The world goes on. Whereas the news has tended to be dominated by what is happening in Europe, with some attention going to the United States, things are still going on in other parts of the world.

For example, “Standard & Poor’s has become the third rating agency this year to upgrade Brazil’s sovereign debt…” (link)

“Brazil’s debt fundamentals are already seen by markets as superior to many European countries with spreads on the Latin American country’s debt trading tighter than those of many eurozone countries.”

“The move…emphasizes the growing divergence between the fast-growing large emerging markets, led by China, Brazil, and India, and the advanced economies.”

Meanwhile, the central banks in emerging markets are buying gold in the largest quantities for forty years. The forty years is important for that refers back to 1971 when President Richard Nixon severed the tie between the United States dollar and gold.

“The scale of the purchases was bigger than previously disclosed and puts central banks on track to buy more gold than at any time since the collapse of the Bretton Woods system 40 years ago, when the value of the dollar was last linked to gold.” (link)

Many emerging countries, especially the BRICs, now believe that they are over-exposed to the dollar in their central bank reserves and are trying to build up gold reserves at times when the price of gold dips. Also, there is incentive to buy as concerns grow over the role of the United States dollar as a reserve currency.

“It is a mark of creeping distrust in the unofficial reserve currency, which nervous central bankers see being printed by trillions even as America’s political leadership shows no sign of dealing with its daunting fiscal challenges. Fiscal worries are even more acute for the number two and three reserve currencies, the euro and the yen.” (link)

But, “Central bankers are late to the gold party. Private buyers of ETFs alone have accumulated 15 times as much since their advent a decade ago as government bought last quarter. But their shift should be of far more concern.” (link)

Seemingly oblivious to these happenings, the United States continues to pursue policies that will devalue its currency. Fed Chairman Ben Bernanke appears to be focused on keeping the world abundantly supplied with U. S. dollars while Treasury Secretary Timothy Geithner continues to swear that U. S. policy is to maintain a “strong” dollar while the Obama administration continues to issue more and more debt.

Others within the Federal Reserve System continue to back up the Fed effort to continue to inflate the world. The President of the Federal Reserve Bank of New York, William Dudley, says that “the central bank isn’t out of ammunition “ and that “monetary policy must do its part” to support economic growth. (link)

And, the pressure in Europe is intense to get the European Central Bank to engage in much more aggressive actions to save the European Union and the euro. Is quantitative easing in the future for Europe? (link)

The emerging nations are seeing the “crack in the door” and are steadily moving to take advantage of the fact that the developed countries must currently keep their focus on current distractions. By following such a policy they see “the door” opening wider and wider.

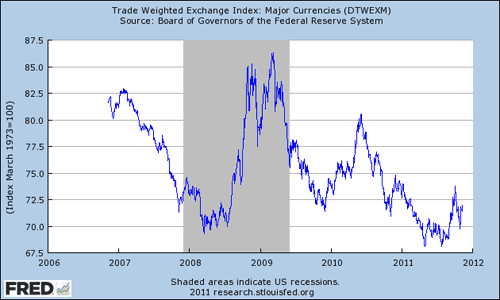

To me, the real report card is the value of the dollar. The credit inflation of the last fifty years in the United States, first, forced the United States off the gold standard, and, second, resulted in a secular decline in the value of the dollar. The U. S dollar still fluctuates near the lows reached over the past forty years since its value was floated.

Looking at the value of the dollar against twenty major currencies one can see that news lows were hit around August of this year. One can note that the three periods of recovery from the lows reached in 2008 were periods when there was a “rush to quality”. The first was during the “Great Recession” and the other two spikes came during the sovereign debt crises in Europe.

The economic policies of the United States government aim at a devaluation of the United States dollar. Still the United States dollar is the reserve currency of the world and is the currency of the country that remains the strongest country economically. This is why the United States dollar is still the haven for others when there is a movement to “quality.”

Since the second world war, the United States…with western Europe tagging along…has dominated the world, economically as well as militarily. During this time, the United States has basically acted independently of all others. It is still “Number One” in these areas but is finding that its voice is growing weaker and weaker. Current examples of this are the position the U. S. had to take in the actions in Libya and the back seat it took in the G20 meetings in Cannes, France. And, more and more it is finding that with its fiscal position that it just does not have the money to “throw at things” that it used to have in the past.

One way or another, the separation between the developed countries and the emerging countries is going to be a major factor in the world going forward. Most analysts have moved up the time they expect some of the larger emerging nations to catch up with America and western Europe. Within this environment, the currency conflicts and the financial conflicts are just going to grow.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply