Altera Corp. (ALTR) is a strong mover this session, as its shares are up nearly 24%. The surge follows a WSJ report that says Intel Corporation (INTC) is in talks to acquire the company in a deal that would be the chip-maker’s largest takeover ever. Intel’s last big purchase was in 2011 when it spent $7.7 billion to buy security-software company McAfee Inc.

The publication said however, terms of the potential acquisition and its timing couldn’t be learned, and that it’s possible there ultimately won’t be one.

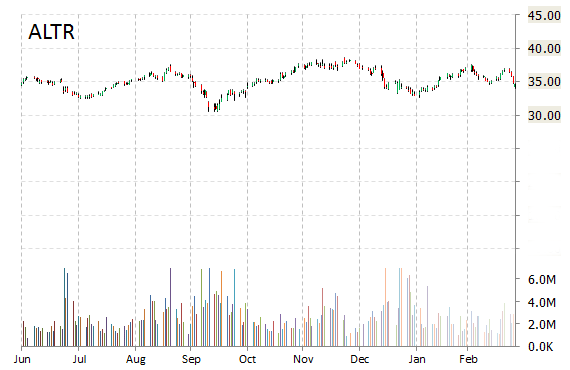

During today’s session, Altera Corp. printed a higher than average trading volume with the issue trading 7.14 million shares, compared to the average volume of 2.91 million. The stock began trading this morning at $34.73 to finish up $8.13 from the prior days close of $34.58. On an intraday basis it got as low as $34.48 and as high as $45.00.

ALTR shares are currently priced at 28.10x this year’s forecasted earnings, which makes them expensive compared to the industry’s 5.35x earnings multiple. The company’s current year and next year EPS growth estimates stand at 7.90% and 17.70% compared to the industry growth rates of 21.50% and 21.70%, respectively. ALTR has a t-12 price/sales ratio of 5.38. EPS for the same period registers at $1.52.

Altera shares have declined 5.83% in the last 4 weeks and 7.88% in the past three months. Over the past 5 trading sessions the stock has lost 5.52%. Shares of the $13.34 billion market cap company are down 5.88% this year.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply