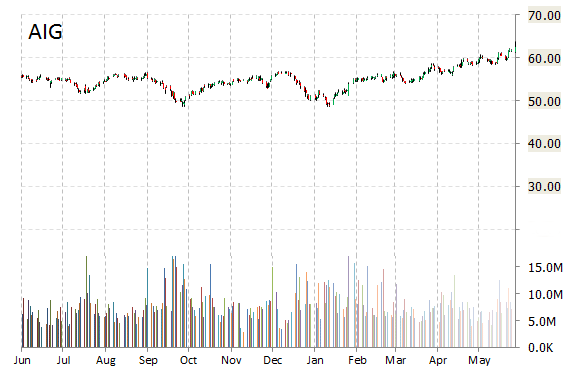

Analysts at Deutsche Bank (DB) downgraded American International Group, Inc. (AIG) from ‘Buy‘ to ‘Hold‘ in a research report issued to clients on Tuesday. The firm set its AIG price target at $64 a share, noting significant outperformance in first-half of 2015 has brought ticker to be largely where firm thinks it will trade this time next year.

On valuation measures, American International Group Inc. stock it’s trading at a forward P/E multiple of 11.13x, and at a multiple of 10.55x this year’s estimated earnings. The t-12-month revenue at American Int’l Group is $63.40 billion. AIG ‘s ROE for the same period is 7.89%.

Shares of the $82.86 billion market cap company are up 15.41% year-over-year and 12.20% year-to-date.

AIG, currently with a median Wall Street price target of $65.00 and a high target of $73.00, dropped $0.42 to $62.145 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

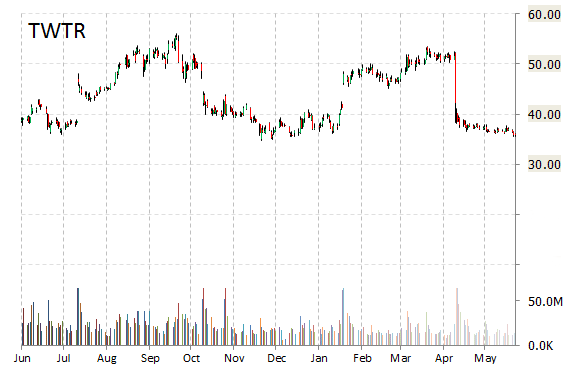

Twitter, Inc. (TWTR) was downgraded from ‘Buy‘ to ‘Neutral‘ and the price target was cut to $39 from $57 at MKM Partners. The firm said that while it still believes in the long-term potential of the company and sees significant upside if it executes on user experience improvements, it currently sees no catalyst for improving sentiment in the next two quarters.

Shares have traded today between $33.51 and $34.39 with the price of the stock fluctuating between $33.51 to $55.99 over the last 52 weeks.

Twitter Inc. shares have a t-12 price/sales ratio of 14.14. EPS for the same period registers at ($0.98).

Shares of TWTR have lost $0.72 to $33.95 in mid-day trading on Tuesday, giving it a market cap of roughly $23 billion. The stock traded as high as $55.99 in October 9, 2014.

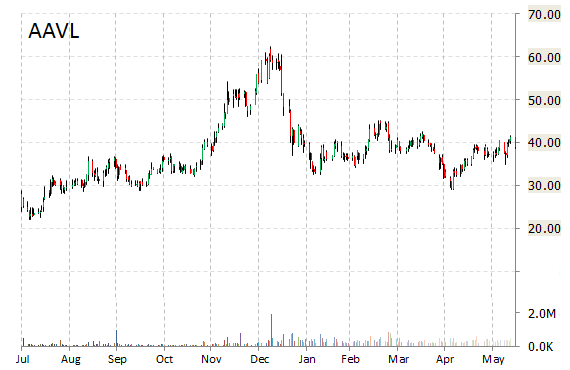

Chardan Capital Markets reported on Tuesday that they have lowered their rating for Avalanche Biotechnologies, Inc. (AAVL). The firm has downgraded AAVL from ‘Neutral‘ to ‘Sell‘ and lowered its price target to $20 from $40.

Avalanche Biotechnologies Inc. recently traded at $17.52, a loss of $21.36 over Monday’s closing price. The name has a current market capitalization of $447.17 million.

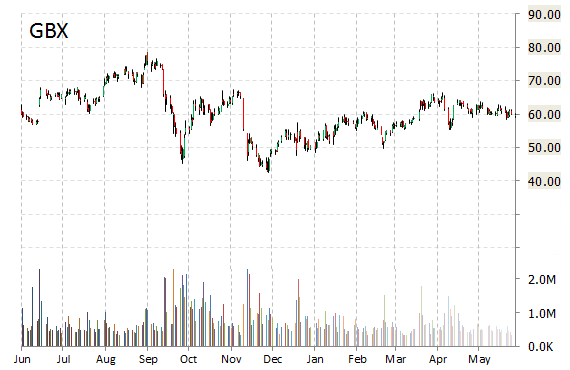

The Greenbrier Companies, Inc. (GBX) had its rating lowered from ‘Buy‘ to ‘Hold‘ by analysts at Stifel on Tuesday. Currently there are 8 analysts that rate GBX a ‘Buy‘, 1 analyst rates it a ‘Sell‘, and 2 rate it a ‘Hold‘.

GBX was down $5.08 at $54.49 in midday trade, moving within a 52-week range of $42.62 to $78.32. The name, valued at $1.44 billion, opened at $58.54.

On valuation measures, Greenbrier Cos. Inc. shares are currently priced at 10.82x this year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 0.67. EPS for the same period registers at $5.04.

As for passive income investors, the firm pays stockholders $0.60 per share annually in dividends, yielding 1.00%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply