I occasionally hear the argument that high taxes promote growth more than they harm it because countries with higher taxes as a share of GDP have higher per capita income. It is true that rich countries have far higher tax revenue as a share of GDP than poor countries. However, this does not prove that high taxes are good for the economy. It is important to distinguish tax revenue from tax rates.

Low tax revenue does not prove that tax rates are low. Poor countries can have high tax rates and still collect little in revenue. One reason is that the economy is less monetized. It is hard to tax an economy based on sustenance farming or barter.

Moreover, disorganized countries tend to have trouble collecting taxes even on the monetized sector. This is even true in Europe and is obviously worse in the thirld world. Greece has far lower tax revenue as a share of GDP than Sweden though tax rates are similar.

The more well-organized and advanced a country is, the higher will tax revenue be for a given tax rate. This creates a significant causality problem when taxes as a share of GDP are compared with growth rates and / or income.

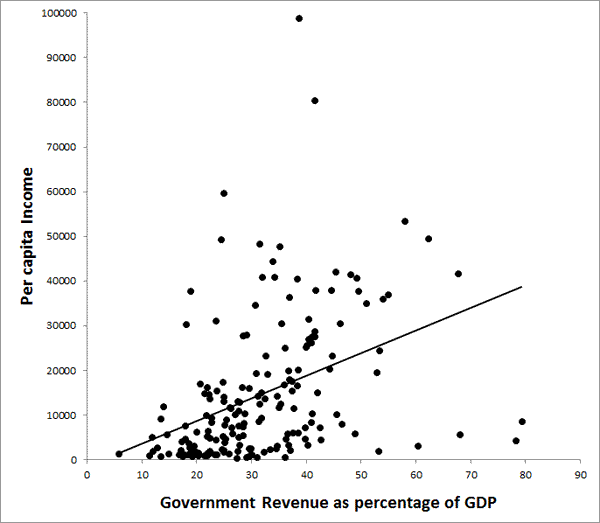

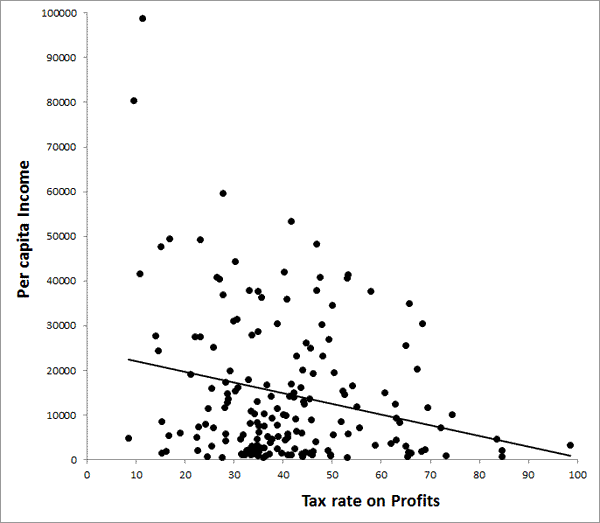

Tax rates are difficult to summarize in one number since most economies have hundreds of different tax rates, depending on the level and source of income. The World Bank has produced an interesting standardized measure of the tax rate faced by business. They construct a fictional medium-sized business and see what taxes the same business would in total face in various countries. From the IMF we get data on government revenue (mostly taxes) as a share of GDP and on per capita income.

As you can see tax revenue correlates positively with per capita GDP.

However if we look at the profit tax rates for the same set of countries, the correlation with GDP is strongly negative. These graphs illustrate the fact that a lot of poor countries with little tax revenue actually have pretty high tax rates on business. The positive correlation between tax revenue as a share of GDP and per capita income should not be used to prove that high tax rates are good for the economy.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply