So Japanese banks rose 7% last night in the face of a huge impending share offering by Mitsubish/UFJ. What gives? Well, the Nikkei reported that the BIS will smooth the path towards implementing Basel II by phasing in the stricter requirements over a 10-20 year horizon.

Ten to twenty years? Are you effing kidding me? What’s the point of implementing new rules if they won’t bite before another two or three crises have erupted and the Macro Boys (current ages: seven and six) will be old enough to have their bonuses garnisheed by bankrupt governments?

Sweet Lord almighty, it’s enough to make one weep. Macro Man is sitting here, thinking about investment themes for next year (he has a roundtable lunch today) , and he feels like he’s embroiled in some weird fairy-tale cross between Pinnochio and the Emperor’s new clothes.

From suspension of marking-to-market to extend-and-pretend to setting LIBOR rates at levels no bank can borrow at to now, evidently, relaxing capital requirements because it might crimp somebody’s style, Macro Man feels like he’s embroiled in a world where the consensus has agreed to try and bluff their way out of crisis.

Going all-in whilst holding a pair of twos might occasionally work at the poker table, and indeed it has worked pretty well for the last few quarters. But ultimately it’s a weak hand that is pretty likely to fail if the holder is forced to show his cards.

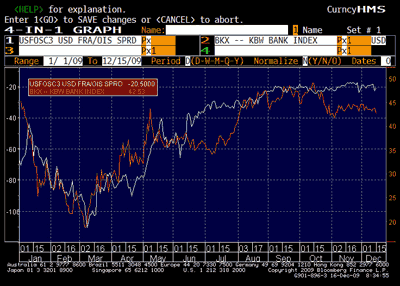

The people who called this mess correctly- your Meredith Whitneys, your Laurie Goodmans- are still bearish, though who the hell knows what it will take for reality to bite (though Macro Man cannot help but notice that the BKX is sagging a bit…perhaps heralding wider bank credit premia next year!?!?!?)

Perhaps the trigger will be a raft of lawsuits from angry investors- maybe Abu Dhabi is trying to get Citigroup (C) to foot the bill for the Dubai slush fund? Or maybe it will be a withdrawal of liquidity from major central banks. Today sees the last ECB LTRO- given the indexation announced the other week, takeup is expected to be modest. And of course this evening, the Fed will announce its policy decision to change nothing.

Perhaps the trigger will be a raft of lawsuits from angry investors- maybe Abu Dhabi is trying to get Citigroup (C) to foot the bill for the Dubai slush fund? Or maybe it will be a withdrawal of liquidity from major central banks. Today sees the last ECB LTRO- given the indexation announced the other week, takeup is expected to be modest. And of course this evening, the Fed will announce its policy decision to change nothing.

Heaven forbid that anyone rock the boat! Macro Man does think that you’ll see a few more jitters next year than you have for the last nine months, even though global policymakers (pictured, right) do their best to prevent it…..

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply