This weekend in the Macro Man household was all about “savings”. West Ham unexpectedly saved a draw against Arsenal after being down 0-2 at the half, which left them….err….still second bottom in the league. Then the once-mighty Steelers defense saved the team not once, but twice against The Clash by returning fourth-quarter turnovers for touchdowns (sandwiching a kickoff return TD by the Vikes.)

Then, of course, there was the daylight savings-related turning back of the clocks here in Europe, which gave us an extra hour yesterday but doesn’t actually save daylight at all- quite the contrary, as we now enter the long, dark winter where it’s pitch black at 5 pm. Ugh.

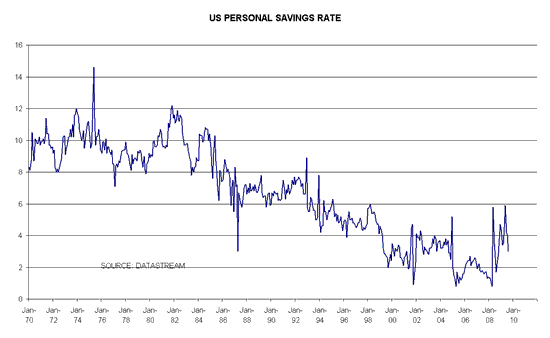

Anyhow, all of this focus on savings led Macro Man to consider the question of savings from an economic perspective. Ever since the financial crisis went nuclear last year, Macro Man has held the view that the US personal savings rate would approach if not breach 10%. It is for this reason that he was largely disdainful of the green shoots phenomenon for much of the summer.

Of course, in real time, that view proved to be wrong. While Macro Man’s relatively pessimistic views on the labour market have proven to be accurate, Cash for Clunkers, among other things, encouraged the consumer to go back to the well, sending the savings rate from 6% to 3%.

Macro Man has a couple of thoughts on the phenomenon. First, it is pretty undesirable from a long-run perspective; US households need to spend less, from both an internal (re-balancing the composition of GDP growth) and external (re-balancing global current accounts) perspective. A swift return to the consumer’s recent spendthrift ways is not encouraging.

However, if one posits that cash-for-clunkers merely brought forward future spending (which seems a reasonable proposition, given ongoing frailties in the labour market), then the bullish expectation of a V-shaped recovery, with the right side of the V just as steep and just as long as the left side, may well be misplaced. Those sorts of recoveries are engineered once pent-up demand is unleashed. From Macro Man’s perch, a halving of the savings rate this early in the cycle suggests that this is unlikely to happen this time around.

Another country plagued by a savings problem is, funny enough, Japan. Over the past two decades, the household savings rate has plunged from the high teens to the low single digits. Ironically, this is exactly the policy prescription that a parade of US Treasury officials have recommended to Japan since the mid-90’s (and are currently recommending to the rest of Asia.) Unfortunately, the decline in savings has come not via higher spending, but via reduced incomes.

And it’s not only households that have seen their incomes reduced; the central government has been forced to drastically reduce its estimated tax take. This has led to something of a brewing crisis; the new DPJ government seems to be flirting with markedly increasing net JGB issuance, even as the Postal Savings dials down its purchases to fund withdrawals and benefit payments.

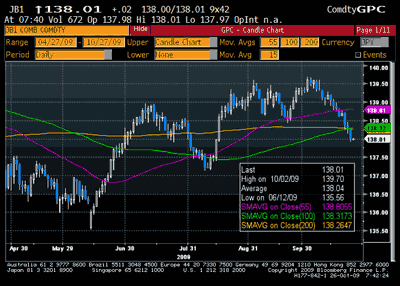

As a result, JGBs have been on something of a slippery slope recently, trending down nicely over the course of the month. At the same time, the yen has recently quit being an “anti-dollar”, and seems to have latterly joined the dollar and sterling in the global currency doghouse.

Whether the downtrend in JGBs and the yen persists remains to be seen, of course. Japan certainly compares favorably to the US and UK in terms of its stock of savings. However, the government is, if anything, more profligate and in more trouble than the Anglo-Saxons; given that the yen has traded as something of an uber-currency over the last few months, one might reasonably posit that moving from a penthouse currency to an outhouse one might provoke quite a sharp move. Naturally, Mrs. Watanabe is now quite long of yen in her currency speculations; just doing her bit, no doubt, to reduce the level of savings in Japan…..

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply