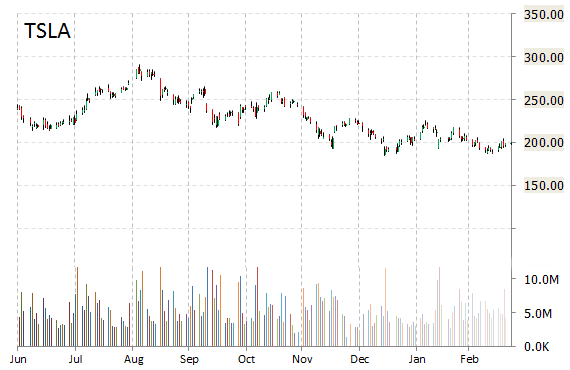

Tesla Motors (TSLA) is displaying relative strength as price seems to be going against its 6 month trendline by continuing holding above the $200 level. The stock had a nice move up this morning to $202.87 and is currently logging an almost 2% gain from yesterday’s close. Some continuation today could set it up for a retest at $205. That said, Tesla shares have found a little support at $200 recently. Should they drop below that level, the next strong support looks like $195 and then $190.

Tesla Motors share price has been on an downtrend from Oct. 16, 2014. Despite its 60 points price depreciation the name still has enough fundamentals that may further drive the stock upward. Currently, ticker is trading at a forward P/E of 49.54x and has long-term earnings growth expectation of about 93%.

Fundamentally, TSLA shows the following financial data:

- $1.91 billion in cash in most recent quarter

- $5.85 billion t-12 total assets

- $911.71 million total equity

- $3.20 billion t-12 revenue

- ($294.04) million annual net income

- ($1.03) billion free cash flow

On valuation measures, Tesla Motors Inc. shares have a T-12 price/sales ratio of 7.85 and a price/book for the same period of 27.52. EPS is ($2.35). The name has a market cap of $25.57 billion and a median Wall Street price target of $275.00 with a high target of $400.00. Currently there are 11 analysts that rate TSLA a ‘Buy’, 6 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’.

In terms of share statistics, Tesla Motors Inc. has a total of 125.38 million shares outstanding with 23.43% held by insiders and 56.90% held by institutions. The stock’s short interest currently stands at 25.27%, bringing the total number of shares sold short to 23.29 million.

Shares of the Palo Alto California-based electric car maker are down 12.78% year-over-year and 10.24% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply