Earlier this week, President Obama talked about the weakening state of the economy, telling us that he’s not worried about a double-dip recession and that the nation should “not panic.” It’s hard to imagine a more alarming assessment at this juncture.

The recovery is faltering. Our economy is growing at annual rate of just 1.8 percent. Manufacturing just grew at its slowest pace in 20 months. More than 44 million Americans – one in seven – rely on food stamps. Employers hired only 54,000 new workers in May, the lowest number in eight months. Jobless claims increased to 427,000 in the week ended June 4. The unemployment rate rose to 9.1 percent. Nearly half of all unemployed Americans have been without work for more than 6 months. About 25% of all teenagers who are looking for work are unemployed. Eight-and-a-half million Americans are underemployed – i.e. working part-time because their hours have been cut or because they can’t find full-time work. There are, on average, 4.6 unemployed people for every 1 job opening. And even if all the open positions were filled, there would still be 10.7 million people looking for work.

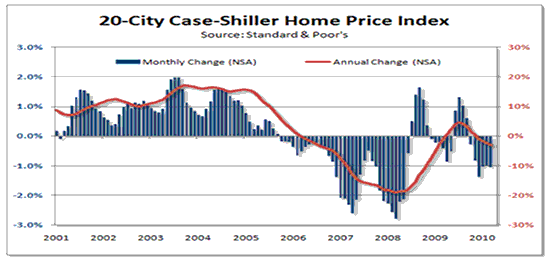

The Case-Shiller index shows that the housing market has already double-dipped.

And, because of the huge shadow inventory of yet-to-be-foreclosed homes, Robert Shiller, a co-creator of the index, thinks home prices could easily fall another 15-25% before bottoming out. If he’s right – and I suspect he is – this spells the end of the recovery. As prices continue to decline they create hidden losses elsewhere in the economy, hurting not just homeowners but the financial institutions that hold their mortgages. The list goes on and on.

These are not, as Obama said, “headwinds” that will slow the pace of our recovery. They are gale force winds that will push millions of families into poverty and thousands of business into bankruptcy.

There is a way out, but it seems unlikely that Congress and the White House will work together to do what’s necessary to turn things around. Why? Because a recent poll shows that 59 percent of the public disapproves of the president’s handling of the economy. And Republicans smell blood. They know that since WWII no president has been re-elected with unemployment above 7.2 percent, so they see Harry Hard Luck and Sally Sob Story as their best chance at reclaiming the White House in 2012. It’s a victory the Republicans have been masterfully engineering since February 2009, when they succeeded in restricting the size and scope of the American Recovery and Reinvestment Act (ARRA).

Some of us saw this coming. For example, Jamie Galbraith and Robert Reich warned, on a panel I organized in January 2009, that the stimulus package needed to be at least $1.3 trillion in order to create the conditions for a sustainable recovery. Anything shy of that, they worried, would fail to sufficiently improve the economy, making Keynesian economics the subject of ridicule and scorn.

But it’s easy to see why the $787 billion package we ended up with didn’t do the trick. Remember that the stimulus didn’t take effect all at once – it was spread out over a three-year period. And while the left hand of the federal government was trying to rev up the economy with increased spending, the right hand of the private sector (together with state and local governments) was dutifully stomping on the breaks. Just consider the fact that bank lending declined by $587 billion in 2009 alone – the biggest one-year drop since the 1940s. That’s a $587 billion hole that businesses and households created just as the stimulus was rolling out the first $200 billion or so. ARRA was the right medicine, but it was administered in the wrong dosage, and this became clear within months of its passage.

In July 2009, I wrote a post entitled, “Gift-Wrapping the White House for the GOP.” In it, I said:

“If President Obama wants a second term, he must join the growing chorus of voices calling for another stimulus and press forward with an ambitious program to create jobs and halt the foreclosure crisis.”

Two years later, both crises are still with us, and the election is just around the corner.

Meanwhile, a new Washington Post-ABC News poll shows former Massachusetts Governor Mitt Romney with a slight edge in a hypothetical race against President Obama, and Howard Dean is warning that without a marked improvement in the economy, even Sarah Palin could clobber Obama in 2012.

To avoid this, President Obama must get his economics right. Unfortunately, he’s too busy fanning the flames of the phony debt crisis and complaining that the discouraging data is hampering the recovery because it “affects consumer confidence, and it affects business confidence.” But here’s the thing – the recovery isn’t going to be driven by a change in our mentality. It’s going to be driven by a change in our reality.

So here’s what he needs to do – stop talking about the deficit. It has always been his Achilles’ heel. The US is not broke and cannot go bankrupt. Let go of that myth, and deliver one of those jaw-dropping, awe-inspiring speeches of yesteryear. Tell the American people that he’s calling on the Republicans to help him enact the most sweeping tax relief since Ronald Regan was in office. Tell us that you understand that sales create jobs, and income creates sales. Tell us that families and small businesses don’t have enough income to dig us out of the ditch we’re still in. Tell us that you will not withhold a dime from our paychecks until cash registers across the nation are chiming and unemployment has fallen below 5 percent. Tell us before it’s too late.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Mrs. Kelton’s spot-on observations had me cheering along right up until it was stated that the US is not going broke and cannot become insolvent. If that’s true, why is China on a hard-asset spending spree, even as they send ominous warnings about the status of our dollar? A Credit Suisse economists on CNN said last year that we have entered an unofficial trade war. This is the elephant in the room nobody wants to acknowledge.

For America’s cash registers to begin chiming, the US needs a flourishing middle class. Not an at-risk middle class, a growing middle class. That, in turn, means that wages that have been stagnating since the late ’70s need to increase and the growing disparity between CEO pay and white collar pay must diminish. The US is increasingly a top-heavy economy trying to balance on atrophying legs. The top needs to go on a diet and the bottom needs to bulk up, otherwise no amount of Keynesian economics will cure what ails us.

I recently read an astounding statistic: The average US non-farm wage is just over $8 per hour. Even if you gave every American who wants one a full time job, that type of earnings will not lead to spending! At some point, we must acknowledge that GDP losses are linked to wage stagnation! Since the mid 1980s our economic trajectory, overall, has been to create a peasant class rather than to sustain the consumer class. We have to start asking the tough question: Where did we go wrong?

For starters, we need a manufacturing base back in this country. That won’t happen to any real extent, however, until we revisit NAFTA and GATT. Protectionism isn’t the answer but nor has it been wise over the past 25-some years for Congress to offer tax breaks as an incentives for corporations to engage in even more off-shoring! We knew, whether anyone wished to admit it or not, that we were building a recipe for trouble when in 2009 a Congressional study revealed that 2/3 of US corporations do not pay federal taxes! Would we be in this economic crisis at all if multi-national size loopholes in the US tax code were fixed? (Google alone allegedly deprived US taxpayers from 7 billion dollars in a single year! Imagine how many deficits we are creating — and incentives for Congress to raid entitlements like Medicare and Social Security by virtue of the fact that we won’t collect our own tax revenues from those entities who can most afford to pay them!) In short, we have lost the will to govern effectively. Good governance is not about making friends, but being re-elected is. And therein lies yet another factor we must face to right this broken economy: True campaign finance reform in Washington!

Even as political incumbents curry favors in exchange for future stints as board members and consultants to the corporations their legislative efforts have benefited over the years, we’re trading our superpower status with none other than China. When the eviscerated American consumer can no longer prop up the economic conveyor belt that is the $800-billion trade deficit with China, China can continue to develop its internal markets by pandering to the growing middle class in China and India — literally most of the world’s population. This will only drive home our economic irrelevancy in the years to come.

One only need look back at the British Empire to realize where we are headed from a prosperity and sovereignty perspective. In recent decades our corporate and political leaders have been enormously successful turning the domestic job market into an unsustainable dichotomy between the high-tech/high-skill sector with workers who posses advance degrees in engineering, biotechnology, medicine who command “living wage” salaries and the low-end service sector with the majority of working Americans earning at or just above minimum wage. For every family who loses a job or a home to the inevitable fruits of our flawed policies, the conveyor belt of American prosperity slows.

There is another factor slowing this recovery that doesn’t get enough press: Despite the housing crisis and the number of vacancies it has not translated, by in large, to lower rents. Until property management companies are willing to charge what the market will bear, there will be no market. Perhaps the simplest way to visualize the sum total of these developments is a hamburger without the beef. The lower class represents the bottom, the upper crust sits on the top and the beef — the “consumer class” in the middle — is the patty, and it’s shrinking by the day.

People are always looking for partisan ways to assign blame, but the truth of our undoing amounts to a bipartisan effort. It’s long overdue, for example, for the media focus some attention on the negative impact of our so-called free trade agreements over the past 20 years. GATT and NAFTA’s effects have been slow yet encroaching. Yet they have played as much a part of this as everything else. Consider that as America’s manufacturing power has fallen the development of speculative financial instruments like credit default swaps have been on the increase. It’s no accident that casino-style gambling has evolved into a larger slice of the financial sector — and with it the increasing and unacceptable risks to pension plans, 401Ks and state investment funds, among others. This is a DIRECT consequence of the real economy having progressively weakened over the past 25 years. Keep it up and the Ponzi Economy will eventually topple the dollar’s dominance as the world’s reserve currency. For all intents and purposes: Insolvent USA.

Were it not for the bump in prosperity and jobs created by the Internet boom, we would have seen NAFTA and GATT for the harm it created because the underlying stagnation would have been that much more obvious. All things considered, if President Obama wants any credibility in 2012, he will have to tell every American to sit down, shut up and swallow the bitter pill of responsibility. As David Walker, former US comptroller and force behind the pre-recession Financial Wakeup Tour pointed out in his 2007 documentary film “IOUSA”, the argument between cutting vs. raising taxes is nonsense. We have passed the point of no return. In plain, English, that means it will come down to a painful mix of tax increases and reduced services with a few token cuts for “stimulative” purposes (to assuage an angry public).

Our best chance to right our economic ship before this double-dip recession transforms into a full-fledged depression is to begin in earnest to address the trade deficits. For that to happen, we need the American media to help people connect the dots. American standards of living are greatly influenced by those agreements, and to effect any significant change for the better we will have to revisit those policies and provisions.

Anybody up for the challenge — the challenge of being honest with a bruised and battered electorate? Our next president, no matter what party he or she hails from, will have to stop patronizing American voters with “feel good” fluff and start giving us the “straight talk”. Nothing less will do.

Stephanie, nice article, but why give the GOP credit for undermining ARRA, when Larry Summers reportedly never let Obama see Romer’s most forceful proposal (the one that most economists with half a clue felt was the minimum deficit required for a sustainable recovery)? Let’s not forget that the ‘New Democrats’ who’ve been running the party’s policies for twenty years are still neo-liberals, just like most GOP economists, only with a slightly-less-malformed social conscience.

If Obama winds up a single-term president, which seems very possible, then the Clinton re-treads he hired (and the Bob Rubin legacy he’s so earnestly embraced out of ignorance) will have been his undoing, not the GOP (which, let’s be honest, is not presently capable of putting up a candidate who could beat him otherwise).

As for trade agreements NewsViews, owners and managers of capital (real and financial) have done very well with expanded trade. Free trade per se does not make countries or people poor. Poorly thought-out policies (such as domestic tax levels and rates, increasingly lax regulations on finance and other sectors, domestic employer mandates, and if you really want a broader manufacturing base, zoning and environmental restrictions, etc), when combined with trade openness, can re-allocate the gains in ways that leave a lot of people worse off. But that’s a political indictment (ie, policy makers should have made adjustments that would ensure the gains from trade were more widely shared), not an economic one. Free trade is a good thing on net.

P.S. NewsViews — David Walker is one of those economists with less than half a clue. He thinks that money still has to be dug out of the ground.

The gratuitous, wrongheaded and partisan swipes at the Republicans for daring to oppose the failed ARRA bill really exposes this column as phony Democrat pandering rather than cogent analysis. Republicans dare to have a different view of how to get the economy moving again, and it takes an extremely narrow mind to interpret that difference of opinion as any desire to hurt the economy.

Lets recall: The Democrats had the House by a larger majority than any party had for several decades. The had a filibuster proof Senate and helpful future Democrats, like Specter, who helped to vote for the bills Democrats wrote.

The Democrats didnt need Republican input, and acted like it, ignoring GOP alternatives and advice, and happily passing a bill with zero Republican votes in the House and an almost party-line vote in the Senate. ARRA and all the policies of 2009-2010 are owned lock, stock and barrel by Obama and the Democrats. The Democrats passed the bill they wanted, and Republicans were shut out.

You cite the stats to show it’s not worked: This ‘recovery’ is the weakest recovery in two generations. However, it is feeble to suggest that the failure from these Democrat polices is due to insufficient government deficit spending, when we are $4 trillion and counting for the past 3 years. If $800 billion ARRA bill didnt work, why would $1200 billion? It can’t and it won’t, not when the 7 million jobs lost were almost all private sector jobs, and the only sustainable recovery has to be private-sector led.

We knew even this up front, in Feb 2009, when CBO scored ARRA as having a negative impact on GDP over the 10-year time period – short-term gain for long-tern net negative.

On the contrary, if Obama did indeed propose extending tax reductions, like the payroll tax, its likely that republicans would agree. No more spending, please, but the Reagan elixir of lowering some tax rates in ways that incentivizes private sector job creation, that deal is doable. Real leadership rather than partisan sniping would be met with Republican common ground.

Patrick:

“This ‘recovery’ is the weakest recovery in two generations.”

Which probably has a great deal to do with demographics. We’re about one decade behind Japan as far as the mid-20th century baby boom. Their lost decades started c. 1990, ours c. 2000. The last thing that calls for is austerity. It also means that some recessions and recoveries may have little or nothing to do with political parties and their respective economic philosophies and policies.

“However, it is feeble to suggest that the failure from these Democrat polices is due to insufficient government deficit spending, when we are $4 trillion and counting for the past 3 years.”

I would agree with you if you said that rising risk aversion due to the Dems ascendance in 2007 had something to do with precipitating recession. But you’re dismissing the deficit issue and size of ARRA too readily. Romer’s a good economist, and she felt it needed to be $1.2T. Summers is a smart guy but a relatively lousy economist (like Bob Rubin, and they’re both a lot like the smart blood-letting surgeons of long ago) who disagreed. And keep in mind that it contained both spending hikes and tax cuts. Finally, if you understand how the gold standard worked, there were times in the 19th century when ‘deficits’ of gold from the mining industry relative to GDP or GNP could reach double digits without causing inflation. Those number mean nothing by themselves, despite the scary campfire tales that Carmen Reinhart and Ken Rogoff have been telling you.

“If $800 billion ARRA bill didnt work, why would $1200 billion? It can’t and it won’t, not when the 7 million jobs lost were almost all private sector jobs, and the only sustainable recovery has to be private-sector led.”

A sufficient deficit would have had private sector effects. In fact, the large deficits that ARRA led to did. But they were not large enough, and we’re now seeing those positive effects peter out. And the GOP’s current push for austerity measures is NOT helping. However smart and sincere Sen Coburn may be, he’s like one of his first profession’s old blood letters too.

If you read Kelton and other MMT’ers writings, you’ll see that they view the budget *deficit* as the key independent variable for the rest of the economy, not govt spending per se, so tax cuts are fine (and again, ARRA contained several). This is based on the idea that the federal govt is the only source of net new financial assets, which in a financial economy, need to keep pace with the demand for them in order for the real economy to thrive. The Fed can be a source too, but only if it does things like buy non- or under-performing assets, Treasuries at a premium, or pays interest on reserves. But that’s far different from how the Fed normally operates, and totally misunderstood by most economists and Fed watchers.

So most or all MMT’ers would agree with tax cuts now (though probably not a repeat of the less-than-fair ones of the W years, e.g., eliminating the estate tax and lowering cap gains and interest income without touching payroll taxes…though they were still a net positive overall insofar as they raised the budget deficit). But if you’re being honest, that is not the GOP’s message at present. They got their fall extensions and their primary objective now is to cut entitlements, based on the faulty notion that those programs will one day become insolvent.

There is one GOP economist with half a clue, Tom Nugent, if you have time to check him out. Used to have a column on NRO.

Art:

Looks like Nugent hasn’t written on NRO for 5 years; any idea where to read him now ?

Stephanie is absolutely correct!!! We need to stop focusing on the deficit and start focusing on jobs! Austerity could actually end up INCREASING our deficits and debt as a percent of GDP as we could easily loose more in output than we “gain” by cuts in spending. We cannot shrink to greatness in the face of a liquidity trap and huge lack of aggregate demand! We literally need a jump start to get aggregate demand for goods and services rising. This cannot be done on the supply side… it’s a problem with demand. Companies will not start hiring until until they see demand for their goods and services. We need our government to step into the gap and spend to create growth. If we continue to cut, we’ll just dig ourselves a bigger hole.

… one more thing the ARRA failed because it was TOO SMALL. Wake up. Christy Romer did the math. Say what you want about Keynes but new Keynesian theory is the only thing that has shown ANY predictive power in this crisis whatsoever. See Krugman’s blog for the details.

Sam: “Say what you want about Keynes but new Keynesian theory is the only thing that has shown ANY predictive power in this crisis whatsoever. See Krugman’s blog for the details.”

You’re giving mainstream Keynesians way too much credit. Krugman’s been OK on appropriate responses to the global financial crisis, but his forecasting record is as lousy as Greenspan’s or worse, and he’s still unable to offer a satisfying explanation for episodes of boom and bust.

I found the post-Keynesian folks like Stephanie while looking for people who could explain, in a rational way, what the hell was going on in the world. Krugman is decidedly not one of them. Neither is Brad DeLong, Geithner, Peter Orszag, the two-headed monster of Bob Rubin and Larry Summers, or any of their ilk.

To be honest and up-front, I’m not a Keynesian.

That aside, I agree with many of the points in your article and, not surprisingly, disagree with some of the fundamental assumptions you make.

However, the one (and there is only this one) thing you said in your concluding paragraph that drives me nuts is ” The US is not broke and cannot go bankrupt. Let go of that myth…”

I hear people (mostly Keynesian on the left) say this with some regularity. This “too big to fail” approach to life and the economy escapes me. Do you, and those of your ilk, also live by the following creeds:

* We can’t be killed so we don’t need to wear seat belts.

* I will never have a credit problem so I can run my credit cards to their max and never worry that I am only paying minimum payments.

Today we pay more than $220,000,000,000.00 in annual interest just to service the debt. And, when I say “we” I mean the U.S. tax payer. That $220,000,000,000.00 will exceed over $500,000,000,000.00 in the next decade without major debt issues being addressed and won’t pay a single U.S. employee’s payroll, fill one pot hole or put a single hot meal on anyone’s table. Poof. Gone.

Question: How stimulating to the U.S. economy is paying $220,000,000,000.00 annually in debt service?

The U.S. is not “too big to fail” and it is a ridiculous economic premise on which to base any sort of plan for recovery.

You people who say that we need more debt to solve a debt problem are absolutely insane. Look at the freaking charts. Since we went off the gold standard in 1971, the US and much of the world has been on a debt binge of historic proportions. Debt at a corporate, government and personal level are off the charts and now we need more debt to fix it?

Until the masses understand that more funny money (which by the way devalues any savings you should have but don’t) is at the very foundation of this scam, the only solution to this addiction and stupidity is a complete collapse in the US dollar.

Debt is not wealth and other than in small, needed doses, it does not solve a debt problem. 14 TRILLION on the books and another 80+ TRILLION in unfunded liabilities. How much more will it take to “fix” the problem? Another couple TRILLION?