I just returned from the annual conference of the Society for Financial Econometrics hosted by the University of Chicago. One of the many interesting papers described changes in Federal Reserve policy over time.

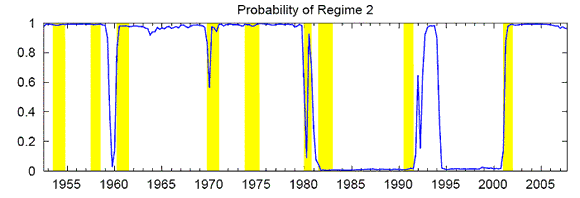

One formulation commonly used to summarize Fed policy is the Taylor Rule , which calls for the Fed to choose a higher interest rate when inflation is high and a lower interest rate when there is a big gap between the level of GDP and estimate of what the economy could produce at full potential. The Taylor Principle suggests that in response to a 1 percentage point increase in inflation, the Fed needs to increase the short-term interest rate by more than 1 percentage point in order to keep the economy on a stable path. A paper by Li, Li, and Yu presented at the SoFiE conference proposed that perhaps the Fed has been using different coefficients for this rule at different points in time. They estimated a regime-switching model that allows for such shifts. They identified some periods in which the Taylor Principle was adhered to (with a 1% increase in inflation leading the Fed to increase the interest rate by 1.5%), and others in which it was not (with a 1% increase in inflation leading the Fed to increase the interest rate by only 0.86%). The graph below plots their inferred probability that the Fed was in the accommodative regime at different historical dates. Their conclusion is that the Fed was not adhering to the Taylor Principle in the 1960s and 1970s, and returned to that accommodative regime again over the last decade.

Inferred probability that the Fed was in the accommodative regime. Source: Li, Li, and Yu (2010).

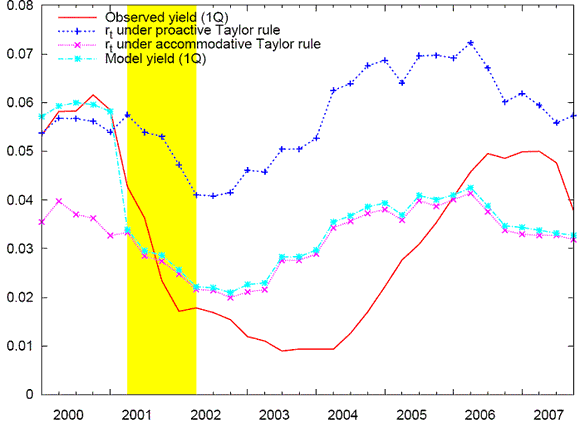

It’s interesting to look in detail at their description of the most recent decade. The red line in the graph below denotes the actual 3-month T-bill rate over 2000-2007. The blue line indicates the interest rate the Fed would have set if it were following the historical pro-active rule, and fuchsia indicates the predicted rate under the accommodative rule. The Fed seemed to start out the decade following the pro-active rule and then switched to an interest rate even below the accommodative rule.

Red: actual 3-month interest rate; blue: level implied by stable Taylor Rule; fuchsia: level implied by accommodative Taylor Rule; turquoise: level predicted by regime-switching model. Source: Li, Li, and Yu (2010)

This provides an interesting confirmation of the theme of a talk by Stanford Professor John Taylor also given at the conference. Taylor argued that a shift away from the policies followed in the 1990s was one factor contributing to the excessive housing boom and subsequent problems. My personal view is that Taylor overstates the contribution of low interest rates, and that poor regulation of the shadow banking system was a more important cause of the problem.

Nevertheless, I agree that the lax monetary policy of 2003-2005 was a mistake.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply