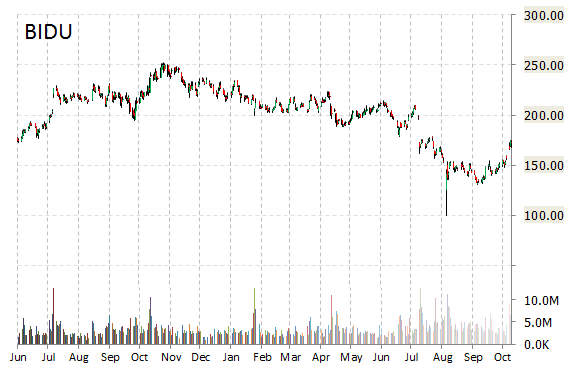

Baidu, Inc. (BIDU) is scheduled to release its fiscal 2015 third-quarter earnings results after today’s close. Wall Street analysts are on average expecting the Chinese language Internet search provider to post $2.90 billion in sales during the quarter. This would represent a year-over-year improvement of about 34%. EPS in Q315 are expected to come in at $1.30, a decline rate of 31.58% from $1.90 per share a year earlier. Meanwhile, EarningsWhisper.com reports a whisper number of $1.25 per share.

As a quick reminder, BIDU reported Q215 EPS of $1.81, $0.06 lower than the Street’s consensus estimate. Revs decreased 77.73% yoy to $2.67 billion versus the $2.6 billion consensus.

On valuation measures, Baidu Inc. ADR shares are currently priced at 29.66x this year’s forecasted earnings, compared to the industry’s 13.99x earnings multiple. Ticker has a forward P/E of 3.99 and t-12 price-to-sales ratio of 6.82. EPS for the same period is $5.82.

In the past 52 weeks, shares of Beijing, China-based company have traded between a low of $100.00 and a high of $251.99 and are now at $172.54.

Shares are down 24.64% year-over-year and 24.31% year-to-date.

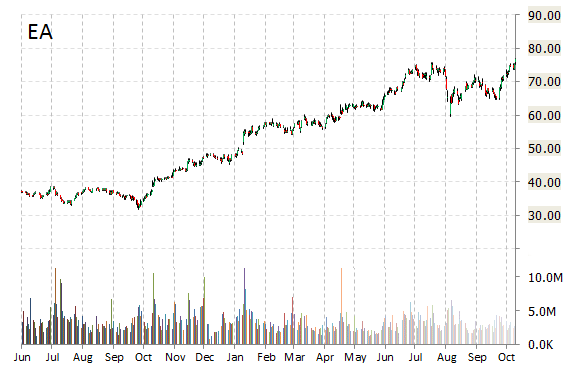

Electronic Arts Inc. (EA) is set to announce its Q216 earnings after the market close on Thursday, October 29. Analysts expect the developer of game software content to report EPS of $0.44 and revenue of $1.1 billion. That would be $0.29 higher the $0.15 per share posted last quarter and $0.29 lower the $0.73 posted in the Q215. Revenue is projected to be $120 million lower than the $1.22 billion posted in the same period a year earlier. Meanwhile, EarningsWhisper.com reports a whisper number of $0.52 per share.

As a quick reminder, EA reported Q116 EPS of $0.15, $0.12 better than the Street’s consensus estimate of $0.03. Revs declined 10.58% year-over-year to $693 million vs the $650.04 million consensus.

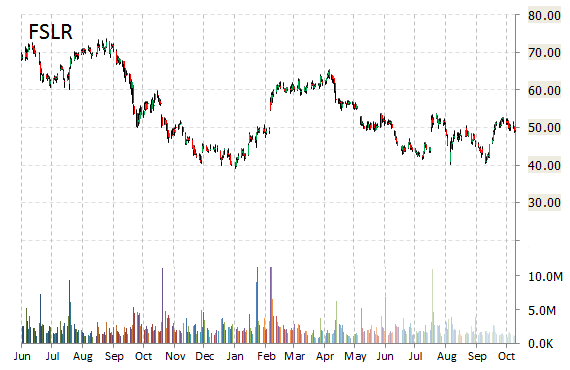

First Solar, Inc. (FSLR) is scheduled to release Q315 earnings after the close today. The Street is looking for EPS of $1.55 and revenue of $1.11 billion. Last quarter, the solar energy solutions provider posted a massive positive earnings surprise of 158.33%, reporting EPS of $0.93, $0.57 better than the Street’s consensus estimate of $0.36. Revs increased 64.71% year-over-year to $896 million versus the $544 million reported. Meanwhile, EarningsWhisper.com reports a whisper number of $1.63 per share.

First Solar recently traded at $50.85, a gain of $1.69 over Wednesday’s closing price. The name has a current market capitalization of $5.13 billion

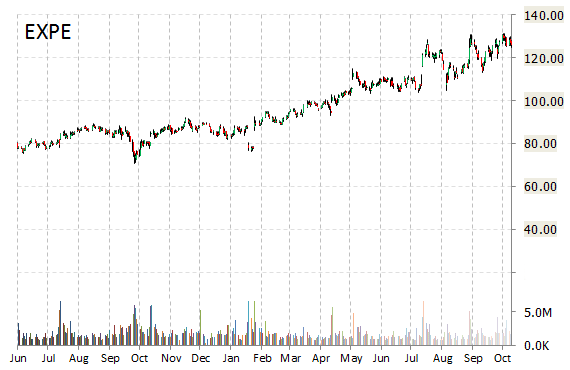

Expedia’s (EXPE) third-quarter results are scheduled to be revealed after the market closes Thursday. The Street has consensus estimates of $2.04 in earnings per share and $1.95 billion in revenue. In the Q3 of the previous year, the Bellevue, Washington-based online traveling company posted $1.93 in EPS and $1.7 billion in revenue. Meanwhile, EarningsWhisper.com reports a whisper number of $2.08 per share.

As a quick reminder, EXPE reported Q215 EPS of $0.89, $0.05 better than the Street’s consensus estimate of $0.84. Revs increased 11.41% on a year-over-year basis to $1.66 billion versus the $1.66 billion consensus.

EXPE was at $126 in pre-market trade, moving within a 52-week range of $76.34 to $131.51. On valuation measures, Expedia Inc. shares are currently priced at 20.33x this year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 2.69. EPS for the same period registers at $6.19.

As for passive income investors, the co. pays stockholders $0.96 per share annually in dividends, yielding 0.76%.

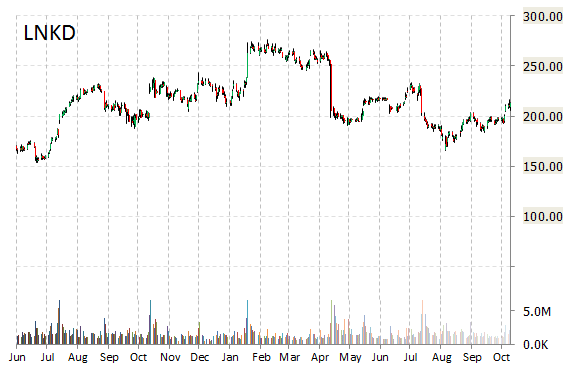

LinkedIn Corporation (LNKD) is set to report its 3Q15 results today after the close. Analysts are on average expecting LNKD to post $754.8 million in sales during the quarter. This would show a 6.01% increase from the Q215 revenue of $712 million, and an increase of 32.89% from the same period in Q314. EPS in Q315 are expected to come in at $0.45, a decline rate of 13.46% from $0.52 per share a year earlier. Meanwhile, EarningsWhisper.com reports a whisper number of $0.50 per share.

As a quick reminder, LinkedIn reported Q215 EPS of $0.55, $0.25 better than the Street’s consensus estimate. Revs increased 33.33% yoy to $712 million versus the $679.8 million consensus.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply