Although Christmas markets are in full swing, with the concomitant reduced risk profiles, low volumes, and general lack of interest (at least judging by the paucity of comments in recent posts), that doesn’t mean that there’s nothing happening. The DGDF crowd are being taken for a visit behind the woodshed, as EUR/USD has traded to its lowest level since October 2 so far this morning.

Perhaps it’s the news that Austria’s banking sector may be imploding, though if that’s the case Macro Man is left to wonder why Eurostoxx futures are up on the day. Or perhaps it’s the latest Krishna Guha article in the FT, suggesting that the Fed may address liquidity policy before monetary policy- a move that could entail a discount rate hike. One wonders how likely that really is, however, before both the end-of-year turn and, perhaps more importantly, Bernanke’s confirmation for a second go-round as Fed chairman.

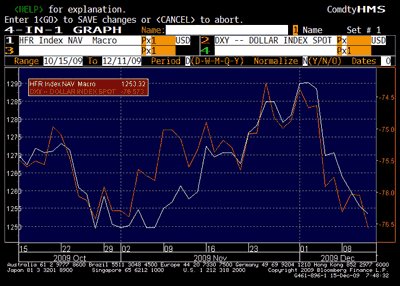

No, the rationale would appear to revolve around a large pink bird that’s fond of standing on one leg. It seems quite clear that DGDF has been a popular theme and trade, and that given Voldemort’s predilection for buying euros positioning has been rather heavy in EUR/USD. Overlaying the (admittedly flawed) HFR macro fund index with the euro-centric DXY reveals a pretty high degree of correlation.

(click to enlarge)

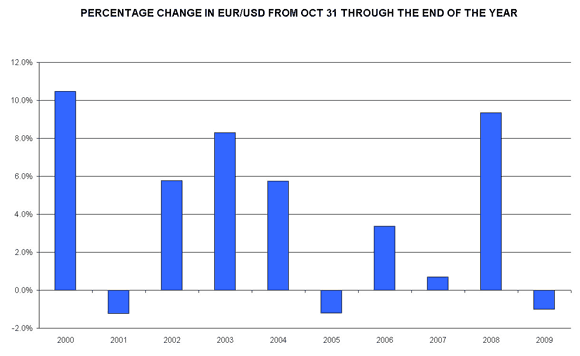

So what’s with the euro fetish? Well, those who trade currencies for a living have become accustomed to seeing the euro rock and roll into the end of the year. Indeed, looking at the returns in November/December for the last ten years, it’s not hard to see why punters may have loaded up on long euro positions.

Macro Man, for example, ran a long euro delta until last week on the rather cynical view that every other punter would drive hi position into profit. Needless to say, that was a disappointment, and once again provides proof that a “greater fool” investment strategy is not the road to fame and fortune.

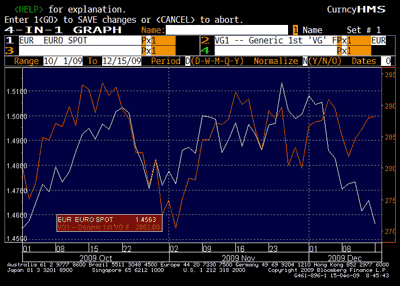

What’s made the euro’s recent weakness particularly galling, however, has been its underperformance of equity markets. While it’s become cliched that “it’s all one trade”, Macro Man can confirm from bitter experience that trying to hedge a long euro exposure with equity puts results in nothing but a one-way ticket to the Pain Cave.

(click to enlarge)

While Macro Man is coasting into the end of the year, as he starts preparing his mental strategies for 2010, he is trying to draw a few lessons from his disappointing EUR/USD experience in Q4:

* Avoid Greater Fool trades

* Keep a closer eye on flamingos

* If he wants to buy a hedge, he should go to a garden center (cheers, RK)

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply