On January 25th, 2012, in addition to its regular statement from the Federal Open Market Committee, the Federal Reserve published for the first time two additional documents: Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents and a Statement of Longer-run Goals and Policy Strategy. The media and the markets reacted positively to the statement. The most quoted phrase was:

In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

Stock markets gained close to 1%, while yields for bonds with various maturities dropped by about 2 basis points.

The two new documents represent a historical shift in the monetary policy of the US. Put together with the standard FOMC statement, they offer much deeper insights into the way that policy makers think about the state of the economy. There are at least a dozen of points worth discussing: The explicit statement of a self-imposed inflation target; the expectations for future interest rates; the projections for GDP; their views on the natural rate of unemployment, etc. I want to focus only on two topics, which in my view are somewhat missing from the popular discussions: the consistency of the statement with the projections and policy-makers’ views on potential growth.

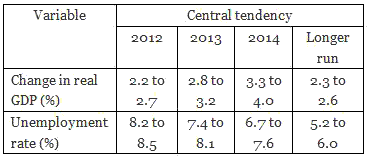

Economic Projections, January 2012 (excerpt)

First, if we look at the projections for real GDP growth and for unemployment, it is clear that by 2014 the output gap in the US is not going to close. Hence, it is quite possible that 2014 is even an early date for tightening according to the Fed. It does not necessarily mean that the statement is inconsistent with the projections. As indicated above, low interest rates are expected to be in place “at least” through late 2014. But it is worth pointing out that their “average” belief is that the economy will be still below potential at the end of 2014.

Second, and more worrisome, is the projection of long-term growth rates for the US economy. According to the Fed, the central tendency will be for long-term growth rates to be between 2.3% and 2.6% p.a. This is a significant departure from the historical record. In the post-WWII period, real growth in the US has been at about 3%. Fed’s projections suggest that this may not be the case anymore – indeed this implies a significant slowdown in the potential growth of the US economy. Just to illustrate the implications of cutting off 0.5 percentage points from the growth rate, let’s look at GDP per person in 2010 if the economy between 1950 and 2010 grew by 0.5% less. A simple calculation shows that instead of its current level of $46,844, US GDP per capita would be 26% lower at $34,530.

The dire projections of the slow cyclical recovery expected by the Fed and the downward shift in the potential growth rate have serious negative implications about the US economy. Is the Fed deliberately over-pessimistic, or do they believe indeed that we are getting into the “New Normal”?

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply