That’s a question recently taken up by the Wall Street Journal. Here are my thoughts.

Before we can discuss this issue, we’d need to agree on what we mean by a “bubble”. Here’s one definition that a lot of people may have in mind: a bubble describes a condition where the price of a particular asset is higher than it should be based on fundamentals and will eventually come crashing back down.

If that’s what you believe, then there’s a potential profit opportunity from selling the asset short whenever you’re sure there’s a bubble. And if that’s the case, my question for you would be, why don’t you do put your money where your mouth is instead of telling the Fed to do it for you? Your answer might be that it could take years for the bubble to pop, and you’re not willing to absorb the risk in the interim. Or maybe you don’t have the capital to cover the necessary margin requirements while you’re shorting the bubble on the way up.

Even so, posing the statement in this way should bring a dash of humility to those currently claiming to see a plethora of bubbles that the Fed supposedly needs to fight. What exactly persuades them that they are right and all the other players in the market are wrong? How much of their personal wealth are they staking on the strength of their convictions? And even if you’re absolutely sure you know how to identify bubbles, raising interest rates as a response is, as Tim Duy observes, “a rather blunt weapon that kills indiscriminately”.

Another concept of a bubble that some people may instead have in mind is one involving the fundamentals themselves, in the form of temporarily and unsustainably low interest rates that are causing the temporarily and unsustainably high asset price. Professor James MacGee of the University of Western Ontario had an interesting discussion (hat tips: Marginal Revolution and reader Robert Bell) of why house prices in the U.S. overshot their long-run values by so much more than those in Canada.

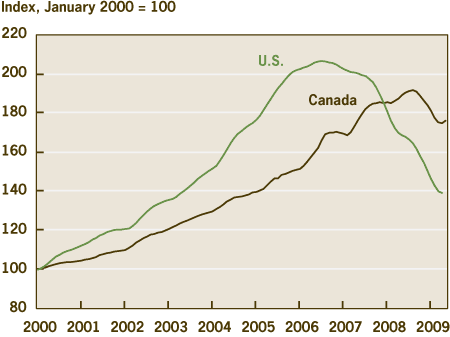

Indexes of house prices in the U.S. and Canada. Source: MacGee (2009).

MacGee notes that the Bank of Canada, like the U.S. Federal Reserve, had lowered interest rates quickly in 2001-2002, though it did not follow the U.S. quite as far down in 2003-2004.

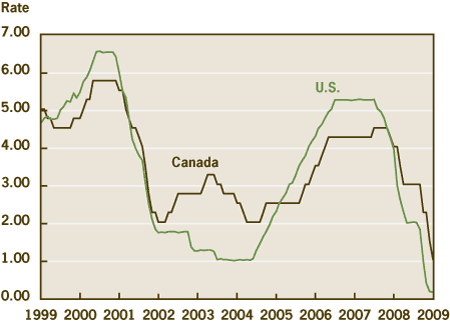

Interest rate targets for the U.S. Federal Reserve and Bank of Canada. Source: MacGee (2009).

The Canadian path for interest rates is closer to the one that Stanford Professor John Taylor has suggested that the U.S. should have followed.

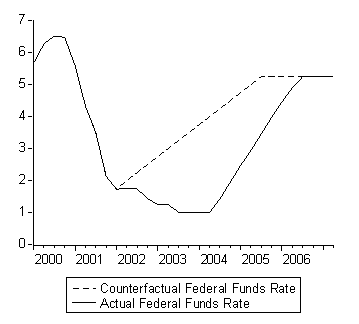

Source: Taylor (2007).

MacGee argues, and I agree, that weak underwriting standards in the U.S. were a bigger problem than the low interest rates. And we share Tim Duy’s assessment that better regulation would have been more important than getting the interest rate right. Nevertheless, I am also sympathetic to Taylor’s suggestion that the exceptionally low U.S. interest rates in 2003-2004 were pouring fuel on the fire.

It is hardly the role of the Fed to be deciding that it knows better than the market what the price of every asset should be. Nevertheless, I think it is necessary for the Fed at least to be forming an opinion about what’s driving asset prices as one input into the Fed’s decision making. Booming U.S. real estate prices were accurately signaling that there was a problem with both the interest rate target and financial supervision, and it’s desperately important to ensure that this same mistake is never repeated.

Of course, it’s easy enough to say what should have been done in 2004. but the real challenge is figuring out what to do in 2010. Are commodity prices experiencing a bubble right now, and if so, is it something the Fed needs to stop? To me, the evidence suggests that U.S. interest rates are an important factor in recent movements in relative commodity prices. I also believe that further big increases in commodity prices could be destabilizing for the real economy. Nevertheless, other economic objectives take precedence at the moment, and it is too early to start raising rates yet. But it is not too early to remember that there are limits to how much you can help the U.S. economy by keeping interest rates low.

I suggest watching commodity prices in the months ahead as one practical guide for acting on that wisdom.

Should the Fed be the Nation’s Bubble Fighter?

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply