Normally, at this juncture of the electoral cycle, one could confidently expect a “giveaway” pre-budget report from the Chancellor of Exchequer. Not so yesterday from Alistair Darling, who has quite clearly “run out of our money“, to quote MEP Daniel Hannan. But hey, look on the bright side: deficit reduction starts next year, as the public sector borrowing requirement is forecast to collapse to £176 billion from the current year £178 billion.

Although Mr. Darling spent most of his time waffling on about woolly job-training schemes and business advice bureaus, the centerpiece of his PBR was, of course, the attack on bankers’ bonuses. Similar to the story reported by Robert Peston yesterday, the Chancellor announced a one-off supertax, payable by banks/building societies and affiliated companies, of 50% on all bonus payments above £25,000.

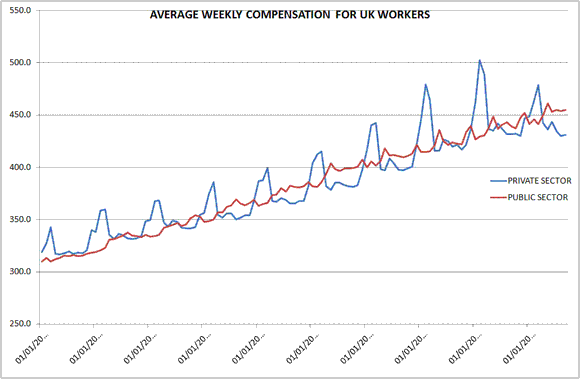

How significant are City bonus payments to the UK? Let’s put it this way: the sharp-eyed reader should have little difficulty in spotting the seasonal pattern on the chart below.

The bulk of those new year spikes are indeed represented by bonuses from the City. Now admittedly, not all City bonuses were affected by Mr. Darling’s measures: brokers and hedge funds, for example, fall out of the web, since they were not backstopped by the government.

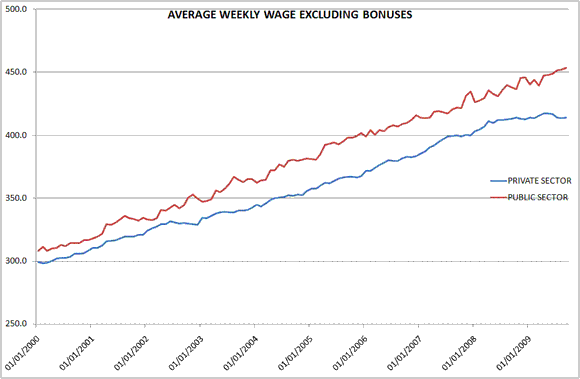

Yet the attack on the financial bonus culture is one that highlights a real fragility of the UK economy and public finances. For the twelve months ended in September, the average weekly private sector income was £443, according to the ONS. For the public sector, that number is higher, at £449. If we were to strip bonuses out of the equation altogether, the disparity becomes even starker, as public sector basic salaries are, on average, 7.5% higher than their private sector equivalents. Moreover, observe how that disparity has widened sharply this year.

Now, it’s true that public sector workers include valuable members of society like doctors and teachers. But it also includes armies of civil service jobsworths and talentless morons like Elmer Fudd Jonathan Ross, who’s on several million quid a year. And what sacrifice are these legions of leeches being asked to make? Guaranteed pay rises of “just” 1% per year.

Anyhow, there are a number of questions which arise from yesterday’s debacle. Among them include the following:

a) Are banks really going to pay this supertax on bonuses? It’s hard to say. Darling waggled his finger and promised to extend the tax if banks try to avoid it, but c’mon….he’ll be out on his ass come May. Strangely, however, the Treasury only forecast a revenue generation of £550 million from the supertax, which wouldn’t cover the charge from the Goldman London bonus pool alone, let alone all the banks in the City. Now, that could mean that a) Darling expects most banks to slip through the cracks, perhaps by issuing stock through an approved scheme? b) the increased tax burden from bonus payments can be offset by tax losses carried forward, in which case the ultimate result of this scheme will be to significantly reduce the tax-loss “asset” carried on bank balance sheets, or c) Darling is a moron and is bad at math.

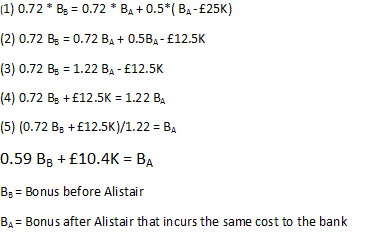

b) OK, let’s assume my bank is going to pay the tax. What is the impact on my bonus if the bank wants to leave the cost to itself unchanged? Here’s where it gets a bit tricky. Banks have always been able to offset bonus compensation costs against company tax (which is set at 28%), so the “true” cost of bonus payments has only been 72% of the face amount. That hasn’t changed.

But they now are further liable for 50% of the difference between the bonus face amount and £25k, which changes the marginal cost to the institution quite dramatically. The graphic below derives the equation to determine the bonus that a bank employee will get in the new regime that would equal the cost to his/her employer of a given bonus before yesterday.

Ouch indeed. Someone who was slated to receive a £100,000 bonus will now get £69,000. £300k will become £187k. And that massive £1 million bonus will shrink to £600k. And of course, you’ll still have to pay 40% income tax on this reduced amount!

c) How does Alistair expect to jump-start the economy in the new year when he’s just taken a huge chunk out of private-sector cash earnings? Your guess is as good as Macro Man’s. Anecdotally, he knows that a lot of bank employees were counting on a cash injection to finance big-ticket purchases. One could reasonably conclude that without the injection, the purchase will not happen.

d) If the supertax was to encourage banks to act more like utilities (i.e., making loans for the public good rather than trying to make as much money as possible), why doesn’t the Government regulate actual utilities? No idea. Electricite de France is Macro Man’s electricity supplier. EDF is constrained in their home market from charging more than a statuatory limit for electricity. Sans limits in the UK, the periodic arrival of the electricity bill is so painful that he’s tempted to hook up electrodes to his sensitive bits to take his mind off the pain. Indeed, he’s dissuaded from doing so only by the knowledge that the act would increase the charges on the next bill. Rather than cutting the public’s fuel bills with the swift stroke of a pen (“But Monsieur Sarko, we are simply adopting the Continental model as you’ve been asking!”), Mr. Darling instead chose to offer a £400 tax credit to replace old boilers.

e) If the supertax is to dissuade the gambling culture in banks, why did Darling cut the tax on actual gambling, namely bingo payouts? For that matter, why are lottery winnings and payoffs from the bookies tax-free? Oh, that’s right…it’s not about actual policy, it’s about Darling being a vote-scrounging cretin.

f) Will employees of Vauxhall and Ford fall under this scheme? After all, US automakers filed to become bank holding companies last year to get some of that sweet TARP lovin’. Macro Man doesn’t know the answer to this, but wonders if there are some sweating auto execs out there.

g) Is this is the start of a new global land-grab on financial companies’ earnings? Perhaps, perhaps not. Macro Man is comforted by two things. First, despite their best efforts to gerrymander their way into another term in office, Labour has been so execrable that the best they can hope for is a hung parliament. The current cast of clowns is on their way out. Second, it was only eighteen months ago that the Chancellor was publicly mulling a windfall tax on energy companies at the height of the oil bubble. How times change. Yesterday, he offered to credits to encourage the drilling of new fields. To quote the old aphorism, “this, too, shall pass”….eventually.

h) And if it doesn’t? Back of the queue for flights to Geneva, mate.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply