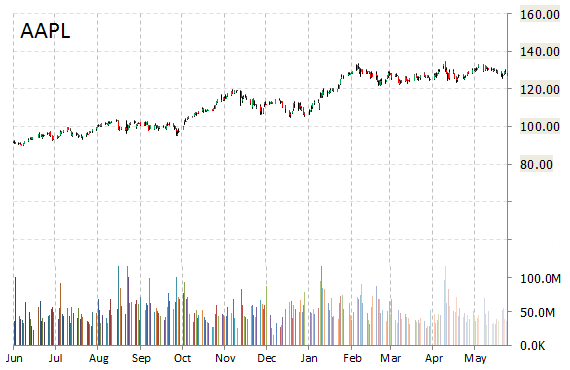

Apple Inc (AAPL) is generating strong profits from sales of Apple Watch bands, according to data seen by Reuters. Nearly 20 percent of the buyers, who are spending hundreds of dollars for the timepiece, are buying more than one band, the publication said citing data by Slice Intelligence, a research firm that mines e-mail receipts.

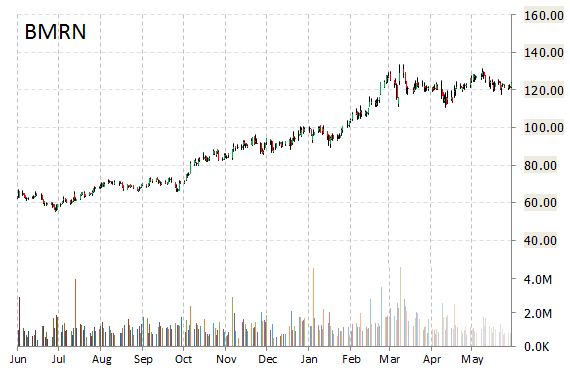

Shares of BioMarin Pharmaceutical Inc. (BMRN) are up more than 7% this morning after the company said its experimental drug was effective in improving growth in children with achondroplasia, the most common form of human dwarfism.

BioMarin said 10 children receiving the highest dose of 15 micrograms per kilogram of the injectable drug a day showed a 50 percent increase in their growth velocity, compared with their annualized prior 6-month natural baseline growth velocity.

“This increase in growth velocity, if maintained, could allow children with achondroplasia to resume a normalized growth rate,” commented Wolfgang Dummer, M.D., Ph.D., Vice President, Clinical Development of BioMarin.

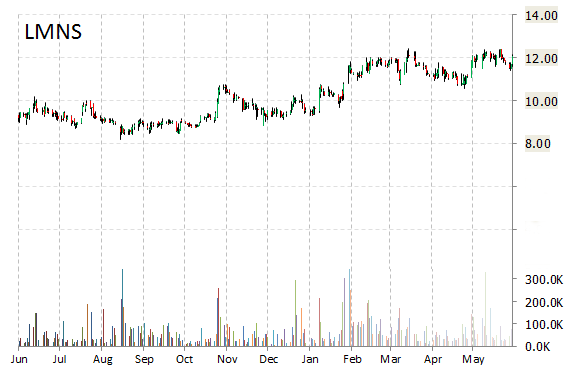

Shares of Lumenis Ltd. (LMNS) are higher by 14.24% to $13.80 in morning trading on Thursday following this morning’s announcement of deal to be acquired by XIO Group for $14.00 per share in cash, for an aggregate purchase price of approximately $510 million.

“This acquisition is a strong recognition and vote of confidence in Lumenis’ achievements and its employees, and I am excited about the future prospects of Lumenis,” said Tzipi Ozer-Armon, Chief Executive Officer.

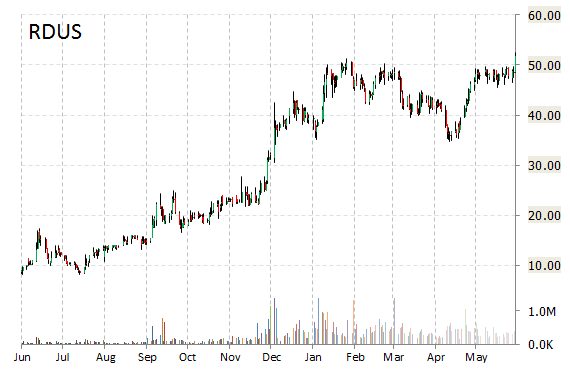

Shares of Radius Health, Inc. (RDUS) spiked up by more than 20 percent on Thursday after the company reported in a press release top line data from the first six months of ACTIVExtend and the 25 month combined data from ACTIVE and ACTIVExtend. Additionally, Radius is reporting new data from an exploratory analysis of major osteoporotic fractures in the ACTIVE trial.

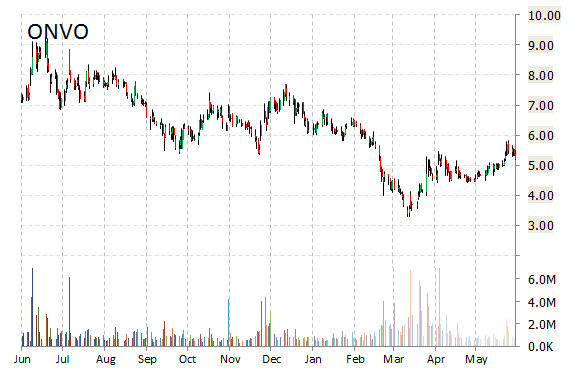

Organovo Holdings, Inc. (ONVO) is plunging nearly 14 percent to $4.49 following the pricing of $40 million public offering of its common stock at a PPS of $4.25.

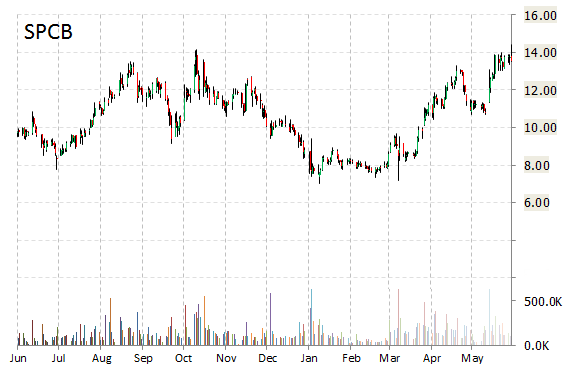

SuperCom Ltd. (SPCB) is under heavy pressure this morning, down 11% in early trading after the company announced the pricing of an underwritten public offering of 2.1 million shares at a price of $12.00 per share. The offering is expected to close on or about June 23, 2015.

About 621K shares of SuperCom were traded by 9:45 a.m. Thursday, above the company’s average trading volume of about 193,000 shares a day.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply