It’s hard to believe that it’s June already. Perhaps it’s because he’s had the whole knee saga to distract him, perhaps it’s because he’s another year closer to the dreaded “four-oh”, but man, Macro Man has found that time has really flown this year.

The good news, from Macro Man’s perspective, is that he feels like he’s finally starting to make some progress on rehabbing the knee. This, in turn, will hopefully make it easier mentally to become fully re-engaged with the market. Taking a look back at the last couple of months, Macro Man feels as if he’s spent much of that time trading defensively. While it may have seemed like a good idea at the time (given that Macro Man’s preferred themes were not in play), much like the “prevent defense” in the NFL, defensive trading rarely if ever works.

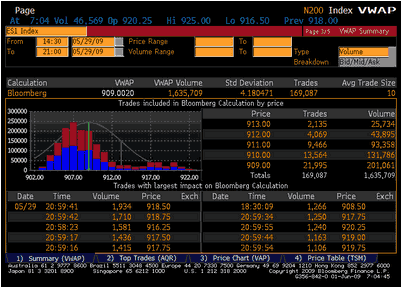

In any event, having the intent to trade off the front foot is one thing…..having the ability to construct attractive trades at current levels is something else. Despite the orgy of positive vibes from asset markets, there is still something a bit broken with markets. Simply put, there remain significant liquidity vacuums in which prices gap on next to no volume. Take Spoos on Friday for example, which were meandering slowly into the close before they were ramped 15 points in the last half an hour. As the e-mini VWAP chart below suggests, it didn’t take make capital to push stocks a lot higher.

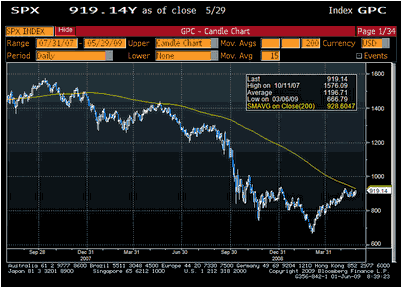

And if it doesn’t take much to gap it higher, presumably it wouldn’t take much to gap it lower, either. Still, it’s hard to ignore the fact the the SPX is knockin’ on heaven’s door…the 200 day moving average. The index hasn’t closed above that level since December 2007; while it traded above it almost exactly a year ago, the failure to close above was a great sell signal. Given that most other assets have roared after breaking the 200d MA, it wouldn’t be a complete to see the risk-asset love-in soar to new heights should the SPX close above 929 today.

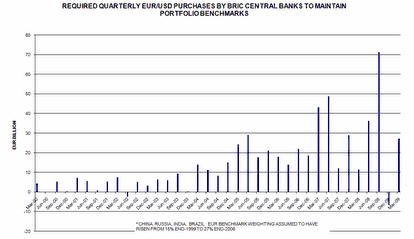

Elsewhere…..they’re baaaaccckkkkk. One of the most pleasant aspects of the whole “global financial crisis/economy going back to the stone age” thing was that emerging market central banks and SWFs pissed off for a couple of quarters and by and large allowed the exchange rates of other countries to be set by private sector supply and demand.

But the poltergeist of Voldemort and chums has returned with a vengeance, drilling the USD against the euro, sterling, Aussie, et al. Part of this is down to a recent increase in FX reserves as these countries slow the pace of hot money inflows (CBC, Bacen), enjoy the bounty of higher petro-revenues (Middle East and, to a degree, CBR), or try to maintain a static currency peg despite large trade surpluses and a much-ballyhooed economic recovery (China.)

That said, the recent noise surrounding these guys would appear to be somewhat louder than recent reserve accumulation would appear to suggest. So Macro Man wonders if these guys haven’t actually decided to legitimately diversify a bit more away from the USD….certainly there have been suggestions of such a decision in, for example, Russia.

And like equities, to a degree it doesn’t matter what the fundamentals really are. If these guys all think the others are diversifying away from the buck, then they will step up and start doing it themselves. And in a market where liquidity has still not returned to normal, that can have a disproportionate impact upon price.

So the question is….does one tag along and hope that he can buy back a short $ position when the music stops? Stay out until the situation becomes a bit clearer? Or start buying $ upside because the private sector market is now getting short dollars, whichy usually means a reversal is around the corner? That’s among the many questions that Macro Man needs to answer over the coming days.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply