Microsoft Corporation’s (NASDAQ: MSFT) nearly 260 percent surge in share price in the last 7 years has pushed the company’s market cap to currently hit the same all-time highs printed just before the dot-com bubble burst in late 1999, reaching at last check $456 billion. After Nasdaq (NDAQ) lost nearly 80% of its value as it nosedived from 5046 points to 1114 points in early 2000, Microsoft’s stock for the following nine to ten years remained stagnant.

Former M’soft CEO Steve Ballmer was largely blamed for much of the stock’s trouble over that time. However, during a farewell stockholder’s meeting in late 2013, Ballmer pointed out that Microsoft’s stock price stagnancy for more than a decade wasn’t a result of the company’s business model direction or his leadership, but instead due to Wall Street’s incapability to recognize the software giant’s underlying value. While that’s debatable as an argument, it’s also true that for the most part, Microsoft shares have moved in tandem with the Nasdaq Composite.

So Who Is Right?

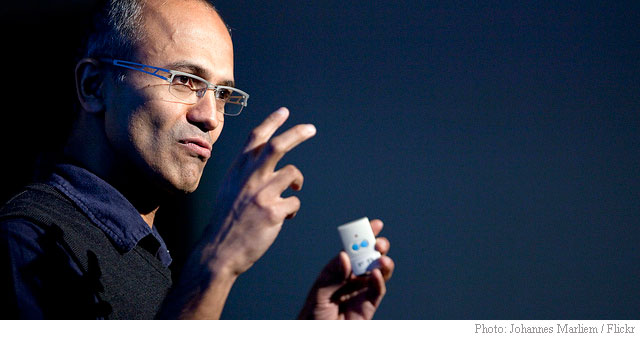

Well, there is no denying that the primary reason and difference to Microsoft’s performance as a top tech stock and its business model direction over the last 24 months, a period which coincides with CEO Satia Nadella taking over the reins at Microsoft, are strictly tied to the company’s success with the cloud and the believe that its future is now connected to the segment. In fact, during Q416 earnings results, the Redmond, Wash.-based firm said that cloud usage surged 102% year-over-year, a figure that more than doubled from last year. Revenue for the cloud business was up 120 percent in the previous quarter. For the entire intelligent cloud segment, revenue jumped 7%, bringing in $6.7 billion.

“The Microsoft Cloud is seeing significant customer momentum and we’re well-positioned to reach new opportunities in the year ahead,” CEO Satya Nadella said in a company statement following the earnings release.

Microsoft’s core businesses is also going strong. Windows 10 is now on more than 200 million active devices worldwide. That makes it the fastest adoption rate of any version of Windows outpacing Windows 7 by nearly 140% and Windows 8 by nearly 400%. Microsoft’s goal is for 800 million more devices to get to Windows 10.

So, clearly, the cloud, a segment that has put Microsoft now up there with Amazon (NASDAQ:AMZN)’s Amazon Web Services and Google’s Alphabet (NASDAQ:GOOGL) in the sector, the core business and the company’s transition from a software services model to a subscription model, has carried Microsoft from the depths of mediocrity a couple of years ago to where it is today, which is ; a name that can be seen again as an attractive investment.

So needless today, investors can keep on counting on the leadership of CEO Nadella.

Microsoft Stock Action

MSFT stock is in a position to have a solid FY2016. If the cloud business continues to grow, Microsoft shares could continue printing the tape higher.

Microsoft stock gained $0.53 to $58.47 in mid-day trading today. Approximately 8 million shares have already changed hands, compared to the stock’s average daily volume of 31.40 million shares.

On valuation-measures, shares of Microsoft Corporation have a trailing-12 and forward P/E of 27.84 and 18.16, respectively. P/E to growth ratio is 2.35, while t-12 profit margin is 19.69%. EPS registers at 2.10. The company has a median Wall Street price target of $60.00 with a high target of $70.00.

MSFT currently prints a year-to-date return of around 5.92%. Since last August, Microsoft stock has rallied more than 27%, outperforming the broader S&P 500 by nearly 23 percent.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply