Shares of Celladon Corporation (CLDN) tumbled 75% in premarket trading Monday morning, putting them on track to extend their 2015 slump of 30 percent. The nosedive being attributed to negative results for CUPID2 Trial of MYDICAR(R) in Advanced Heart Failure. Celladon said its Phase 2b CUPID2 trial did not meet its primary and secondary endpoints.

“We are surprised and very disappointed that MYDICAR failed to meet the endpoints in the CUPID2 trial, and we are rigorously analyzing the data in an attempt to better understand the observed outcome. We would like to express our sincere gratitude to our investigators and patients who participated in the study,” said in a statement Krisztina Zsebo, Ph.D., CEO of Celladon. “At the same time we are evaluating our other programs in order to determine the best path forward to maximize shareholder value.”

Following the news, Celladon was downgraded by Wedbush from an ‘Outperform’ rating to a ‘Neutral’ rating.

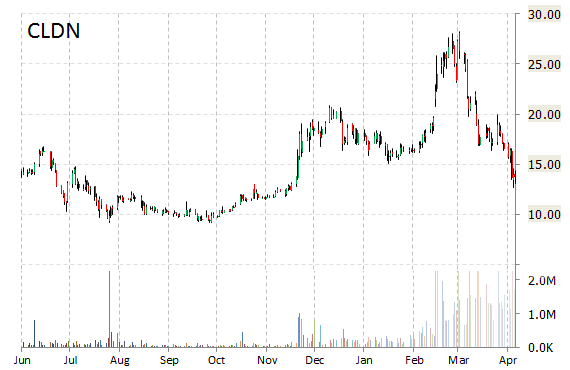

CLDN shares recently lost $10.09 to $3.59. In the past 52 weeks, shares of San Diego, California-based clinical-stage biotechnology company have traded between a low of $3.59 and a high of $28.25.

In terms of share statistics, Celladon Corp. has a total of 23.31 million shares outstanding. The stock’s short interest currently stands at 42.44%, bringing the total number of shares sold short to 4.83 million. Needless to say, CLDN shorts are having a solid start this week.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply