OK, so it looks as if disaster may be averted in Dubai: the latest hot rumor is that the central bank will guarantee all Dubai World debt. This is not altogether shocking- was this not among the rationales for the big intraday equity bounce on Friday?- but has nevertheless provided comfort to bondholders. The (in)famous Dec ’09 Nakheel bond was recently quoted 65/70….well below par, but certainly a damn sight better than the 40-mid price that Macro Man saw on Friday morning.

Equity holders, on the other hand, may be left holding the bag…or at least that’s the fear. The Dubai stock market, open for the first time since Wednesday, has cratered lower, down more than 8% at the time of writing.

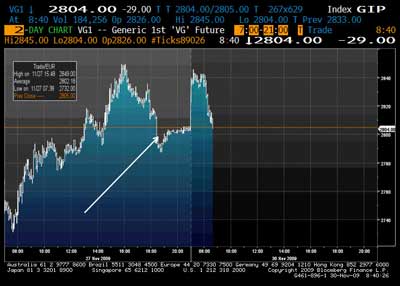

That price action looks pretty grim, doesn’t it? Well, yes and no. The chart above is clearly pretty ugly. But it’s worth taking a step back and putting it into context. The Dubai equity market was always telling us that they were buggered; the index has barely recovered any of its massive 2008 losses this year. Seen in this context, today’s meltdown barely registers. Indeed, taking the message from equities, one wonders why the recent turbulence surrounding Dubai World constituted that much of a surprise….

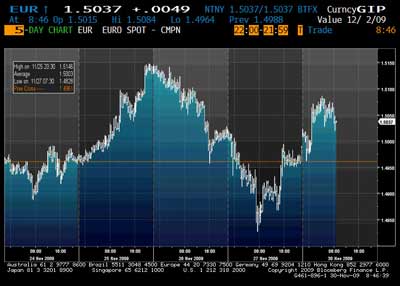

In any event, the price action of the last 72 market hours has been ugly. Both longs and shorts have been stopped, in, say EUR/USD, which put in a nice 2% 3-day range not long after Macro Man observed that realized vols were at post-Lehman lows. It took a pretty firm stomach to hold positions through the “Dubai meltdown.”

Indeed, observing price action across markets, Macro Man feels a bit like Tiger Woods’ next-door neighbor. He can see that something bad is happening and that people are getting hurt, but he’s not sure exactly what’s happening and the people who do know aren’t talking.

Friday’s post-NY close price action in equities is a case in point. A few minutes after US equities closed at 6pm London time, someone did a bit of a drive-by in Eurostoxx futures, sending the price more than a percent lower. Macro Man felt like he was enrolled in Journalism 101. Who? What? Where? Why?

Anyhow, for the time being it seems as if we’ve stabilized. The euro’s above 1.50, Western index futures have held onto Friday’s gains, and for some reason oil is still chugging higher. But with month-end upon us, there’s ample opportunity for fixing-driven noise.

And bubbling below the surface, Greece remains a source of worry. Wolfgang Munchau suggests that Europe will not ride to the rescue, while the WSJ reports that the Greek government will flog their paper to the Chinese. While China is justly proud of its thousands of years of cultural history, they might do well to consider a proverb based on the Greco-Roman tradition: Beware of Greeks bearing gifts….

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply