It is on the Forex screens. Turn off NBC or Fox and tune to FX. Will there be a Dollar Dump tonight? Or is a Dollar short squeeze on?

A few days ago I speculated:

Throughout November we have seen overnight selling of the USD Sunday, and a sharp spike up in equities Monday; then a fade through the rest of the week. Given Thanksgiving and Dubai, the pattern reversed into a sharp overnight drop in equities; but the pattern returned on the last day of the month, with overnight dumping of the Dollar on Monday night and a sharp rise [in equities] to greet the new month.

Why this play? A number of Asian Tigers publicly announced that they would intervene to debase their currency (or at least stop it rising so fast against the USD) in order to remain price competitive with China. China stayed out, Japan is tapped out, and the US stayed mum. If you were George Soros, who had called a bluff of the Bank of England and won, what would you do? Sell into them, let them drive it back up, and do it again! In the meantime hedge via buying into US equities. I cannot confirm the play, but it is pretty clever.

The overnight Dollar Dump begins Monday morning in Sydney, and then spreads towards Europe with the rising sun. Australian markets are open, and the AUD has fluctuated, being slightly higher right now. Japan just opened, and the Yen is also slightly higher (vs the USD). The US Dollar Index is fading right now, down a little. Hard to extrapolate so far. We have to see what Europe begats.

The choice of Dump vs Squeeze will have a huge impact. The denouement may not happen tonight, but tonight will give us a clue. There is an estimated $1T in the Dollar Carry Trade, meaning (simplified) borrowing in USD and lending (buying bonds) in another currency. The darling right now is the AUD, since the Oz government has been increasing rates. Borrow in Dollars at 0.25% and buy the AUD bonds at 3.25%. Nice spread, especially if the USD continues to fall and the borrowing can be paid back with cheaper Dollars.

But what happens if the USD spikes up? Those near-zero interest-rate debts have to be covered with more expensive Dollars, creating a potential loss that dwarfs the rate spread. If you don’t have the inventory of USD accounts to cover, you have to race into the market. Banks of course have all sorts of swaps between currencies, but swaps have time limits (like CDs) and other limitations that still require covering at a higher cost.

There are several events that argue for a reversal of this pattern:

- The sharp spike up in the USD Friday bespokes a short squeeze

- We hit record lows on 2-yr Treasuries after Dubai, and although have eased off this, it suggests a return to risk aversion could happen quickly

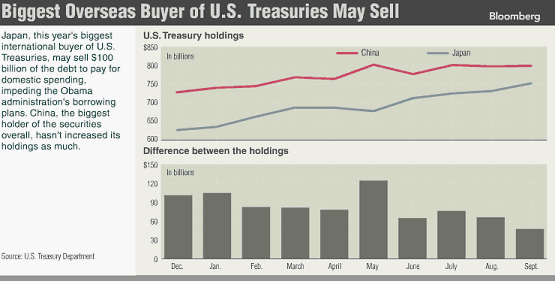

- The Japanese may be tapped out – there is a story that Japan may stop buying Treasuries. See chart. A major speech is expected today in Tokyo, tonight in the US.

- The $1T carry trade would suffer huge losses with a Dollar spike, and need to move quickly to cover their short positions (short the USD) if it occurs

My take is that the Draconian scenarios like Japan backing out of Treasuries are not an immediate policy change. We might find out differently tonight! Yet absent a crisis these changes tend to ease in and the market rolls over, not spikes.

Think like a carry-trade bank or hedge fund: would you back down your play over a vague set of statements out of Japan and a one-hour pike in the USD? You have $1T in play, and can probably quickly add another $0.5T. This magnitude dwarfs the currency intervention of the smaller countries; no need to fear them. The US has signaled as clearly as it can that the Fed is not prepared to intervene to support the USD; indeed US policy is to allow a controlled fade to support low interest rates. Is Japan really about to intervene at scale to drive the Yen down? Well, maybe, but let’s wait and see if they actually do it first.

If I were playing currency poker, I might back off a week and see what happens, then hammer the trade again next week. But it has worked so well so far despite jawboning, why not continue pressing?

At some point the Fed will have to support its currency. The US is under huge pressure from Europe and Asia to stop their reckless monetary policy. The FOMC now seems to have dissenters of Bernanke’s policies, and Bernanke is having to fight for re-appointment.The well-respected economist David Malpass put forth his case for raising rates over the weekend. David’s comments are priceless:

The irony of the zero-rate policy, coupled with Washington’s preference for a weak dollar, is a glut of American capital in Asia (as corporations and investors shun the weakening U.S. currency) and a shortage at home. …

According to International Monetary Fund data, U.S. GDP has fallen to 24% of world GDP from 32% in 2001. And as U.S. capital escapes the weak dollar and high tax rates, the U.S. share of world equity market capitalization has fallen to 30% from 45%. This leaves the U.S. alone with Japan at the bottom of the monetary heap, with rate expectations so low they repel investment. …

The fed-funds rate can stay near zero for a while longer, but the Fed can’t keep promising “exceptionally low rates for an extended period,” as it did last month.

David thinks a change of policy may come at the Dec16 FOMC meeting. The apparent peak in unemployment gives political air cover for the Fed to shift. He expects Wall Street to throw a tantrum (ie equities to drop) if this occurs, but it will do more for righting the global economic situation than a steady drop in the USD. So perhaps the fun is not tonight, but in two weeks.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

The FED will not raise interest rates to the point where it really matters. How could they? The Treasury is financing most of its debt short term. If they raise interest rates to just 5% it will mean an other 200 to 400 billion in interest payments or 2 to 4 Trillion over the next 10 years. That would put us well over 20 Trillion by 2020 just at the time when all the other bills start coming due. I just don’t see how this will continue for much longer. Eventually the can will run out of street.