When will the US economy turn around? World renown macroeconomist Bob Gordon – a member of the NBER Business Cycle Dating Committee since 1978 – documents a surprisingly robust link between the business cycle tough and the lagged peak in unemployment claims. According to this link, springtime for the US economy is just around the corner.

“No one can possibly know how long the current recession will last or how deep it will go,” says Nobel Laureate Robert M. Solow in a new review article written only two weeks ago (Solow 2009). The American economy led the world into the current economic downturn, by numerous measures already the worst since the Great Depression. The catalyst was the sub-prime mortgage debacle and subsequent meltdown of America’s financial sector, more recently interacting with the real economy through a multidirectional interplay of ripple and multiplier effects. The US downturn has spread around the world with unprecedented velocity and ferocity.

If the U. S. started it all, when will the US economy turn around? The rest of the world is eager to know, as a US revival seems an essential precondition to break the momentum of the worldwide economic free-fall.

A new, surprisingly tight link: lagged new unemployment claims & the trough

Despite Solow’s skepticism, it is tempting to forecast the date of the trough of the US recession, that is, the month in which real economic activity will reach its lowest level. Eventually many months after this hypothetical low, the Business Cycle Dating Committee of the National Bureau of Economic Research will weigh the evidence and declare a particular month to be the “trough”.¹ Do we have any hope of predicting which month they will choose before the economy even reaches the date of its trough?

Since economists are notoriously poor at forecasting turning points, this hope is likely to be dismissed as a will o’ the wisp. But is it wisely dismissed?

Recently I have discovered a surprisingly tight historical relationship in past US recessions between the cyclical peak in new claims for unemployment insurance (measured as a four-week moving average) and the subsequent NBER trough.²

Trough of the US recession: May 2009?

If we refine the NBER weekly trough date to be the third week in the NBER trough month, then in four of the past five recessions the new claims peak leads the NBER weekly trough by a range of only four to six weeks, and in the fifth recession the new claims peak lags the NBER weekly trough by two weeks. Since new claims have recently reached a peak in the week ending 4 April 2009, it is tempting to conclude that the monthly trough of the US recession could come as early as the middle of May 2009 – a date earlier than most analysts appear to expect.

If the NBER procedure were to use data on new unemployment claims as a major criterion for choosing the trough date, then this “discovery” would be tautological. However, as a participant in the NBER deliberations for three decades, I can attest that neither new unemployment claims nor continuing claims nor the unemployment rate itself has ever been given the slightest consideration. The four monthly indicators traditionally weighed by the NBER committee include the current level of payroll employment, but this is not in any definitional way related to new claims for unemployment insurance. In fact, the trough in the monthly level of employment in the 2001 recession occurred 20 months after the peak in new claims.

For any macroeconomic variable to show such a tight relationship over five successive business cycles is quite startling because of the changing dynamic relationship between output and employment during the same period. Until 1982 the monthly unemployment rate exhibited its peak simultaneously with the NBER output trough or soon afterwards, but in 1991 the peak unemployment month occurred 15 months later and in 2003 occurred 19 months later. Employment continued to decline after the November 2001, NBER trough until June 2003. Yet the short lead of new claims in advance of the NBER trough week remained as brief in the last few weeks of the 2001 recession as in the previous four recessions that in some other respects were quite different.

Skeptics would instantly ask two critical questions about the usefulness of the historical relationship between new claims and the NBER trough.

- First, how do we know that the current recession is similar in kind to previous recessions and does not share some elements with the much more protracted contraction between 1929 and 1933?

- Second, how can we recognize a peak and with what precision? If new claims begin to decline, this could be a local maximum rather than the global maximum which could still be far off in the future.

The historical record on the short lead

A continuous data series on weekly new claims and continuing claims for unemployment insurance exists from 1967 to the latest week and is easily downloadable.

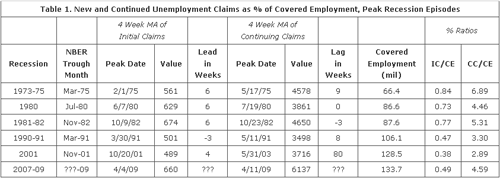

Table 1 summarizes the historical record for the six completed recessions that have occurred since 1967 and adds relevant comparable data for the current recession. The table displays from the left the date of the NBER trough month, the peak date of the four week moving average of new claims (hereafter for short just “new claims”), the lead in weeks of new claims in advance of the NBER trough week (defined as the third week of the NBER trough month), the peak absolute value of new claims, and similar data for continuing claims. The lead in weeks was an identical six weeks in the recessions of 1973-75, 1980, and 1981-82 and 4 weeks in 2001, with an idiosyncratic lag of 3 weeks in 1990-91.

The Department of Labor and its disciples in the media, are strangely inconsistent in their presentation of unemployment data. The Department of Labor tells us every Thursday morning the number of new and continuing claims as an absolute number in thousands, even though the headline of the monthly employment report is the unemployment rate expressed as a percentage rather than as an absolute number. Few have noticed the% rate of new and continuing claims as reported in the right part of the table.

Contrary to the widespread view that the current recession is the worst of the postwar years, new claims expressed as a percentage of covered employment in the peak week of 2009 were only 0.49 percent, as compared to much higher rates of 0.84, 0.73, and 0.77 in the recessions of 1973-75, 1980, and 1981-82 respectively. The same percentage of continuing claims exhibits a rate now slightly above the recession of 1980 but still well below the percentage rates of 1973-75 and 1981-82. The relatively low current level of new claims compared to continuing claims presumably indicates that the relatively small number of people who are currently entering the state of insured unemployment are finding it more difficult than in the past to exit that state.

The recession of 1969-70 is clearly an exception to the history of the tight lead of new claims in advance of the NBER trough. In that episode there was a double peak of new claims, the first on 9 May 1970 and the second almost identical peak on 17 October 1970. We exclude from further consideration the 1969-70 recession because the second peak was an artificial outcome of a special event, the famous General Motors strike that lasted 67 days and began on 14 September 1970. This was a big deal at the time when GM had a 50% share of the US automobile market and 400,000 members of the United Auto Workers went on strike. The initial peak of new claims suggests that the recession would have reached its trough at some point in June or July, but the direct and indirect impacts of the strike delayed the actual NBER trough until November 1970.

No doubt a similarly surprising event could occur in late 2009 or in 2010 that would delay the trough of the recession, whether the side effects of a flu pandemic, a secondary round of plant closures, or anything else. In the rest of this article we abstract from future hypotheticals on the joint grounds that no forecasting method can take account of major unforeseen catastrophes and also that such events after 1970 did not cloud the tightness of the timing relationship between new claims and the NBER trough date in five previous recessions.

The dynamics of the lead of the new claims peak

We are now three weeks past the most recent peak of 660,000 in the week ending 4 April 2009, and the four-quarter moving average was down to 437,250 for the week ending 25 April (as before all numbers in this article refer to the four-week moving average of new claims), a decline of 3.3 percent. How does the evolution of the new claims series compare to the previous five recessions?

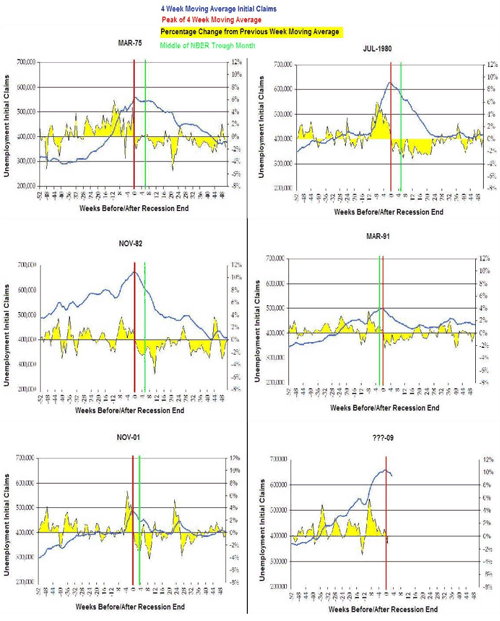

Figure 1 displays (as the blue line) the absolute value, e.g., 600,000, of the new claims series over an interval of two years centered on the peak week, which is also demarcated by the vertical red line. The vertical green line shows the NBER trough week, defined as the third week of the NBER trough month. Thus the difference between the red and green lines corresponds to the leads recorded in Table 1. Except for 1975 the peaks of new claims in previous recessions are all well defined with a sharp and continuous rise in the weeks leading up to the peak and then a nearly monotonic decline after the peak. In the four most recently completed recessions, new claims fell to 90% or below of their peak value within 8 weeks of the peak, whereas in 1975 this decline required 16 weeks.

Also shown in Figure 1 by the thin black line with yellow shading are the weekly percentage changes in new claims. As would be expected, the changes are mainly positive before the peak and negative after the peak. However, clearly visible are strings of negative changes at scattered intervals prior to the overall peak. These signal “false peaks” in which the four-week moving average declined. (More on this below where I examine these false peaks in previous recessions and evaluate the extent to which the most recent peak of 4 April 2009 resembles or differs from those false peaks.)

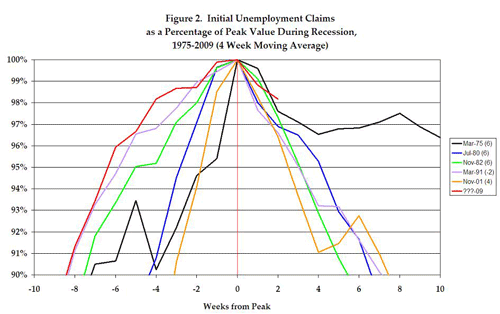

Another perspective on the sharp rise and subsequent fall after the previous cyclical peaks is provided by Figure 2.

This graph spans 20 weeks centered on the peak week of new claims. The vertical axis is expressed as new claims in each week expressed as a percentage of new claims in the peak week. Here again we see the sharply defined peaks in the five previous recessions. How does the peak of 4 April 2009 compare with completed recessions in the past? The 2009 post-peak decline in new claims does appear somewhat slower than in the four previous episodes, but it is little different thus far than 1975. The sharp increase in new claims in the eight weeks before the 2009 peak tracks the 1991 episode almost exactly.

Distinguishing false from true peaks in past recessions

Now that new claims have declined for three weeks by a cumulative 3.2%, the next question is whether this three-week decline has statistical characteristics similar to the global maxima of the past five recessions and whether it is more similar to several previous false peaks that occurred when new claims were still well below their ultimate global maximum during each completed recession.

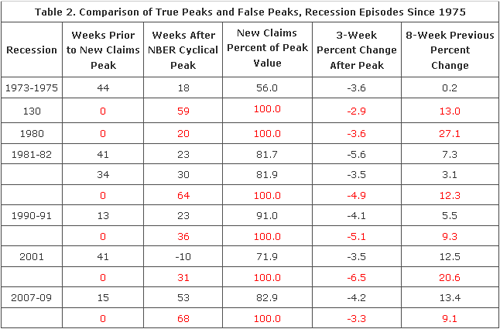

Table 2 compares false and true peaks during recessions since 1975 with the two local peaks that have occurred thus far in the current recession.

Because new claims have in the past three weeks declined by 3.2% from their peak on 4 April 2009, the previous history was filtered by selecting all observations over the year prior to the ultimate true peak when the three-week change was equal to or more negative than -3.2%. This criterion uncovered five false peak episodes in the previous five recessions. The first column of Table 2 lists the number of weeks that each false peak occurred prior to the true peak, e.g., in the first line 44 weeks for the lead of the false peak of the 1973-75 recession. True peaks are displayed in red and in each case by definition occurred zero weeks prior to the true week. The second column lists the number of weeks that each peak occurred after the NBER date for the peak of the business cycle, and this criterion disqualifies from further consideration the 2001 false peak which occurred 10 weeks before the week of the NBER cycle peak (as before dated as the third week of the NBER peak month). This leaves us with only four previous false peaks for consideration.

Otherwise the second column showing the lag of each new claims peak after the NBER cycle peak does not provide helpful information except for the obvious conclusion that the false peaks occurred earlier than the true peaks. The true peaks occurred as early as 20 weeks after the NBER peak in 1980 and as late as 59 and 64 weeks in the recessions of 1973-75 and 1981-82. The tentative new claims peak on 4 April 2009 occurred 68 weeks after the NBER cycle peak, suggesting that this recession is already a senior citizen, but the false new claims peak in 2009 15 weeks prior to the most recent peak occurred 53 weeks after NBER cycle peak, almost as “late” in the recession as the true peaks of 1973-75 and 1981-82. It is worth noting that the false peak in the 2007-09 recession occurred on 20 December 2008 and was followed by four weeks of temporary decline, at least two of which could be attributed to the impact of holidays in altering the timing of the filing of new claims at the end of 2008 and the beginning of 2009.³

Another possible criterion to distinguish the false peaks is the level of new claims at the time of the false peak as a percentage of new claims at the ultimate true peak. Note that the level of new claims of the 1973-75 false peak at the top of Table 2 was only 51.9% of the level at the ultimate global peak. Other false peaks registered ratios of 82 and 91% (excluding the disqualified 2001 false peak). One could look at these ratios and infer that a typical 82% value for a false peak implies that if the April 2009 peak were false, the ultimate peak would not be 660,000 as on 4 April but rather 660/0.82 or 805,000. There is no statistical reason why a future peak of 750,000 or 800,000 could not happen, and we are cautioned by the right-hand columns in Table 1 showing that new claims in 2009 are running well below both 1973-75 and 1981-82 as a percentage of total insured employment.

The next column of Table 2 displays the percentage decline in new claims after each previous false and true peak. Clearly the current 3.2% decline is well within the range of previous false peaks and cannot be used to distinguish false from true peaks. More useful is the next column showing the eight-quarter moving average of new claims at each peak, false or true. The true peaks exhibit a double-digit rise in the previous eight weeks with the exception of 1990-91 (close to double digits at 9.3 percent) and in previous completed recession episodes this rate is uniformly much higher at the true peaks than false peaks. Recall that the 2001 false peak is disqualified as occurring before the NBER business cycle peak and the 2007-09 false peak is tainted by occurring just before the Christmas holidays.

With these exceptions taken into account, it does appear from the eight-week moving average in Table 2 that a distinguishing feature of global peaks is a preceding period of relatively rapid increases in new claims. The weekly change in new claims (as before, the four-week moving average) is always greater than 3% prior to true peaks, and prior to true peaks there are often multiple consecutive weeks that exhibit increases greater than 3 percent. By this criterion there are 30 weeks in which a 3% weekly rise in new claims occurs, of which 21 occur before global peaks and 9 occur before local peaks.

Conclusion

When the data are filtered, one finds remarkably few false peaks in previous recessions. The 2001 false peak is disqualified because it occurs prior to the NBER business cycle peak. The previous 2008-09 peak occurred just before the end-of-year holidays and is thus tainted by holiday timing. Prior to 2001 there are only four examples of false peaks, each occurring within 30 weeks of the NBER cycle peak, in contrast to 68 weeks for the most recent 2009 peak. In each of these previous false peaks, the previous increase in new claims as measured by the eight-quarter moving average was 7% or below, while at the true peaks the previous eight-quarter rise in new claims was well into double digits with the two notable exceptions of 1991 and 2009 with eight-quarter preceding increases of 9.3 and 9.1% respectively. The sharp preceding rate of increase at true peaks, evident in Figure 2, helps to distinguish the 2009 interim peak from other earlier false peaks.

It is always too early to make definitive conclusions, but the recent 2009 peak in new claims looks sufficiently similar to previous recession peaks to allow a conclusion that it is highly probable that the new claims peak has now occurred. The evidence provided here suggests several differences between the recent peak and previous false peaks in earlier recessions. The recent peak occurred much later in the recession than previous false peaks, and the run-up of new claims in the two months prior to the recent peak was substantially faster than in previous false peaks.

To this point I have examined a single indicator to see if it is useful in predicting the end of recessions without any consideration of what is going on in the rest of the economy. Our conclusion is supported by the fact that previous false peaks occurred when new claims were at 80 to 90% of the level at the ultimate true peak. For the peak of 4 April 2009 to be false by this historical precedent, the ultimate future peak would have to be in the range of 730,000 to 800,000. As the weeks go by, such a sharp future increase in new claims looks increasingly implausible.

Bottomline – The US turn-around will come in May or June 2009

My reasoning leads me to conclude that the ultimate NBER trough of the current business cycle is likely to occur in May or June 2009, substantially earlier than is currently predicted by many professional forecasters.

Footnotes

1 The author has been a member of the Dating Committee since 1978. This article represents his own opinion and contains no input, approval or disapproval, from other committee members.

2 My “discovery” occurred in mid-March and was summarized in Evans (2009).

3 Easter occurred on 12 April 2009 and Good Friday on 10 April. It seems implausible that the timing of Good Friday could have mattered in any way other than shifting a few new claims from 10 April to the following week without altering the most recent four-week moving average for the week ending 25 April.

References

Solow, Robert (2009), “How to Understand the Disaster,” New York Review of Books, 14 May 2009, pp. 4-8, submitted to the NYRB on 16 April 2009.

Evans, Kelly (2009). “Economy Raises Tentative Hopes a Trough is Finally in Sight,” Wall Street Journal, March 28, 2009, p. A2. A more recent update is “Jobless Claims Suggest Recession’s End Could be Near,” April 18.

Note: The author is grateful to Lucas Zalduendo, a Northwestern undergraduate, for astute research assistance, helping to develop criteria for distinguishing false and true peaks, and providing constructive criticism at all stages of the development of this research.

![]()

Leave a Reply