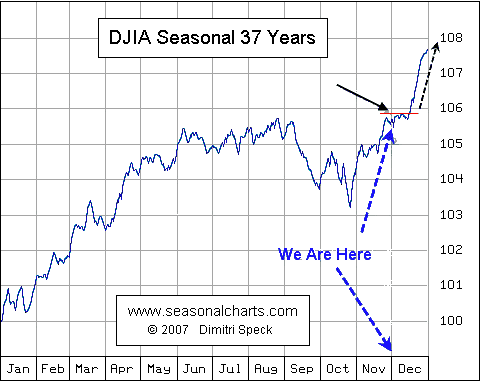

As we enjoy this Santa Rally, question is how far might it go? We have three plausible scenarios:

- It ends this week, not much higher

- It rallies into Jan to Dow10700

- It rallies into May to Dow11285

(1) If we look at the typical pattern, around 25% of the whole year’s rise happens in this rally, and it ends in early Jan. This gives a target of Dow10700:

- We started at Dow8802

- The Santa Rally started at Dow10236

- So far the year is 1434 pts

- A rally that is 25% of the year would be 33% up from here or 478 pts

- Target: 10236 + 478 = 10714

(2) If we look at the bigger picture, a typical rally after a sharp fall is 50-61.8% of the drop. We have gone a bit above the 50% retrace. In 1930 the retrace was 50%; whereas in 1937 after the drop to 1933 the retrace was 61.8%. The 61.8% retrace can be counted off the closing numbers or the intraday. An intraday target is Dow11285. In terms of timing, the rally so far has broken into two segments of about equal length, and is now in the third segment. if time is about the same, this goes to Feb. This seems, however, a bit far to go in such a period. Typically the seasonal rally after Santa continues all the way to May or even into June (see chart). Hence the outside target is a continuation into May.

The rally so far has been slowing down, which would also support a slow curve into May to hit the target. This would be consistent with the Summer of Disillusionment I expect for Obama next summer, where a realization sets in of a double-dip recession and a tragic failure of Obama to please either the independents (whom he is losing now) or his core base (due to a political need to triangulate back towards the center). I view this scenario as least likely of the three, in part because the Dollar Bottom will provide a huge headwind against a continuation of the rally. So far the Obama Hope Rally has been driven by massive liquidity slopping into speculation, not any real recovery of the economy.

(Doubts about this? Read what Paul Volcker, the only honest man left in this administration, had to say over in Europe:

SPIEGEL: The US has not yet instituted any kind of reform policy. What we see is the government and the Federal Reserve pouring money into the economy. If one looks beyond that money, one sees that the economy is in fact still shrinking.

Volcker: What should I say? That’s right. We have not yet achieved self-reinforcing recovery. We are heavily dependent upon government support so far. We are on a government support system, both in the financial markets and in the economy.)

(3) If we look at the wave count and not typical patterns, we get a more pessimistic view. We have been in a sideways pattern which counts well as a triangle (other counts are out there but this is the easiest). After the sideways move will be a final wave up, which can be counted as either 5 of C or C itself (the difference is not that important, but it relates to whether the wave down to Nov2 is considered an X wave or a wave 2 of C). This wave 5 or C coming out of a triangle typically goes the length of the largest width in the triangle, or runs hard and much longer. Since we have been in a long rally and it is losing strength, it is unlikley this final wave will run.

In an expanding triangle, the last leg (E) is the largest, so wave 5 tends not to do more than retrace E. Neely has found that typically the wave 5 is truncated and goes on 61.8% of E. The reason for this is expanding triangles tend to be near the end of a complex correction that has run a good ways, as this has; and the truncation indicates exhaustion. EWI in Friday’s STU in contrast thinks a truncation is lower odds. As a matter of market reality, we have already run just about that width.

The next likely stopping point is for the final wave to hit or slightly break above the rising upper trendline of the expanding triangle (see chart in this recent post). Today that level would be Dow10532. So far today we are below that at intraday Dow10515. This Wed we have the FOMC meeting. Markets tend to rise into that, and fall after; unless the message jinks the market.

Tonight’s STU notes that the upper trendline crosses 10543 on Wed (I think this is a typo; they mean 10548). The fib relationship of A and C in this rally points to Dow10705, where C=61.8% of A.

The issue this week is whether the Fed will begin to signal their exit from massive liquidity and ZIRP. The WSJ discusses how the Fed has already begun exiting. If the market sees a change of easy money, the top is likely to be in. A reasonable target would be around Dow10565 by end of this week. If the FOMC causes a run up, Dow10705-15 is the next level to watch.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply