Crazy stories of a feeding frenzy in housing are what we should expect to be seeing nearing the top. Imagine: multiple offers, selling in a “blink of an eye”, all cash offers – what gives?

Crazy stories of a feeding frenzy in housing are what we should expect to be seeing nearing the top. Imagine: multiple offers, selling in a “blink of an eye”, all cash offers – what gives?

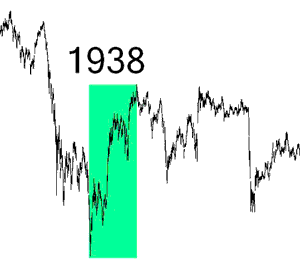

After a bubble bursts, the snap-back rally carries with it a snap-back psychology. The irrational behavior at the bubble peak comes back, and often is even more crazy. You can look at market history and see the same psychology in 1930, when the powers-that-be were convinced the recession was over; in 1938, which is the closest analog to today (see chart, courtesy of SlopeofHope); in 1974; and on and on.

This is not surprising. If it weren’t occurring, something would be wrong, and the Obama Hope Rally would not be nearing an end.

The Bubble Echo psychology should accelerate from here. JP Morgan put out a series of recommendations, which include going into emerging markets – another bubble-era theme which has returned. Sumitomo put out a projection of the Dollar going to 50 on the Dollar Index next year and fading as a reserve currency – weak Dollar being another bubble theme, and this an extreme projection. If you keep your eyes open, you will see these Bubble Echo craziness all around.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply