The U.S. recovery is underway. But so far it doesn’t look as strong as we had been hoping.

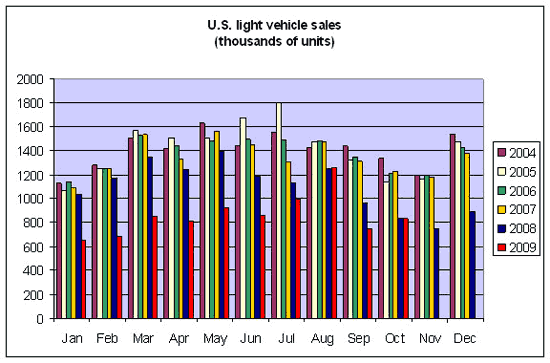

Data source: Wardsauto.com

U.S. light vehicle sales last month were up slightly from September and about the same as October 2008. Given how dismal those comparison months were, that’s not saying much. Last month’s sales were 3.5% below the average level of April through June, which, because sales usually decline a bit more than that in the fall, counts as a modest seasonally-adjusted improvement. We seem to be past the bottom for autos, but climbing back painfully slowly at this point.

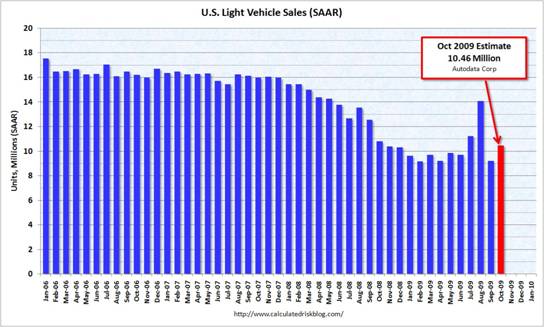

Source: Calculated Risk

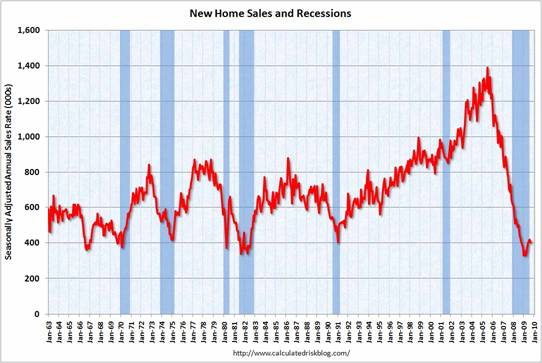

The same might be said of new home sales, which despite a slight setback in the most recently reported month (September), have definitely been gaining from the lows reached in March. But there’s still a long way to go before new home sales would reach the average levels seen in the 1980s.

Source: Calculated Risk

Existing home sales, which don’t contribute directly to GDP but which do help absorb some of the overhang of distressed properties for sale, have been growing more solidly, and NAR’s pending home sales index is up 12.5% over the last two months.

Source: Calculated Risk

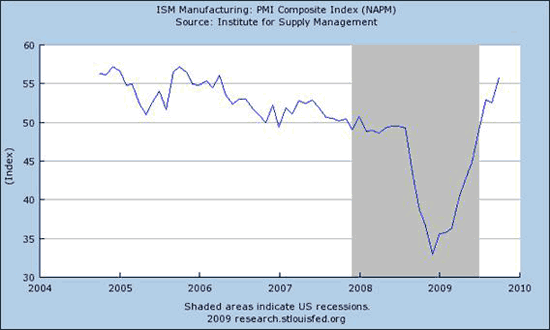

Other new indicators have also been mixed. The Manufacturing ISM PMI, an index summarizing the responses of managers answering their survey, registered its third consecutive month above 50, indicating more respondents said that conditions were improving than said things were getting worse.

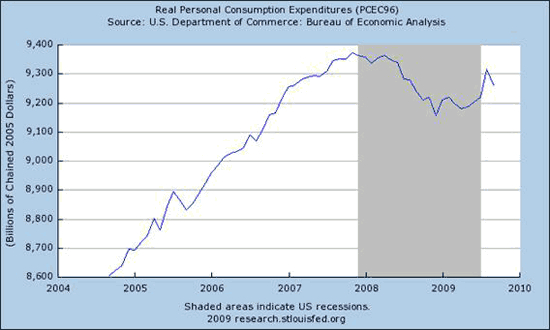

Source: FRED

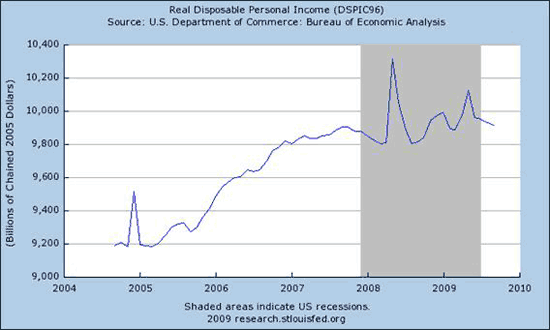

On the other hand, real personal consumption expenditures and real disposable personal income both dipped back down in September.

Source: FRED

Source: FRED

I remain convinced that the key indicator for a normal recovery will be a resumption of growth in U.S. employment. Unfortunately, ADP is estimating that the U.S. lost 203,000 private-sector jobs in October on a seasonally adjusted basis.

Bill McBride says we are a long way from normal. And I say, don’t bet against Bill McBride.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply