Let me begin with some observations on the basic mechanics of sovereign debt default. If you borrow $1 at a 5% interest rate, next year you’re going to owe $1.05. If you don’t pay any of it back and just roll over the debt, you’d then have to borrow $1.05 next year, meaning you’d owe $1.10 at the end of the following year. It’s hard to see how that game can go on forever, even if it’s a sovereign government doing the borrowing.

One critical parameter is the GDP growth rate. If the GDP growth rate is bigger than the interest rate (e.g., nominal GDP growing faster than 5% in the previous example), then the debt you owe, although growing, would still shrink as a percentage of GDP. A sovereign government might well continue to find lenders in such a situation, even if it’s just rolling over a growing amount of debt. But if GDP growth is below the interest cost, then debt that’s continually rolled over would grow to become an arbitrarily large multiple of GDP. Eventually you run into the logistical constraint that there simply aren’t enough funds in the world to buy that much debt. As soon as lenders recognize that’s where the process is headed, the government is going to find it suddenly much more difficult to borrow the necessary new sums.

To prevent that from happening, over the long haul any government is forced to run a primary budget surplus, meaning that tax receipts exceed expenditures other than interest costs, in order to be able to use some of that primary surplus to make interest payments. The higher the debt load, the higher the steady-state primary surplus needs to be.

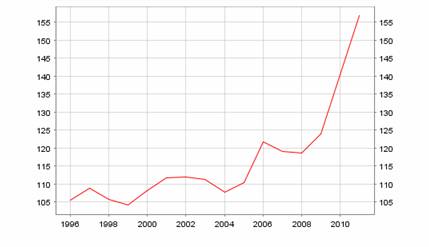

According to ECB data, Greek government debt was already 120% of GDP in 2008. The primary budget deficit was over 10% of GDP in 2009 and almost 5% in 2010. That plus the rapidly increasing interest rate facing Greece pushed their debt to 156% of GDP for 2010.

Greek general government debt as a percentage of GDP. Source: ECB.

And from there it’s hard to tell a story with a happy ending. Even if the Greeks defaulted 100% on the outstanding debt, moving the primary budget back to balance requires significant contractionary moves. And default (or large “haircuts”) on the debt means huge capital losses for Greek banks and pensions. That kind of financial disruption can eliminate the extension of most credit and initiate a brutal economic contraction.

Nervous investors were speculating last week whether Italy might be next. The situation in Italy is different from Greece, with much more modest primary deficits, and a debt-to-GDP ratio that remains below what the country had in 1996.

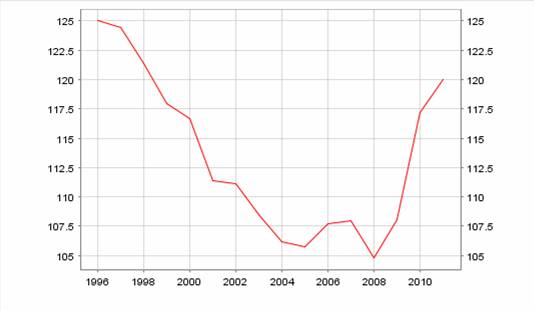

Italian general government debt as a percentage of GDP. Source: ECB.

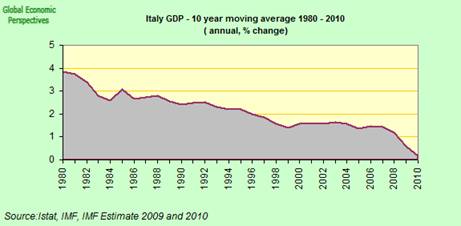

The pessimistic calculus in Italy has been a more slowly-unfolding drama, with a key development being the continuing slowing of the country’s growth rate. As the growth rate slid from 3% to 1%, being able to meet the interest burden of 120% debt-to-GDP becomes increasingly problematic.

Italian GDP growth rate (10-year moving average). Source: Fistful of Euros.

A year ago, the Italian government was able to issue 10-year bonds with an interest cost below 3.8%. Some might have argued that those low rates were a signal from the market that there was not much chance of Italy following Greece down the drain. At a visit to UCSD a few weeks ago, University of Maryland Professor Carmen Reinhart was asked whether that’s a correct inference to draw from a low government borrowing cost. Emphatically not, she said: “Yes, yields are low– until they’re not.” Historically, the changes can come pretty quickly, as the Italians discovered last week.

Yield on Italy government 10-year bonds. Source: Bloomberg.

Italy has responded with a series of reforms described by the New York Times:

The legislation includes selling $21 billion of state assets and increasing the retirement age to 67 from 65 by 2026. It also sets the stage for a liberalization of closed professions and labor laws, a gradual reduction in government ownership of local services and tax breaks for companies that hire young workers.

Good ideas, which succeeded in bringing the Italian 10-year yield down 60 basis points by week end. But what is the downside in all of this?

Obviously the sentiment could shift again, and other countries could find themselves in the crosshairs next. That would likely mean significant contractions in the affected countries from the credit factors noted above. What would be the implications of that for countries like the United States?

A significant economic contraction in Europe will reduce demand for U.S. exports. But my bigger concern is with international financial linkages. Which financial institutions have made loans or entered into derivatives with exposure to these troubled debts? A recent assessment by the Congressional Research Service estimated that U.S. banks have $641 billion in loan exposure to Portugal, Ireland, Italy, Greece and Spain. But French and German banks themselves have considerable debt to those same countries, and U.S. banks have another $1.2 trillion in loan exposure to German and French banks.

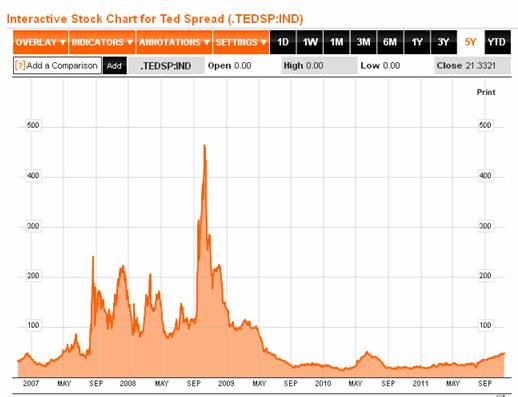

And this is the heart of the problem. Who takes the losses, and if they fall, who do they then bring down in turn? If you’re somebody with funds to lend and don’t know the answer, in response to these fears what you do is cut back all kinds of lending. If that sounds familiar, it should, because it’s exactly this kind of ricocheting financial uncertainty that brought down the world economy in the fall of 2008.

One key indicator to watch for whether we’re about to see a replay of those dynamics is the TED spread, which measures the gap between the rate at which banks can borrow Eurodollars from each other and the U.S. T-bill rate. This has been edging up, but is nowhere near signaling a crisis yet.

TED spread. Source: Bloomberg.

So, at this point the really scary fallout from the situation in Europe is perceived to be under control.

Until it isn’t.

Leave a Reply