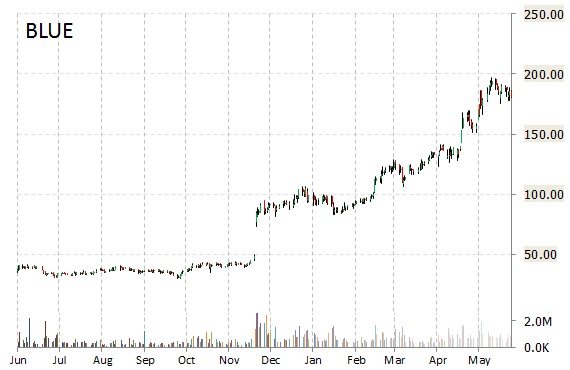

Shares of bluebird bio, Inc. (BLUE) are higher by nearly 6 points to $116 in pre-market trading on Monday after the company reported new data from HGB-205 study. The clinical-stage biotechnology firm said patients with beta-thalassemia major remain transfusion-independent at 16 and 14 Months.

“These data are promising for patients living with beta-thalassemia major and severe sickle cell disease, two devastating, genetically-based hematologic diseases that have a profound impact on both quality of life and life expectancy,” stated Professor Cavazzana, Marina Cavazzana, M.D., Ph.D., lead investigator of the HGB-205 study. “The steady rise and high-level of HbAT87Q production in our patient with severe sickle cell disease is cause for optimism as we expect levels of anti-sickling hemoglobin of 30 percent or more could significantly improve and potentially eliminate the serious and life-threatening complications associated with sickle cell disease.”

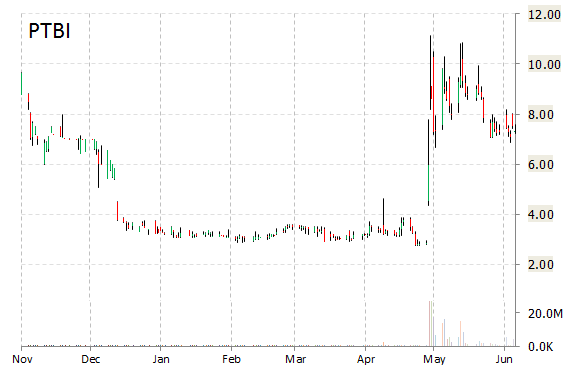

PlasmaTech Biopharmaceuticals, Inc. (PTBI) shares gained 5.73% to $7.75 in pre-market trading following the company’s addition of another adeno-associated virus (AAV) gene therapy program to its product pipeline. PlasmaTech said it has licensed an AAV gene therapy and IP from the University of Minnesota to treat patients with Fanconi anemia (FA) disorder and other rare blood diseases.

“This licensing transaction expands our commitment to building a leadership position in the gene therapy space, with a focus on developing therapies for patients with rare diseases,” said in a press release Steven Rouhandeh, Executive Chairman of PlasmaTech. “We plan to leverage the unique capabilities of the CRISPR-Cas9 gene editing platform technology to build a robust product pipeline to address the unmet needs of patients that may have one of a variety of blood diseases.”

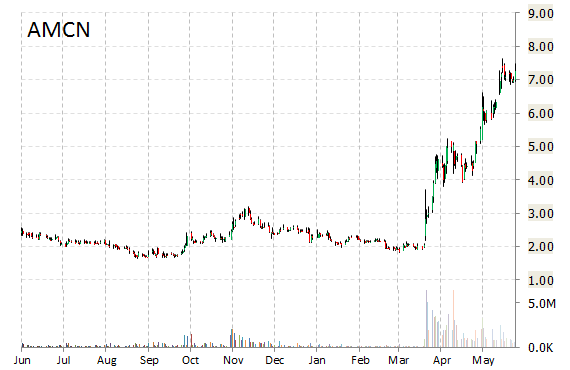

Shares of AirMedia Group Inc. (AMCN) spiked 14% this morning on news the operator of out-of-home ad platforms in China will sell 75% of the equity interest in its Advertising Business for RMB 2.1 billion.

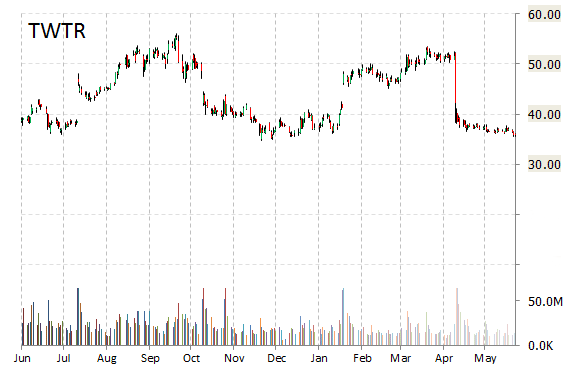

Shares of Twitter, Inc. (TWTR) were down marginally in pre-market hours ($0.36, or 1.01%, to $35.54) following a statement by Prince Alwaleed bin Talal, a major investor in Twitter, saying he would back chairman Jack Dorsey — soon to become interim CEO — if he wished to become chief executive permanently. Earlier, the Financial Times had reported the prince was against the idea of Dorsey being the permanent CEO.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply