Should regulation be dumb? In one sense yes, in others, no. It really depends on how well the regulators understand the risks involved, and how much they can encourage professionalism among profit center heads and risk managers. As those two increase, regulation can be smart. “Follow these detailed rules to calculate the capital you need to be solvent 99% of the time.”

But when either of those two aren’t true, dumb regulation may be in order:

- Strict leverage limits, reflecting the worst outcome from underwriting poor quality loans.

- Disallowing risky types of lending, regardless of capital level.

- Disallowing liabilities that can run easily.

- Disallowing products that commonly deceive buyers.

- Disallowing certain types of contracts that fuddle accounting.

- Those regulated may not choose their regulator. The highest regulator assigns a regulator to you. The highest regulator must evaluate the jobs that lower regulators are doing, and eliminate/lessen regulators that do not use the powers they have been granted, and get co-opted by those that they regulate.

If everyone were smart, things could be different. Deceiving people would not take place, and managements would not take undue risks. Limits could be looser, and products would be designed for discriminating buyers.

But, face it, we are dumber than we think, myself included. Consumer choice is a good thing, though it implies that some will be deceived, no matter where one places the line of demarcation. Along with that, some bank will not fit the rules and go insolvent, though it previously passed the solvency tests.

Dumb Regulation: Insurance in the US

My poster child for relatively good dumb regulation is the insurance industry in the US. The industry is far less free-wheeling than the banking industry, and under most circumstances, the solvency margins are set high enough to have few insolvencies. There is room for improvement, though:

- Make risk based capital charges countercyclical. Perhaps tinkering with the Asset Valuation Reserve would do that.

- Have some sort of rigorous testing for capital relief from reinsurance treaties.

- Ban surplus notes in related party transactions.

- Ban all forms of capital stacking, especially where the transactions go both ways. I.e., subsidiaries can’t own securities of any companies in their corporate family. All subsidiaries must be owned by the holding company.

- More rigorous testing for deferred tax assets.

- Assets as risky as equities, including limited partnerships, should be a deduction from capital.

- Securitized bonds that are not “last loss” should have higher RBC charges than comparable rated corporates, because loss severities are potentially higher, and assets that are originated to securitize are always lower quality than those held on balance sheet.

- A standardized summary of cash flow testing results should be revealed.

As for the banks, they need to do that and more:

- Insurance companies list all of their assets. Banks should as well.

- Intangible assets should be written to zero for regulatory capital purposes.

- Risk-based capital standards need to be tightened to at least the level of insurance companies, if not tighter.

- Some sorts of lending to consumers should be banned. I am talking about complex agreements, that individuals with IQs less than 120 can’t understand. Insurance policies have to be Flesch-tested. Bank lending agreements should be the same. If some argue that the poor need access to credit, I will say this: the poor need to get off of credit. Credit is for the upper-middle-class and rich. Poor people should not go into debt.

- Standardized summaries of terms and fees must be created for consumer lending, with large, friendly letters, and simple language that all can read.

What I am saying is that accounting has to be more conservative, and that regulators have to require larger amounts of capital to support their business, particularly at the banks. Financial products must be made simpler for consumers to understand. More transparency is needed everywhere, and if the financial companies complain, tell them that they will all be in the same goldfish bowl, so no one will gain an unfair advantage.

Preventing Too Big to Fail

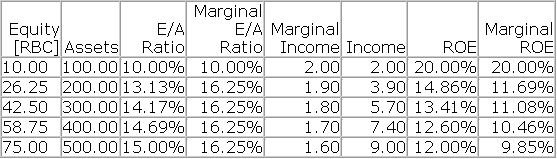

As part of preventing too big to fail, the Risk based capital [RBC] percentage should rise with the amount of risk-based capital. Say, when RBC gets over $10 billion, the percentage of capital needed for RBC grades up to 50% higher than the level needed at $10 billion by the time RBC gets up to $50 billion.

Here is my example of how it would work:

I have assumed that firms undertake their highest ROE projects first, and do progressively lower ROE projects later. Now, by raising capital requirements on bigger firms, a common response is, “Well, then they will just take on riskier loans to compensate.” Sorry, but that dog don’t hunt. If they take on riskier loans, their RBC goes up even more rapidly, because loan quality is reflected (or, should be reflected) in RBC formulas prior to adjustment for bank size.

More Dumb Regulation

Dumb regulation bars certain lending practices, and raises capital levels higher than is needed over the long run. So be it. Smart regulation is far more flexible, and trusting that companies and consumers know what they are doing. Unfortunately, when financial firms fail, there are often larger repercussions. It is better to limit regulated financial companies to businesses where the risks are well-understood. Let the less understood risks be borne by those outside the safety net, and bar those inside the safety net from holding any assets in those companies.

That brings me to the Volcker Rule, which is a good example of dumb regulation. My preferred way would be to do something similar through adjusting the risk-based capital formulas — Equity-like risks should be funded through a 100% allocation of equity. Few banks would take on that level of speculation at that level of capital used.

If you need proof, look at the life insurance industry. Companies used to hold a lot more equities prior to the tightening of RBC rules. Now they hold little, except at a few mutual companies that are flush with capital.

That also has preserved the insurance business in this crisis, leaving aside mortgage and financial risks, where the state regulators still have no idea what they are doing — that a proper reserve level would leave most of the companies insolvent today, but had it been implemented ten years ago, would have preserved the companies, but eliminated much of their profits.

At the Treasury meeting with bloggers in November 2009, I commented that the insurers were better regulated for solvency than the banks. One of the reasons for that is that they do harder stress tests, and they look longer-term. Life and P&C insurers survive the process because of better RBC standards, and “scaredy cat” state regulators. What a great system, which prior to the crisis, was criticized as behind the times. (I suspect that if we ever get a national regulator of insurance, there will be a big boom and bust, much as in banking at present. It is easier to corrupt one regulator than fifty.) The more state involvement in bank regulation, the dumber (better) bank regulation will be.

What to Do

So, if one is trying to regulate banks for solvency, there are seven things to do:

- Set risk-based capital formulas so that few institutions fail.

- Make it even less likely that larger institutions fail.

- Limit the ability of financial institutions to invest in other financial institutions.

- Regulators must benchmark the underwriting culture, and raise red flags when underwriting is poor.

- Insure that equity is truly equity.

- Institute a code of ethics for risk managers.

- Make sure that balance sheets fairly reflect derivatives.

It is almost always initially profitable to borrow short and lend long. That said, it is a noisy trade. Who can be sure that short rates will remain below the rates at which one invested long? Another component of a good risk-based capital formula is that there is no investing in assets that are longer than the liabilities that fund the financial institution. (For wonks only: regulated financial institutions should be matching assets versus liabilities as their most aggressive posture. Unregulated financials can do what they want. And no investing in unregulated financials by regulated financials.)

One of the great subsidies banks get is the cheap source of funds through deposits. It is only cheap because depositors know the FDIC is there. The FDIC should raise its fees to absorb that subsidy back to the taxpayer. Keep raising it until you see banks begin to shift to repo and other short-term sources of funding.

As a clever old boss of mine once said, “A banks liabilities are its assets, and its assets are its liabilities.” The idea is this — banks that focus on their deposit franchises have something of real value — that is hard to replicate. But any bank can invest their funds aggressively, which will lead to defaults with higher frequency. It is true of insurers as well, most financials die from bad investing policies, and short-term liabilities that require complacent funding markets.

That’s why there has to be a focus on liabilities in regulating solvency. Financial institutions, even simple ones, are opaque. Most die from the deadly combo of illiquid assets and liquid liabilities. Those that have funded the bank in the short run refuse to roll over the loans at any price. Assets can’t be liquidated to meet the call on cash, and insolvency ensues. Those that have read me for a long time know that I don’t buy the malarkey that some managements will trot out, “We’re not insolvent; we merely have a liquidity crisis.” Hogwash. You took too much risk, because the first priority of risk control is liquidity management. Assets are only worth what you can sell them for, or, what cash flows they can generate. If assets can’t generate cash flows or sale proceeds adequate to service liabilities, then you are insolvent, not merely illiquid.

Cash flow testing for banks should focus on the ability of the bank to finance itself without recourse to selling assets. To the extent that selling assets is allowed in modeling, they must be Treasury quality assets.

The essence of a good risk-based capital formula is that it forces intelligent diversification, and forces adequate liquidity. No assets should be bought that the liability structure of the bank cannot hold until maturity. There should be no concentration of assets by class, subclass, or credit, that would be adequate to lead to failure.

My view is that a proper risk-based capital regime would start with asset subclasses, and double the capital held on the largest subclass, and 1.5X the capital on the second largest subclass. After that, within each subclass, the top 10 credits get twice the level of capital, the next 10 1.5x the level of capital. Having managed assets in a framework like this, I can tell you that it creates diversification.

Beyond that, no modeling of asset correlations would be brought into the modeling because risky asset correlations go to one in a crisis. Any advantage derived from diversification should be accepted as earned, and not capitalized as planned for.

Securitization deserves special treatment: risk based capital should higher for securitized assets versus unsecuritized assets in a given ratings class, because of potentially higher loss severities, and assets that are originated to securitize are always lower quality than those held on balance sheet. Capital charges should be raised until banks don’t want to securitize as a matter of common practice.

Eliminating Contagion

In order to avoid systemic risk and contagion, banks should not lend to or own other financial firms. That would end contagion. At least that should be limited to a percentage of assets, or through the RBC formula. Think of it this way, financials owning financials is a form of capital stacking across the country as a whole. In a stress situation it raises the odds of a deep crisis. Setting a limit on the ability of financials to own the assets of financials is the single most important step to avoid contagion. I would set the limit at 5% for equity, and 20% for debt.

Regulating Underwriting

Most of the real risks came from badly underwritten home mortgage debt, whether conventional, Alt-A and Jumbo, or subprime. Underwriting standards slipped everywhere. Commercial mortgage lending hasn’t yet left its marks — there is a lot of hope that banks can extend maturing loans rather than foreclose and take losses.

For much but not all of this crisis, it was not a failure of laws but a failure of regulators to do their jobs faithfully. Regulators should have looked at indicators of loan quality, and raised red flags when they saw standards deteriorating. Where I worked, 2003-2007, we saw the deterioration, and were amazed that the regulators had been neutered.

Let Equity Be Equity

Beyond that, there was a dearth of true equity, and a surfeit of preferred stock, junior debt, trust preferreds, and particularly, goodwill. Equity has to reflect assets that are high quality and that are not needed to support short-term obligations from the cash flow tests.

Code of Ethics for Risk Managers

One reason the banking industry is worse off than insurance, is that they don’t have many actuaries. Actuaries have a code of ethics. They tend to be “straight arrows” telling it like it is. Bank risk managers need the same thing, together with the rigorous education that actuaries receive. Accept no substitutes: CFAs and CERAs are no match for FSAs.

Reflect Derivatives Properly

Derivatives must come onto the balance sheet for regulatory purposes, revealing leverage increases/decreases, counterparty risk, overall sensitivity to the factors underlying the contracts. Any instrument that can cause cash to flow at the regulated entity should be on the regulatory balance sheet.

Other Issues

I would not create a prospective guarantee fund. The insurance industry has a retrospective fund that has worked fairly well. Do you really know what it would take to create a macro-FDIC, big enough to deal with a large systemic risk crisis like this one? (The FDIC, much as it is pointed out be an example, is woefully small compared to the losses it faces, and it is not even taking on the large banks.) It would cost a ton to implement, and I think that large financial services firms would dig in their heels to fight that. Also, there would be moral hazard implications — insured behavior is almost always more risky than uninsured behavior.

Though it is not bank reform, we need to end the Greenspan/Bernanke Put. The Fed encouraged risk-taking by the banks by not allowing recessions to damage them. They tightened too late, and loosened too early, and that pushed us into a liquidity trap. Monetary policy that is too loose creates perverse incentives for the solvency of financial institutions in the long run.

Bonuses to executives skew incentives. Bonusing a financial executive on current earnings creates perverse incentives. It is a form of asset/liability mismanagement, because cash flows in the short run, while the value of the institution is a long-run issue. Far better to incent using long dated restricted common stock. The only trouble is, it doesn’t incent as well as cash. Tough, sorry, but that is a loss that must be accepted for the good of the system as a whole.

Summary

Dumb regulation is good regulation. Regulators should be risk-averse, and take actions that limit ROEs for banks in order to promote solvency, and reduce the likelihood of liquidity crises. The remedies that I have proposed here will do just that. May we use them to regulate our financial sector better, for the good of all in our nation.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply