The minutes from the April 28-29 FOMC meeting are out and make for some interesting reading. As you can see from the excerpt below, the committee at least thinks we’re in for one long haul.

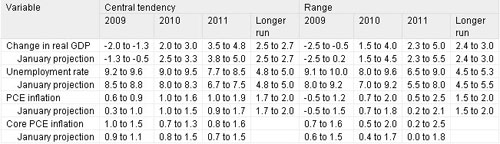

As indicated in table 1 and depicted in figure 1, all FOMC participants projected that real GDP would contract this year, that the unemployment rate would increase in coming quarters, and that inflation would be slower this year than in recent years. Almost all participants viewed the near-term outlook for economic activity as having weakened relative to the projections they made at the time of the January FOMC meeting, but they continued to expect a recovery in sales and production to begin during the second half of 2009. With the strong adverse forces that have been acting on the economy likely to abate only slowly, participants generally expected a gradual recovery: All anticipated that unemployment, though declining in coming years, would remain well above its longer-run sustainable rate at the end of 2011; most indicated they expected the economy to take five or six years to converge to a longer-run path characterized by a sustainable rate of output growth and by rates of unemployment and inflation consistent with the Federal Reserve’s dual objectives, but several said full convergence would take longer. Participants projected very low inflation this year; most expected inflation to edge up over the next few years toward the rate they consider consistent with the dual objectives. Most participants–though fewer than in January–viewed the risks to the growth outlook as skewed to the downside. Most participants saw the risks to the inflation outlook as balanced; fewer than in January viewed those risks as tilted to the downside. With few exceptions, participants judged that their projections for economic activity and inflation remained subject to a degree of uncertainty exceeding historical norms.

Table 1. Economic projections of Federal Reserve Governors and Reserve Bank presidents, April 2009

Yikes, five or six years or longer! I don’t think that anyone has prepared the public for that. I particularly don’t like the fact that MOST of them agree with this assessment.

Now the question that begs to be answered is how do you accommodate this sort of growth forecast with the Obama spending plans. His budget certainly takes a different view of the world and, as I recall, calls for a substantially different set of growth projections in order to bring deficits down to just barely tolerable levels. Sounds like something has to give.

I guess this is how lost decades happen.

Leave a Reply