Sometimes, those little guys matter. That seems to be the message of the past twenty-four hours where rumors/uncertainty over a possible default by Dubai has created a good-old fashioned panic in asset markets. It’s been what…eight and a half months since we’ve felt remotely like this? Seems like a lifetime ago…

In fairness, this isn’t quite the same as the post-Lehman maelstrom. While Dubai’s debts are not inconsiderable, they pale in significance when placed side-by-side with queries over the viability of the entire global banking system. Still, those itching for a good crisis will take what they can get, and the implication for financial market pricing is exacerbated by the fact that the US is on its Black Friday post-Thanksgiving hangover and that Dubai itself (with the rest of the Muslim world) is out ’til Tuesday for the Eid al-Adha holiday.

Oh dear. So in impaired liquidity conditions, we are unlikely to see any real news on the catalyst for a few days. You can almost see the boogey-man emerging from the closet, can’t you, coming to fan your darkest fears (or at least to aim a shotgun at your favorite position flamingo.) Those Nakheel bonds, the chart of which Macro Man posted yesterday, have been quoted as low as 32 mid this morning, and are now trading around 45 mid. For a bond that went 112 paid on Tuesday, that’s got to hurt.

Now, while the good times might roll again on Tuesday if, as many suspect, Abu Dhabi rides to the rescue on a white camel to backstop/guarantee Dubai’s debts. Still, there’s been quite a bit of technical damage exacted on the marketplace. Frankly, Macro Man isn’t sure how much appetite there will be to reload next week (and month)…he is curious to hear informed readers’ views.

Anyhow, gold has crashed through its steep uptrend, at least temporarily, today….

(click to enlarge)

…and while EUR/USD is still clinging on to its uptrend (as well as the 55 day moving average), its hold looks precarious. A crash below 1.48 could confirm the reversal in gold. Jeez, that breakout above 1.5064 seems like a looonnnggggg time ago…

It’s squeaky-bum time for owners of equities, many of which have crashed through interesting levels in these illiquid markets. Owners of the Hang Seng, for example, must feel like they are riding the London Underground. “Mind the gap….”

(click to enlarge)

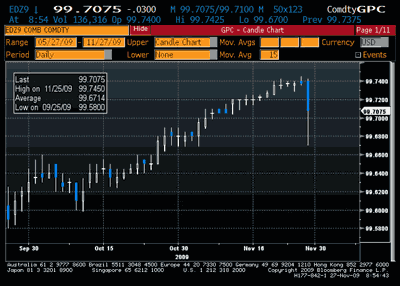

A key to whether this sell-off has further to go or is merely an early Christmas sale (it is Black Friday, after all!) may well be what happens to LIBOR. The entire risk-asset orgy has been propelled by the normalization (and then some!) of LIBORs since the imposition of QE. Should LIBORs begin to move out as we approach the end of the year, that could spark concerns of a more systemic kind…and likely give this sell-off legs.

Punters have already come to that conclusion, and there has been good interest from “smart money” to sell the front LIBOR contracts. It’s a nice trade at the highs, as your stop is the current LIBOR fix. Selling at a 8-10 bp discount to current LIBOR, with settlement just 3 weeks away, is perhaps less interesting.

(click to enlarge)

So there you go. Not only do you have to watch for news of an Abu Dhabi bailout of Dubai, but you’ve also got to see if LIBOR bloows out or not. If it’s “yes” on the former and “no” on the latter, then we may well revert to an “as you were” risk/reflation rally (particularly if today’s jitters dissuade the ECB from monkeying with the LTRO next week.) If it’s “no” and “yes”, however….well, then maybe we really could see a good old-fashioned panic…

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply