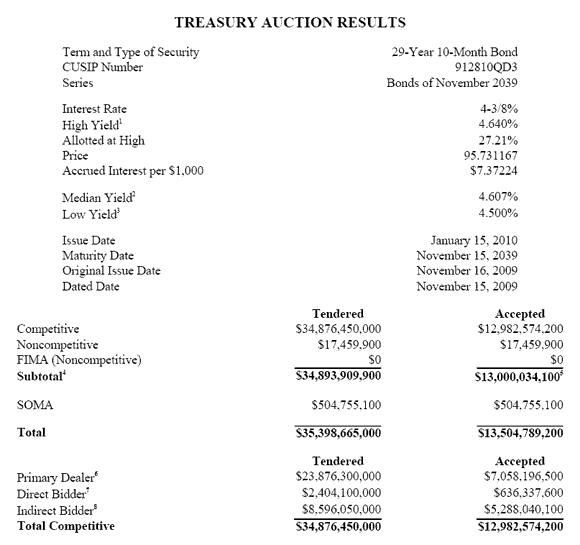

The Treasury Department sold $13 billion in 30-year bonds on Thursday at a yield of 4.640%, ending a week of $84 billion in issuance that generally drew strong demand.

- Bid To Cover 2.68 vs. an average of 2.53 times in the last four refundings of long bonds

- Indirects bought 40.7% vs. an average of 42.9%

- Direct Bidder take down 4.9% vs. 5% on average in recent sales

- Alloted at High 27.21%

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

what do these terms mean, especially “indirect” and “alloted” and can you tell how much the fed bought with freshly printed money?

Alloted at High – it’s basically the % of those bidding the exact accepted price

Indirects – is that group that includes foreign central banks

Directs – domestic institutions buying for their own account

how much the fed bought with freshly printed money? – Only Ben knows the correct answer to that ? Peter