Darling Int Inc. (DAR) is trading strong in the volatile market, trading within striking distance of its recent 52-week high on a big Q1 earnings surprise. Estimates have since spiked higher, greasing the wheels of this Zacks #1 rank stock.

Company Description

Darling International Inc. provides rendering, recycling and recovery solutions for the food industry worldwide. The company was founded in 1993 and has a market cap of $2.1 billion.

Darling has seen some very sharp gains over the six months, more than doubling in price after reporting excellent Q1 results in early May that came in ahead of expectations.

First-Quarter Results

Revenue for the period more than doubled from last year, jumping to $440 million, largely driven by the company’s acquisition of Griffin Industries from December of 2010. Earnings also looked great, coming in at 43 cents, 43% ahead of the Zacks Consensus Estimates.

The company noted that in addition to the acquisition, the company also benefited from strong prices for fats, proteins and bakery products.

Financial Profile

Darling used its strong earnings momentum and cash flows to take a big chunk out of its total debt load, falling $340 million from just last quarter to $370 million against cash and short-term investments of $38 million.

Estimates

We saw some extremely bullish movement in estimates off the good quarter, with the current year jumping 33% to $1.52. The next-year estimate is pegged at $1.62, a respectable 6% growth projection.

Valuation

But in spite of the recent gains, DAR still has value, trading with a forward P/E of 11.5X, a discount to its peer average of 12.3X.

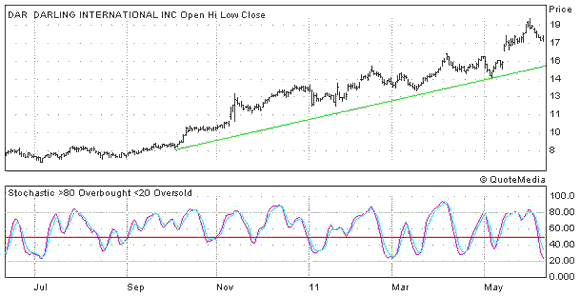

12-Month Chart

On the chart, DAR had been grinding higher for the last 9 month before spiking higher into a new all-time high on the good quarter. The stochastic below the chart is signaling that shares are trading in oversold territory. Look for support from the long-term trend on any weakness. Take a look below.

DARLING INTL (DAR): Free Stock Analysis Report

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply