I do not often comment on gold but as Hank Wernicki posted in a comment, “Gold is Going Nuts!” Even George Soros has jumped in, saying: “When I see a bubble, I buy that bubble, because that’s how I make money.” Neely also jumped in today, with a wave structure that says gold is about to rush to a blow off top. Going back to 2005, Neely has gold in an expanding triangle, and says it has entered the final, most vigorous leg E. This indicates we will see gold go to new highs (it still remains below recent highs) and head towards $1300.

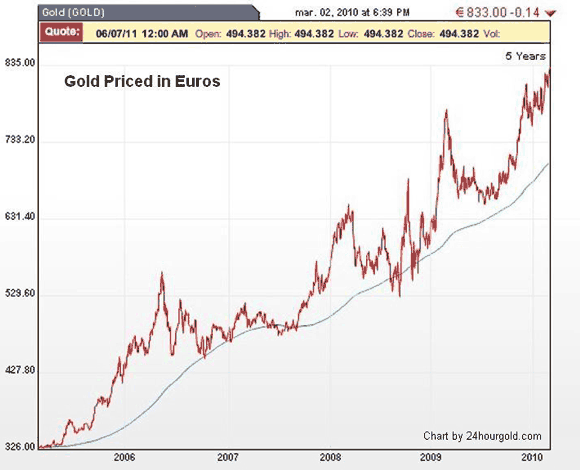

Here is a circumstance where technical analysis is way ahead of fundamentals. With inflation fears fading and deflation showing up in the most recent CPI, conventional wisdom is a bit surprised by the new gold rush. The CW fails to see that gold is a hedge not just against inflation, but a hedge against poor government policies. The Greek troubles in the Euro have spilled over into gold. Gold has surged to a six-week high in USD and record highs in the Euro and Sterling:

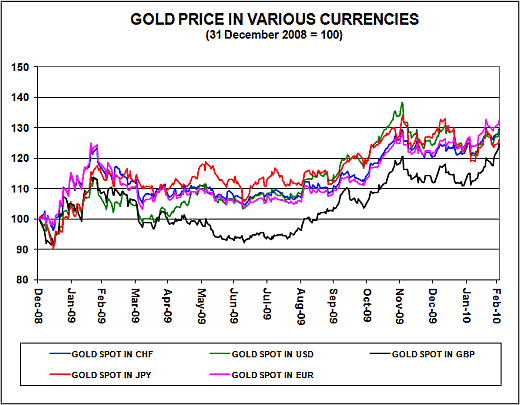

Pierre du Plessis notes that gold is gong up across all major currencies:

The CW is also surprised as the USD is now rising with gold, whereas they had been in an inverse relationship. With equities floating on speculation and stimulus, it should not surprise how they can float up with gold, but all markets had been in an inverse relationship with the USD. Most likely the change in this Dollar Down/Everything Up relationship is due to Euro and Sterling weakness overcoming Dollar strength.

My take:

- From a short term perspective: if gold is about to run, the Dollar is about to correct down. A blow-off top in gold would coincide with the most serious correction in the Dollar since it turned in early December.

- From a longer term perspective: the blow off in gold spills over into Treasuries. Jesse’s Cafe Americain notes in this chart how Treasuries are right on the cusp of breaching a 30-year trendline, ever since Volcker killed the inflation of the ’70s:

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply